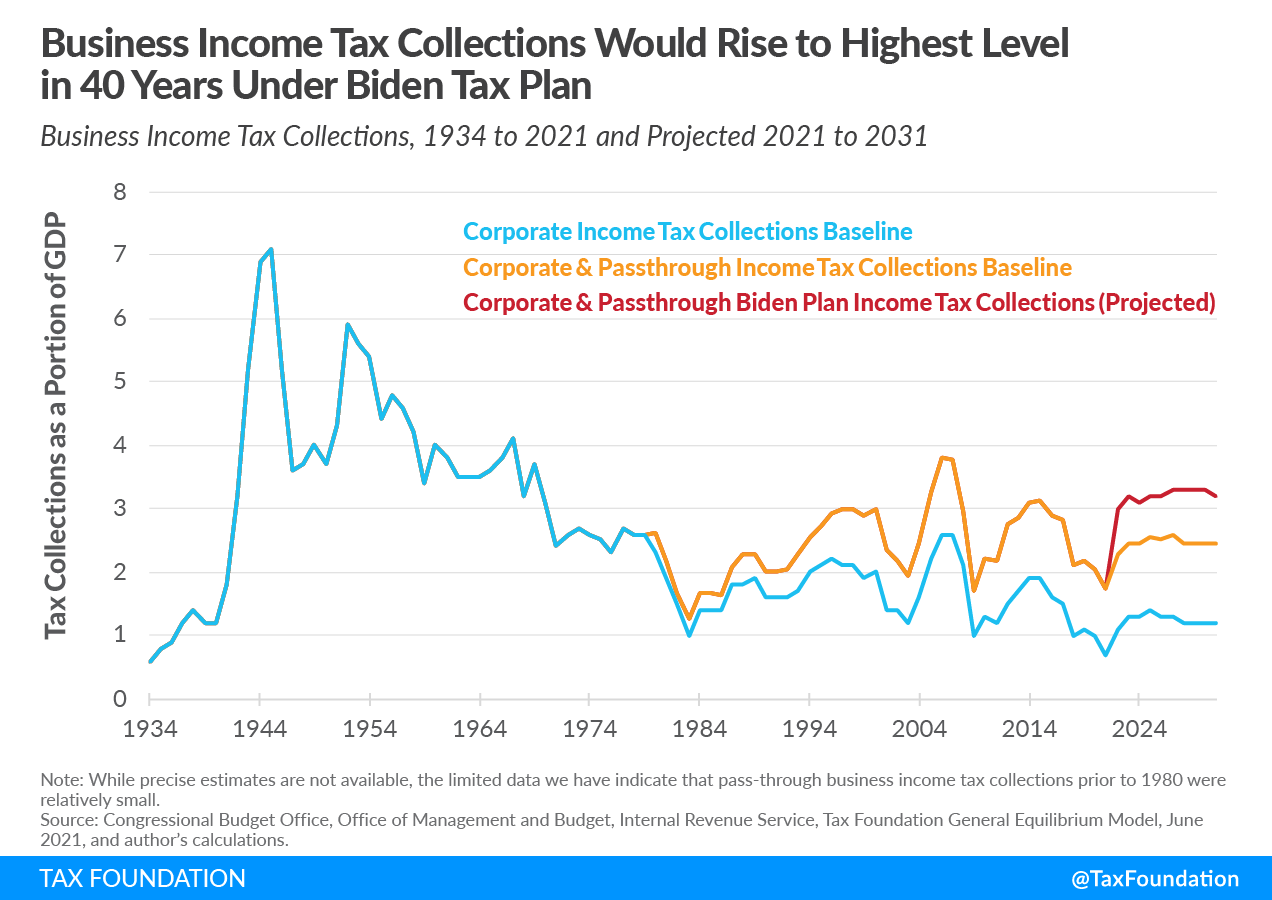

President Biden’s tax proposals released as part of his fiscal year 2022 budget would collect about $2 trillion in new tax revenue from businesses over 10 years. This new revenue would bring income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections on businesses as a portion of GDP to its highest level on a sustained basis in over 40 years.

Income tax collections from businesses include revenue from corporate income taxes levied on C corporations and the portion of individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. paid by owners of pass-through businesses like partnerships, sole proprietorships, and S corporations. Biden’s tax plan would raise the corporate income tax from 21 percent to 28 percent, raise taxes levied on international corporate income, and increase taxes on pass-through business income.

Using data from the Congressional Budget Office (CBO) for historical and projected corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. revenue and Internal Revenue Service (IRS) data on income earned by pass-through firms, we can calculate a conservative measure of business income tax collections over time. For tax years after 2021, we project business tax collections under the CBO budget baseline and compare it to the additional income tax revenue collected from businesses under the Biden tax plan.

Biden’s tax plan would raise about $1.7 trillion from C corporations and another $370 billion from pass-through firms over 10 years. This adds up to about 0.6 percent of GDP in new corporate tax revenue and about 0.1 percent of GDP in new pass-through business tax revenue from 2022 to 2031.

Baseline business income tax collections are projected to rise from 1.7 percent in 2021 to 2.5 percent by 2025, and peak at around 2.6 percent in 2027 after the Tax Cuts and Jobs Act (TCJA) base broadeners take effect, including stricter limits on deductions for the cost of new investments and interest payments.

Under Biden’s tax plan, business income tax collections would increase to 3 percent of GDP in 2022 and rise to about 3.3 percent after 2025 (see Figure 1), averaging 3.2 percent from 2022 to 2031—a level that has only been reached one other time in the last 40 years, during the peak of the housing and financial bubble from 2005 to 2007. Furthermore, in the last 40 years there has not been a sustained period of 10 years or more in which federal business tax collections reached or exceeded 3 percent of GDP.

The last time federal business tax collections clearly exceeded 3 percent of GDP on a sustained basis was in the 1960s, when the federal corporate tax rate approached or exceeded 50 percent. This was a time when the U.S. and many other advanced countries had relied heavily on corporate tax revenue as a way to pay down national debt accumulated during World War II.

Since that time, most advanced countries reduced business taxes and specifically corporate taxes in recognition of competitive pressures and the economic costs of heavily taxing business. Biden’s plan amounts to a reversal of the trend and a return to heavy taxation of U.S. companies. It is not at all clear that foreign competitors will follow suit.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe