Arizona entered 2019 as one of four states (along with California, Minnesota, and Virginia) conforming to a pretax reform version of the Internal Revenue Code (IRC) for both individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. purposes. With the signature of Gov. Doug Ducey (R) on House Bill 2757, Arizona becomes the latest state to conform to the new IRC, cutting taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates and raising the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. in the process.

Because the Tax Cuts and Jobs Act (TCJA) expanded the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , and most states—including Arizona—use federal adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” as the starting point for state tax calculations, updating the state’s conformity date without making any other changes would have represented a net tax increase. In fact, it already had: the 2018 tax forms assumed tax conformity, even though an updated conformity date was never adopted, and resulted in an estimated $155 million in higher tax collections, which the new law allows the state to keep and use to pay down state debts.

Going forward under H.B. 2757, however, Arizona will return that additional revenue—along with the anticipated new revenue from online sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. collections—to taxpayers through rate cuts, a higher standard deduction, and the replacement of dependent exemptions with a new child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. . Arizona’s individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate schedule drops from five brackets to four with the elimination of the second-lowest bracket, which is now taxed at the existing lowest rate of 2.59 percent. The top three brackets see modest rate reductions: 3.36 to 3.34 percent, 4.24 to 4.17 percent, and 4.54 to 4.50 percent.

| Old Rate Structure | New Rate Structure | |||||

|---|---|---|---|---|---|---|

| $0 | > | 2.59% | $0 | > | 2.59% | |

| $10,602 | > | 2.88% | ||||

| $26,501 | > | 3.36% | $26,500 | > | 3.34% | |

| $53,000 | > | 4.24% | $53,000 | > | 4.17% | |

| $158,996 | > | 4.54% | $159,000 | > | 4.50% | |

The new law increases the standard deduction from $5,312 (single filer) last year to the new federal deduction amount (currently $12,200), while replacing the dependent exemption ($2,200) with a child tax credit of $100 per child, which is slightly more generous.

Note here that an exemption represents a reduction in taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. whereas a credit is a dollar-for-dollar reduction in tax liability. This also makes a credit more progressive than the exemption it replaces. Within the lowest bracket, a $2,200 deduction is equivalent to a $57 credit; within the second, $73; within the third, $92; and for the top bracket, $99. Under the new law, a $100 per-dependent credit is available for all filers.

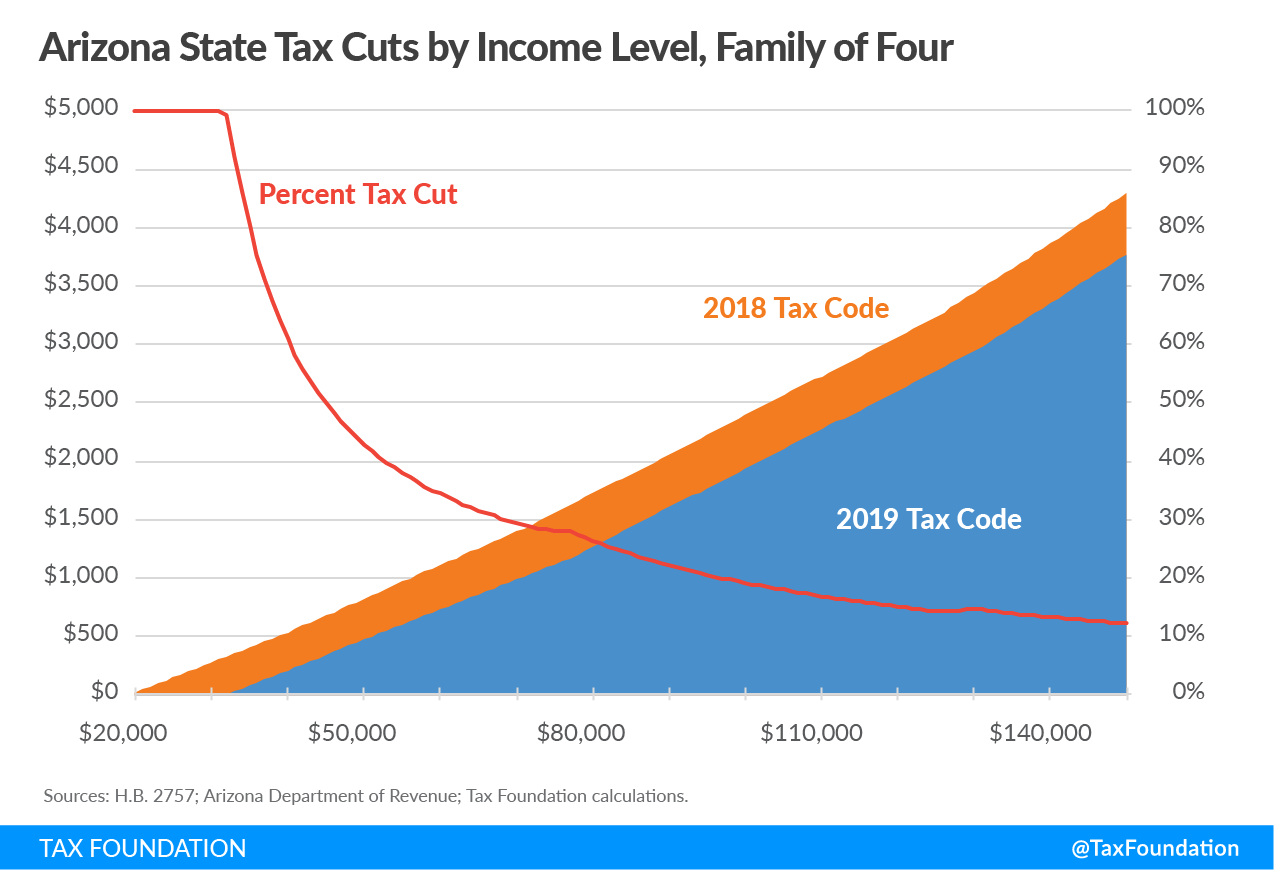

The bill provides across-the-board rate reductions, paid for through tax conformity and online sales tax revenue, and represents a 27 percent tax cut for the median filer. The following figure illustrates the effect of these tax cuts, showing liability under the 2018 tax code, the lower liability under the new law, and the percentage reduction in tax liability (the overlaid line), for a family of four. (For the sake of simplicity, adjustments only include the standard deduction, personal exemption, the old dependent exemption, and the new child tax credit.) The greatest tax relief, on a percentage basis, is for lower- and middle-income families.

Importantly for businesses, the law also makes clear that Arizona will not follow the federal government in imposing the new tax on Global Intangible Low-Taxed Income (GILTI), which makes a certain amount of sense as a guardrail within the new federal tax code, but represents an unwarranted expansion into international taxation at the state level. Under H.B. 2757, GILTI income is classified as foreign dividend income, which is fully deductible in Arizona.

The bill does not, however, address two other provisions of the federal tax law, full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. and the net interest limitation. At the federal level, these provisions are meant to counterbalance each other, with § 168(k) allowing businesses to deduct the full cost of machinery and equipment purchases in the first year (rather than depreciating them over time), while § 163(j) limits the deductibility of interest for business debts with the goal of reducing a bias in the tax code for debt over equity financing.

While these provisions counterbalance each other at the federal level, many states, including Arizona, automatically conform to § 163(j), which increases business investment costs, without conforming to § 168(k), which eliminates a tax penalty on investment. The new law does not address this imbalance.

With the enactment of H.B. 2757, Arizona becomes the sixth state to cut income taxes using the additional revenue from tax conformity, following Georgia, Iowa, Missouri, Utah, and Vermont. Following a conformity update in Virginia earlier this year, Arizona’s actions leave only California conformed to a pre-TCJA version of the IRC for both individual and corporate income tax purposes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe