Leveling Up: The UK’s Super-Deduction and its Regional Divide

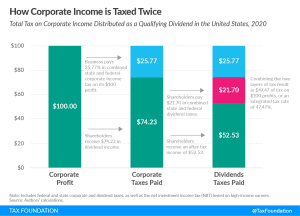

As part of the 2021 Budget, the UK introduced a 130 percent super-deduction for plant and equipment for the next two years, meaning that businesses can take a deduction amounting to 130 percent of the costs in the year the investment is made.

4 min read