OECD Report: Tax Revenue as a Percent of GDP in Latin American and Caribbean Countries Is below the OECD Average

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min readCristina Enache writes on the economics of tax policy and is the author of the Spanish Regional Tax Competitiveness Index. She was formerly the Director of Research at Civismo, an economic research organization based in Spain. She also served as head of research at Institución Futuro, a regional think tank based in Navarra in northern Spain. She is also currently Secretary-General at the World Taxpayers Associations and General Manager of the Spanish Taxpayers Union, which she joined in 2016.

Cristina has a degree in economics from the Academy of Economic Studies in Bucharest and a master’s degree in Economics and Finance from the University of Navarra.

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

The EU recently launched a consultation to reform the business tax system, which will outline the priorities for corporate taxation over the coming years to meet the needs of a globalized economy that struggles to recover from the consequences of the COVID-19 crisis. It will also set EU actions regarding the ongoing international discussion on the taxation of the digital economy and a global minimum tax.

3 min read

Policy changes to attract foreigners are not without benefits, but governments should carefully weigh the costs of the tax incentives against opportunities to implement broader tax reforms. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read

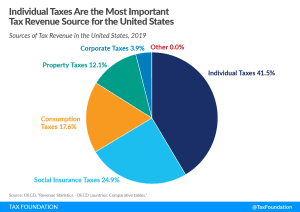

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

The Regional Tax Competitiveness Index (RTCI) for Spain allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare. This Index has been designed to analyze how well regions structure their tax system. Additionally, it serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

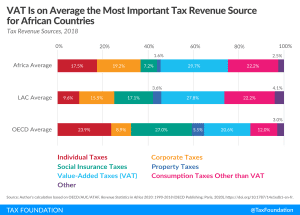

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

Spain’s upper house passed two major tax bills today: the financial transaction tax (FTT) and the digital service tax (DST). Both taxes will go into effect in January 2021.

3 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

A recent OECD report reveals a tendency towards higher property taxes, often in the form of base broadening, tax rate increases, or both.

5 min read

A more efficient property tax system in Greece is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

Value-added taxes (VAT) are traditionally considered regressive, meaning they place a disproportionate burden on low-income taxpayers. However, a recent OECD study used household expenditures micro-data from 27 OECD countries to reassess this conclusion.

5 min read

First, the introduction of the wealth tax would significantly impact international capital flows and cause large economic dislocations in the short term. Second, provinces that are looking at raising their corporate tax rates might hinder capital attraction, growth, and economic recovery.

4 min read

Brazil has one of the world’s most complex tax systems. Brazil has the opportunity to implement a simple consumption tax and foster tax progressivity at the same time.

5 min read

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read