2022 Spanish Regional Tax Competitiveness Index

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min readCristina Enache writes on the economics of tax policy and is the author of the Spanish Regional Tax Competitiveness Index. She was formerly the Director of Research at Civismo, an economic research organization based in Spain. She also served as head of research at Institución Futuro, a regional think tank based in Navarra in northern Spain. She is also currently Secretary-General at the World Taxpayers Associations and General Manager of the Spanish Taxpayers Union, which she joined in 2016.

Cristina has a degree in economics from the Academy of Economic Studies in Bucharest and a master’s degree in Economics and Finance from the University of Navarra.

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min read

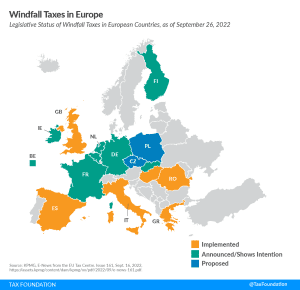

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

While the tax and benefit system can be successful in keeping low-income working households out of poverty and encouraging workforce participation, high marginal tax rates like the one observed in the case of this Australian working parent act as barriers to upward mobility.

6 min read

Canadian workers could face up to two important marginal tax rate spikes and lose 60 percent of additional earnings to the provincial health-care premium.

4 min read

Reshaping some of these policies to generate a smoother variation of marginal tax rates over different income levels would likely raise labor supply and encourage the upward mobility of workers and especially that of average-income workers.

5 min read

High marginal tax rates can act as barriers to upward mobility, discouraging people from advancing in their careers.

5 min read

Research has shown that spikes in tax rates can act as barriers to upward mobility. High marginal tax rates might directly influence the decisions workers make about accepting a raise, working additional hours, or whether they might remain on government benefits.

8 min read

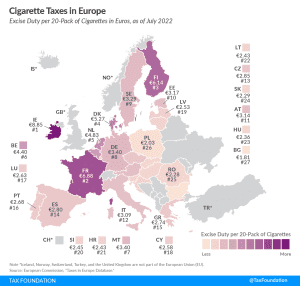

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min read

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read

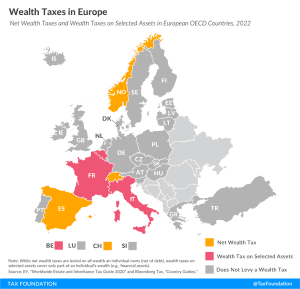

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

In recent years, EU countries have undertaken a series of tax reforms designed to maintain tax revenue levels while supporting investment and economic growth. However, not all tax reforms were created equal.

7 min read

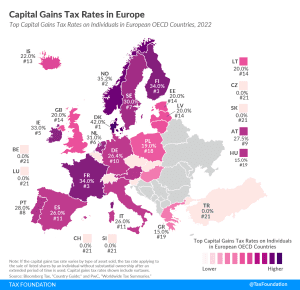

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read

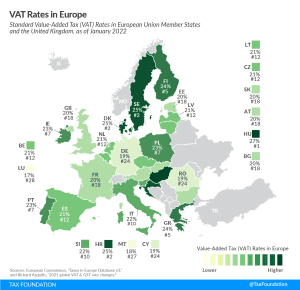

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

Spain should follow the example of Madrid, the country’s most competitive region. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

5 min read

Norway’s proposed reductions in income tax have the potential to increase disposable income for workers that can potentially raise consumption and contribute to economic growth. However, the increase of the wealth and indirect taxes is likely to step up the complexity of the tax system and create additional distortions.

3 min read

While other countries in Europe are working towards introducing tax cuts or delaying the introduction of new taxes to stimulate economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on businesses.

3 min read

Austria should not shy from lowering the corporate income tax rate sooner or even implementing a more ambitious tax reform to improve its tax competitiveness and contribute to greater economic growth.

3 min read