Businesses Pay and Remit 87 Percent of All Taxes Collected in Europe

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

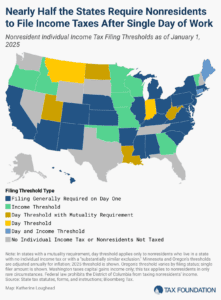

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

The flat tax trend is gaining momentum nationwide, and Missouri lawmakers are right to identify income tax rate reductions as particularly pro-growth.

4 min read

The better we understand taxes, the better we can manage our finances, but it starts with familiarizing ourselves with basic tax concepts like how tax brackets work.

3 min read

On April 10, the House adopted the Senate’s amended version of the budget resolution, which allows $5.3 trillion in deficit-financed tax cuts.

8 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

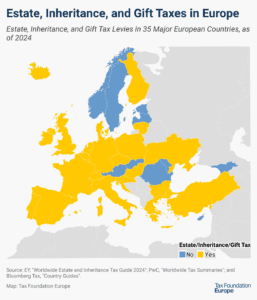

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

With a wealth tax, property tax increases, and this new payroll tax on the agenda, Washington lawmakers have reason to fear that many employers could be looking for the exits.

5 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Lawmakers should prioritize pro-growth tax policies and use the least economically damaging offsets to make the legislation fiscally responsible. If lawmakers choose to use C-SALT, they should carefully consider the economic trade-off with permanent, pro-growth tax cuts that support investment and innovation in the US.

7 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

A recent proposal in Minnesota exempting certain nonresident workers from having to file and pay income taxes would reduce compliance costs for business travelers and their employers at limited cost to the state.

4 min read

While capping C-SALT has superficial appeal in perceived parity with personal limits, it rests on flawed assumptions about the nature of individual and corporate income taxes.

7 min read

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

55 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read