Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read

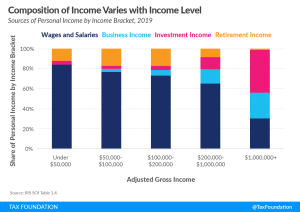

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

Idaho Ballot initiative would impose an incredibly high top marginal rate that would fall on many small businesses, not just high-income earners.

7 min read

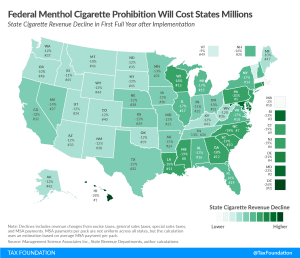

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The FDA’s expected announcement of a national ban on menthol-flavored cigarettes and cigars with a characterizing flavor would carry significant revenue implications for both the federal government and state governments, with likely limited benefits in smoking cessation.

6 min read

While Tennessee now boasts no individual income tax, there is still more work to be done for businesses—Tennessee is in a good position to get the job done.

7 min read

Spain should follow the example of Madrid, the country’s most competitive region. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

5 min read