Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform

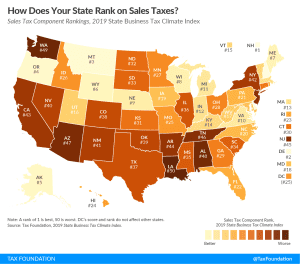

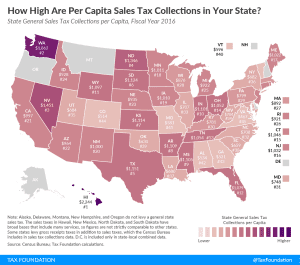

Despite tax cuts in recent years, Wisconsin’s overall tax structure lags behind competitor states in simplicity, tax rates, and business climate for residents and investment. Explore our new comprehensive guide to see how the Badger State can achieve meaningful tax reform.

11 min read