Vehicle Miles Traveled Taxes Rollout across States

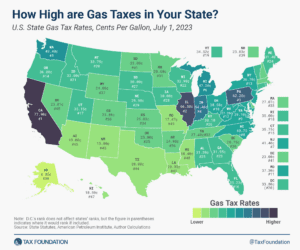

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read