All Related Articles

Economic Analysis of Financing Options for Infrastructure Spending Proposals

Our analysis shows that the economic benefits of federal investment in productivity-enhancing infrastructure may be undercut by the negative effects of the financing of those investments, such as when the corporate income tax is increased.

6 min read

The Weird Way Taxes Impact Behavior

Learn about how taxes can influence human behavior through the power of incentives. See how different tax policies have impacted everything around us, including the buildings we live in, the cars we drive, and even what we eat and wear. Gain a deeper appreciation for the importance of designing tax policies that encourage positive economic behaviors.

Gas Tax Revenue to Decline as Traffic Drops 38 Percent

Fewer people driving means fewer people buying gasoline, which may have positive effects on air pollution but could be detrimental to motor fuel excise tax revenue for federal and state governments.

4 min read

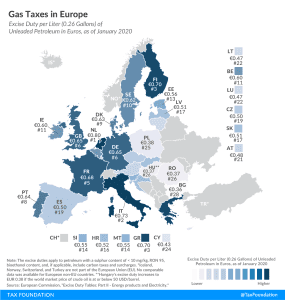

Road Taxes and Funding by State, 2019

4 min read

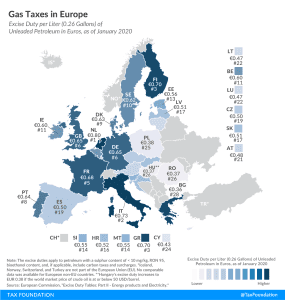

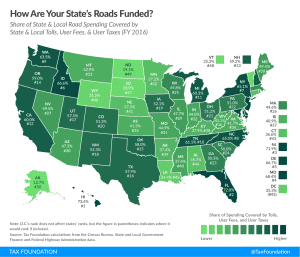

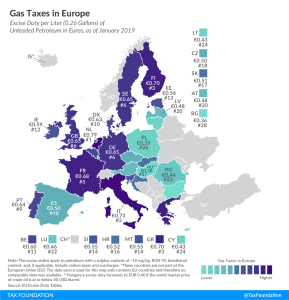

Gas Taxes in Europe, 2019

4 min read

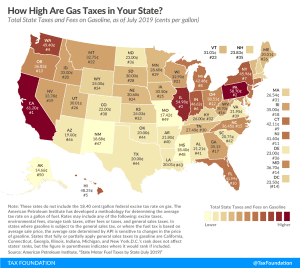

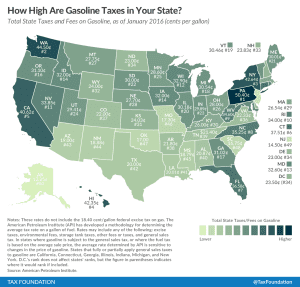

Gas Tax Rates by State, 2019

3 min read

How High are Other Nations’ Gas Taxes?

3 min read

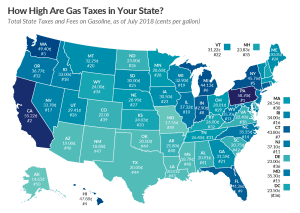

Gas Tax Rates by State, 2018

2 min read

Electric Vehicles Will Have a Long-Term Impact on the Gas Tax

In the wake of the Trump administration’s infrastructure plan, it’s worth considering how the gas tax will remain viable with the rise of electric vehicles.

3 min read

Gas Tax Rates by State, 2017

3 min read