State Tax Changes Taking Effect January 1, 2024

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

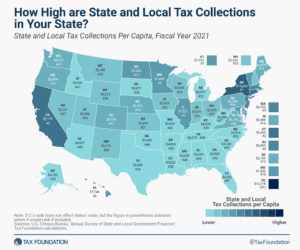

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

At the most recent Republican primary debate, former governor and United Nations ambassador Nikki Haley (R-SC) proposed eliminating the federal gas tax to lower fuel prices for consumers.

3 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

One prominent feature of President Biden’s agenda on the environment is to target U.S. fossil fuel producers and production with nearly $97 billion in tax increases over the next decade.

16 min read

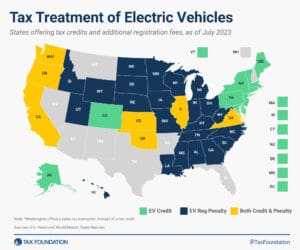

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

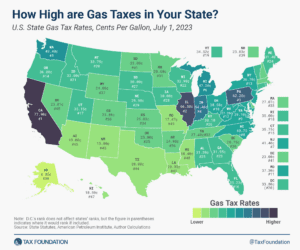

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

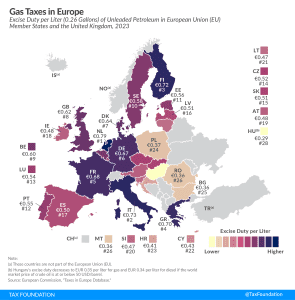

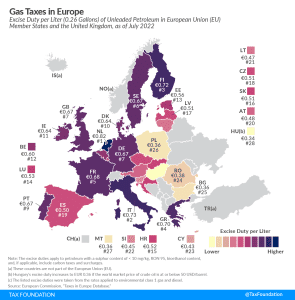

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

5 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

Oil prices have skyrocketed, posing a new risk to the post-pandemic recovery. Feeling the pressure to respond, policymakers have proposed everything from gas tax holidays, tapping into strategic reserves, and even rebate cards. One idea that has crawled back from the dead: “Windfall Profits Taxes.” This idea is seemingly simple: legislation targeted at the “excess” profits of oil companies. However, as with anything in tax policy, the reality is much more complicated.

As oil prices skyrocket, a windfall profits tax targeted at oil company profits could punish domestic production and increase reliance on imports.

3 min read

A gas tax holiday may be good politics, but it’s unlikely to achieve its aims. There are far better ways to provide tax relief—short- or long-term—than an inefficient gas tax suspension.

4 min read

The cost of gas is going up. To address this, policymakers have proposed suspending the gas tax. But could this actually make matters worse? We discuss why suspending the gas tax might be a mistake and what lawmakers could do to help with the rising costs of gas.

If policymakers are looking to change the tax code to help fight inflation, they should pump the brakes on the federal gas tax holiday and instead consider structural reforms to raise the economy’s productive capacity in the long term.

4 min read