Taxing Life Insurance

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

The individual income tax has plenty of problems, but in some respects the tax has improved in recent decades. Unfortunately, several Trump administration proposals would move us in the wrong direction, including the president’s call to drop taxes on tips.

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

A North Carolina House bill titled “No Tax on Tips, Overtime, Bonus Pay,” is gaining bipartisan traction in the General Assembly, mirroring similar proposals nationwide, including those championed by President Trump.

4 min read

In a perilous economic and fiscal environment, with instability created by Trump’s trade war and publicly held debt on track to surpass the highest levels ever recorded within five years, a lot rides on how Republicans navigate tax and spending reforms in reconciliation.

6 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

While capping C-SALT has superficial appeal in perceived parity with personal limits, it rests on flawed assumptions about the nature of individual and corporate income taxes.

7 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

55 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

If Republicans want a successful year for tax reform, they must put aside the extensive demands for niche provisions and, instead, approach this debate with a principles-first mindset.

The House Budget Committee has released a budget resolution that specifies large reductions in both taxes and spending over the next decade, paving the way to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially cut other taxes.

6 min read

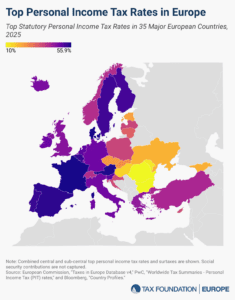

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min read

While many Scandinavians get mailed comprehensive pre-filled tax returns and only have to check whether they are correct, the average German taxpayer spends 9 to 10 hours and over €100 filing their tax return.

7 min read

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

Are tariffs making everything more expensive? With Trump’s new tariff plans hitting $1.1 trillion in imports—far more than his first term—prices could rise for businesses and consumers alike.

If Republicans want to pursue this policy, they’ll need to answer some questions about what Trump’s promise means. And they’ll need to be careful that the idea doesn’t turn into a budget-buster.

What will the future of tax policy look like? In this episode, we dive into the critical challenges and opportunities looming on the horizon, especially with major tax cuts set to expire, which could increase taxes for 62 percent of filers.