All Related Articles

A Tradition Unlike Any Other: The Masters Tax Exemption

Augusta National Golf Club is famous for more than green jackets and pimento cheese sandwiches—legend has it that it’s the impetus for one of the tax code’s many exemptions.

3 min read

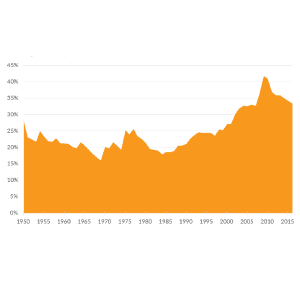

A Growing Percentage of Americans Have Zero Income Tax Liability

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read

Analysis of the “SALT Act”

Lawmakers recently introduced a bill to repeal the $10,000 cap on the state and local deduction (SALT) and raise the top tax rate on ordinary income from 37 percent to 39.6 percent.

4 min read

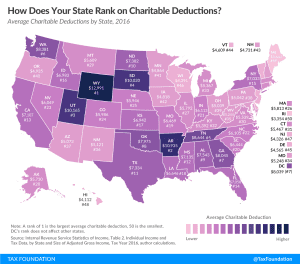

Who Benefits from Itemized Deductions?

While some tax preferences like the earned income tax credit (EITC) and child tax credit benefit lower- and middle-income households, others, like itemized deductions, benefit high-income households.

4 min read

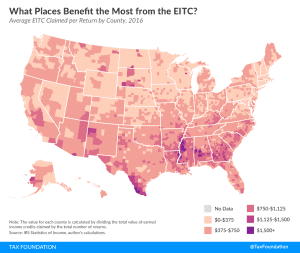

Analysis of the Cost-of-Living Refund Act of 2019

We estimate that a new proposal to expand the EITC would reduce federal revenue by $1.8 trillion and decrease long-run GDP by 0.29 percent, while boosting labor force participation for low-income tax filers by 822,788 full-time equivalent jobs.

10 min read

Evaluating Education Tax Provisions

Research shows that the current menu of education-related tax benefits is not effectively promoting affordability or the decision to attend college. Lawmakers wishing to provide education assistance should reconsider whether the tax code is the best tool to achieve that goal.

21 min read

Don’t Judge Your Taxes by Your Refund

3 min read