Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

The economy and climate change are two challenges the Biden administration has identified as priorities. One way to address both issues at the same time is to enact a carbon tax to discourage carbon emissions, and to use the resulting carbon tax revenue to lower—or in the case of the TCJA’s individual provisions, avoid increases of—other, more distortive, types of taxes. This would not only address the challenges of climate change but also support the economy.

3 min read

Expensing for capital investments is a powerful tax policy for economic growth. But expensing can also help shift the economy to a more sustainable future through increased investment in new, less carbon-intensive technology. Expensing for capital investment would eliminate a tax bias against energy efficiency improvements that reduce operating costs but involve high upfront investments. It could also serve to accelerate the existing trend of movement towards more green energy power sources.

28 min read

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

What do election results mean for the future of the federal tax code? What role will tax policy play in curbing the economic effects of the COVID-19 pandemic? How should policymakers address the federal deficit and could a carbon tax be part of that solution? How much of President-elect Joe Biden’s pre-election tax plan will actually come to pass?

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

What can the U.S. do to raise the revenue needed for infrastructure upkeep and accurately internalize the costs associated with road usage?

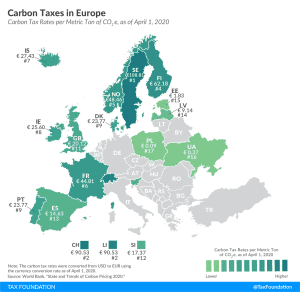

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

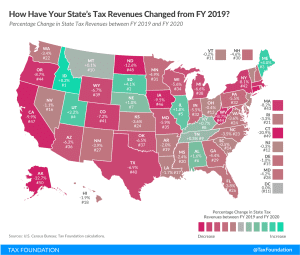

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

The highway trust fund is on track to run out of money by 2021, states are struggling to cover their transportation spending, and increased fuel economy, plus inflation, is chipping away at gas tax revenue year. How can Congress and state governments ensure they have the revenue necessary to fund our highways? One solution is the vehicle miles traveled (VMT) tax.

35 min read

One under-discussed part of the CARES Act, passed in March to provide economic relief during the COVID-19 epidemic, is a correction to a drafting error in the Tax Cuts and Jobs Act of 2017, often known as the “retail glitch.”

3 min read

First, the introduction of the wealth tax would significantly impact international capital flows and cause large economic dislocations in the short term. Second, provinces that are looking at raising their corporate tax rates might hinder capital attraction, growth, and economic recovery.

4 min read

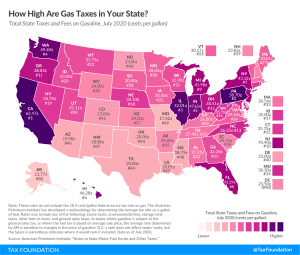

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read