The U.S. Tax Burden on Labor, 2020

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

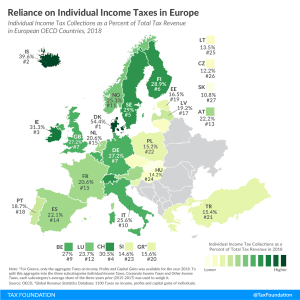

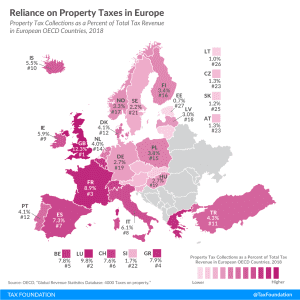

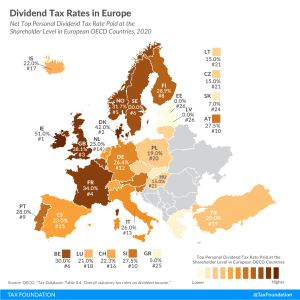

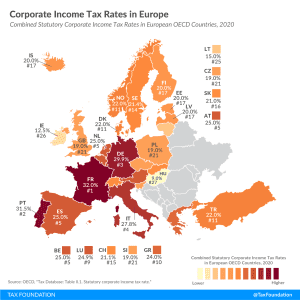

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read

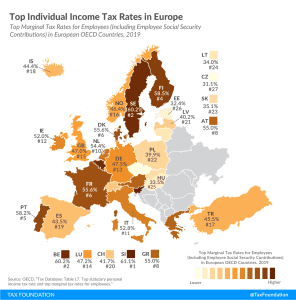

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

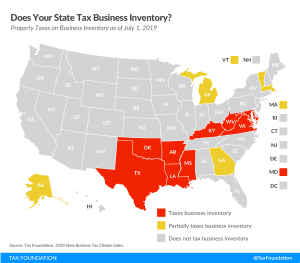

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

2 min read

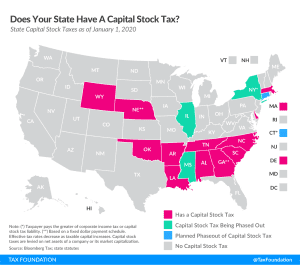

As many businesses may need time to return to profitability after this crisis, states should prioritize reducing reliance on capital stock taxes, and shift toward more neutral forms of business taxation.

4 min read

While it’s unclear how soon state economies may be able to fully open again, it’s not too early for states to consider how they can remove barriers to businesses & consumers resuming activity.

3 min read

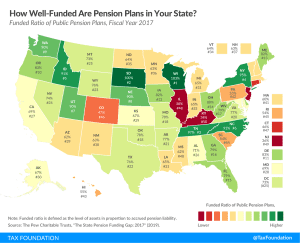

The current crisis highlights the cost of underfunding pensions in years of economic growth. Twenty states have pension plans that were less than two-thirds funded, and five states had pension plans that were less than 50 percent funded.

3 min read

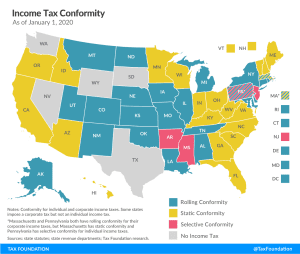

If states fail to update their income tax conformity, they will wind up taxing the federal lifeline to small businesses in the CARES Act: the Paycheck Protection Program (PPP) loans.

3 min read

Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation claims that have already come in since the start of the COVID-19 pandemic.

3 min read

Although sometimes overlooked in discussions about corporate taxation, capital cost recovery plays an important role in defining a business’s tax base and can impact investment decisions—with far-reaching economic consequences.

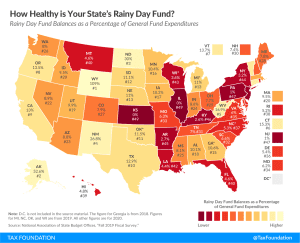

27 min readState revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great Recession and can be a valuable tool as states face a sharp pandemic-linked economic contraction.

18 min read

Another 1.4 million Americans filed initial regular unemployment benefit claims, the eleventh week of a decline in the rate of new claims, but still among the highest levels in U.S. history. The total number of new and continued claims now stands at 19.3 million, a marked decline from the peak of 24.9 million a month ago.

7 min read

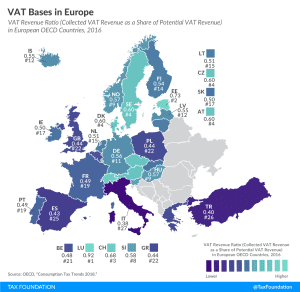

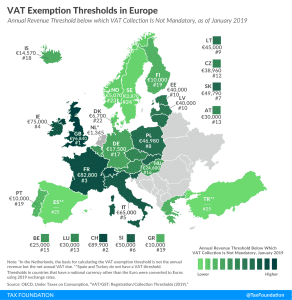

The extent to which businesses and consumers will benefit from coronavirus relief measures like temporary VAT changes will depend on the VAT base.

2 min read

Rainy day funds have increasingly emerged as a standard component of states’ budgeting toolkits. Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund.

2 min read

Due to certain VAT exemption thresholds, many small businesses will not be able to benefit from the VAT changes being introduced throughout Europe to provide relief during the COVID-19 crisis.

2 min read