The Global Tax Deal, Tax Cuts, and Tariffs—5 Major Tax Debates

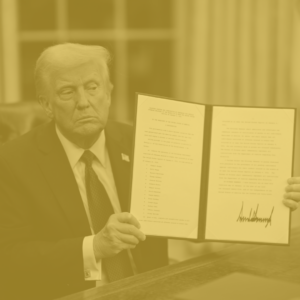

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.