Results of a Survey Measuring Business Tax Compliance Costs

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

7 min read

Dive into the highlights from the DNC as we break down Vice President Kamala Harris’s tax proposals and their potential impact on everyday families. What do higher taxes on businesses and the wealthy mean for working Americans?

Depending on the 2024 US election, the current corporate tax rate of 21 percent could be in for a change. See the modeling here.

4 min read

Pillar Two risks creating a more complex and unfair international tax system. It is inadvertently fostering new, opaque, and complex forms of competition, and policymakers should consider alternative approaches to creating a fairer international tax environment.

4 min read

How does living abroad impact the taxes an American has to pay? Unlike most countries that tax based on residency, the US employs citizenship-based taxation, meaning Americans are taxed on their global income regardless of where they reside.

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

Americans will spend more than 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024. This is equal to 3.8 million full-time workers doing nothing but tax return paperwork—roughly equal to the population of Los Angeles.

7 min read

The global tax deal and Pillar Two are shaking up the tax landscape worldwide, introducing a web of complexity and confusion.

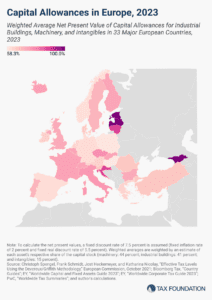

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

A 15 percent corporate rate would be pro-growth, but it would not address the structural issues with today’s corporate tax base.

4 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

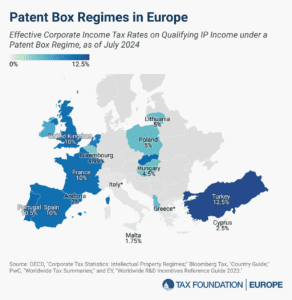

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

Puerto Rico, a US territory with a limited ability to set its own tax policies, will be the first part of the US to be substantially affected by Pillar Two, the global tax agreement that seeks to establish a 15 percent minimum tax rate on corporate income.

17 min read

The Treasury Department recently touted strong business investment in the years following the pandemic-driven recession and pointed to the Biden administration’s industrial policies in the Inflation Reduction Act and CHIPS Act as key drivers.

7 min read

The proposal is a good example of what can be done to reduce tax burdens on residents if spending is constrained. There are real, tangible benefits associated with enacting this pro-growth reform that should not be discounted.

5 min read

Governor Sarah Huckabee Sanders (R) recently called a brief special legislative session to enact the fourth round of reductions to the Natural State’s individual and corporate income taxes. Legislators also passed a modest property tax reform proposal.

4 min read

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read