State Implications of the One, Big, Beautiful Bill

As the US House hashes out its “One, Big, Beautiful Bill,” statehouse lawmakers are watching closely, given the impact of both its tax and spending provisions on state budgets.

12 min read

As the US House hashes out its “One, Big, Beautiful Bill,” statehouse lawmakers are watching closely, given the impact of both its tax and spending provisions on state budgets.

12 min read

We break down the House GOP’s One, Big, Beautiful Bill—a sweeping tax package designed to extend key parts of the 2017 Tax Cuts and Jobs Act before they expire in 2026.

William McBride discussed how and why the budgetary cost of the IRA’s tax credits has grown, described who benefits from the tax credits, and recommended ways to reform the credits amid budget reconciliation.

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

As lawmakers consider options for budgetary offsets, they should prioritize competitiveness and economic growth, as a heavier corporate tax burden will undermine the core purpose and achievement of the TCJA.

24 min read

Lawmakers have a prime opportunity to achieve a more stable economy through the debate about the tax code that is now ramping up.

As lawmakers continue to debate the “One Big Beautiful Bill,” they should abandon temporary and complex policy in favor of simplicity and stability.

4 min read

The tax bill prioritizes politics over economic growth, writes Daniel Bunn.

Tax simplification has two aspects. The first is a code without a mess of targeted provisions for various social policy goals. The second is a code with provisions that are simple and easy to comply with. The bill succeeds at the first, but fails at the second.

7 min read

Pairing permanent TCJA individual tax cuts with new limits on business SALT deductions would shrink the economy, reduce American incomes, and increase the federal budget deficit, undermining the policy goals of TCJA permanence.

3 min read

Catastrophic rhetoric about US manufacturing is not justified. The tariffs are extremely counterproductive. Still, all is not well in the US manufacturing sector. What should we do?

7 min read

As Congress debates expensing and other policies impacting business investment, lawmakers should consider the importance of business investment in research and development (R&D) as a driver for economic growth. Recent studies suggest that the economic benefits of R&D spending are even greater than previously understood.

7 min read

A tax preference originally designed to level the playing field now has the opposite effect, creating preferences for one class of financial institutions even though the distinctions between credit unions and banks are increasingly blurred.

6 min read

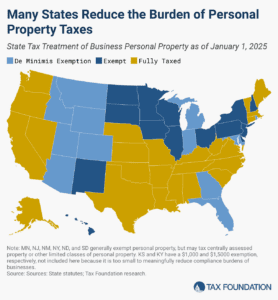

Does your state have a small business exemption for machinery and equipment?

4 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

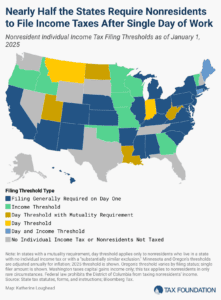

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

Congressional Republicans are looking for ways to pay for extending the tax cuts scheduled to expire at the end of the year. Repealing the green energy tax subsidies expanded or introduced in the Inflation Reduction Act is an appealing option.

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.