Full Expensing is Good for the Short Run and the Long Run

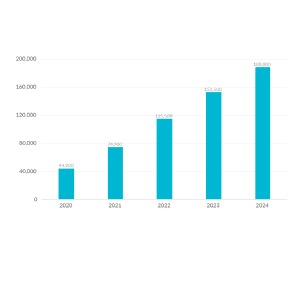

In the first year of enactment alone, we estimate the combination of full expensing and neutral cost recovery would increase full-time equivalent employment by more than 44,000 jobs. The cumulative impact by year five of the policy would be nearly 200,000 new jobs.

4 min read