Spain’s Race to the Bottom in the International Tax Competitiveness Index

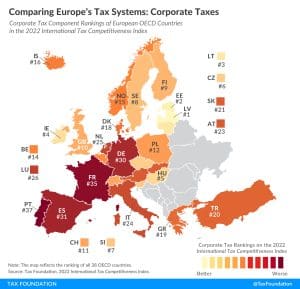

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read