Featured Articles

All Related Articles

Sources of Government Revenue in the OECD, 2022

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

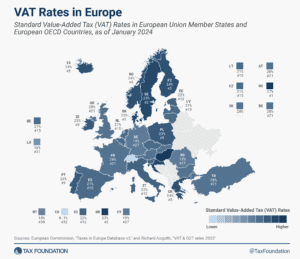

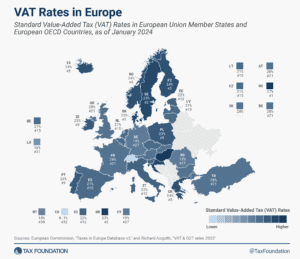

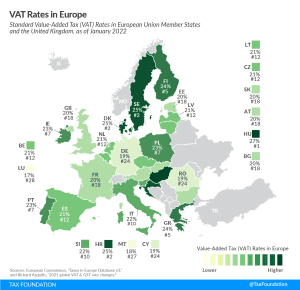

VAT Rates in Europe, 2022

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

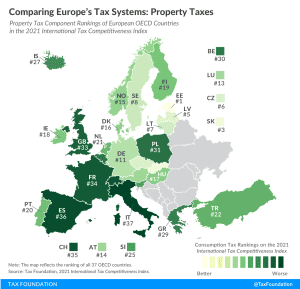

Comparing Europe’s Tax Systems: Property Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

2022 State Business Tax Climate Index

While there are many ways to show how much is collected in taxes by state governments, our State Business Tax Climate Index is designed to show how well states structure their tax systems and provides a road map for improvement.

169 min read

Permanent Build Back Better Act Would Likely Require Large Tax Increases on the Middle Class

Policymakers and taxpayers should understand the scope of tax changes necessary to fully pay for the large-scale social spending programs that would be initiated under the Build Back Better Act.

6 min read

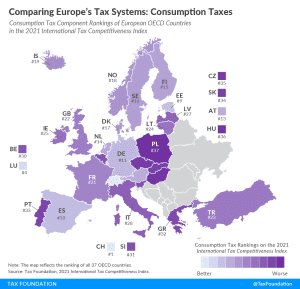

Comparing Europe’s Tax Systems: Consumption Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

How Would House Dems’ Tax Plan Change Competitiveness of U.S. Tax Code?

The legislation put forward by Democratic members of the House of Representatives would reverse many of the 2017 reforms while increasing burdens on businesses and workers.

2 min read

Movers and Shakers in the International Tax Competitiveness Index

The Index provides lessons for policymakers when they are thinking of ways to remove distortions from their tax systems and remain competitive against their peers. The further up a country moves on the Index, the more likely it is to have broader tax bases, relatively lower rates, and policies that are less distortionary to individual or business decisions. Going the other way reveals a policy preference for narrow tax bases, special tax policy tools, and rules that make it difficult for compliance.

5 min read

International Tax Competitiveness Index 2021

A well-structured tax code (that’s both competitive and neutral) is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

40 min read

Carbon Tax: Weighing the Options for Financing Reconciliation

A carbon tax would be a less economically harmful pay-for than either personal or corporate income tax hikes and a more efficient way to reduce carbon emissions than green energy tax credits, but would come with other trade-offs.

4 min read

A 15 Percent VAT Rate Is Possible by Scrapping Reduced Rates

A VAT tax reform that eliminates VAT reduced rates would decrease compliance costs and allow for a more rapid economic recovery. Policymakers should focus on simplifying VAT rules and making them more efficient and neutral by broadening their tax bases and eliminating reduced rates and unnecessary tax exemptions.

4 min read

Comparing Three Financing Options for President Biden’s Spending Proposals

While Congress continues to debate how to pay for President Biden’s spending proposals in the fiscal year 2022 budget, it is useful to consider the economic impact of a range of financing options in addition to the President’s proposed tax increases.

3 min read

Asian and Pacific Countries Faced Revenue Loss Prior to COVID-19 Outbreak

As economies are starting to recover and growth is expected to rebound in the region during 2021, Asian and Pacific countries should start exploring changes to their fiscal tax policies while carefully evaluating the optimal time for eliminating fiscal stimulus and temporary tax relief.

4 min read

New Hampshire Closes in on Tax Cuts to Enhance State’s Competitive Advantage

New Hampshire lawmakers are scheduled to take up a budget conference report which contains several tax reforms negotiated by both chambers that would ultimately make New Hampshire the ninth state to impose no tax on individual income. These reforms floated at the beginning of the 2021 session found their way into HB 2, including rate reductions in the Business Profits Tax (BPT) and Business Enterprise Tax (BET) and a phaseout of the interest and dividends tax.

4 min read

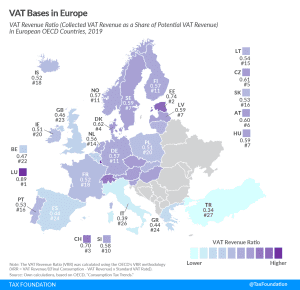

VAT Bases in Europe

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read

A Comparison of the Tax Burden on Labor in the OECD, 2021

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read

Reviewing Options to Raise Tax Revenue and the Trade-offs for Economic Growth and Progressivity

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read

OECD Report: Tax Revenue as a Percent of GDP in Latin American and Caribbean Countries Is below the OECD Average

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

More Tax Hikes Than Investment Projects?

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

IMF Tax Proposals: Shrink Inequality or Sink Post-Pandemic Recovery?

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read