Featured Articles

All Related Articles

How Taxing Consumption Would Improve Long-Term Opportunity and Well-Being for Families and Children

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

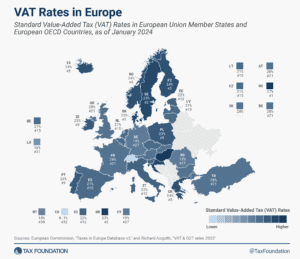

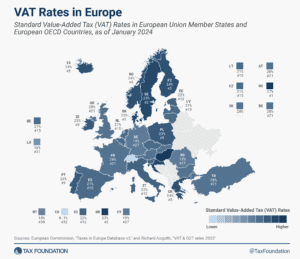

Tax Trends in European Countries

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

How to Rein in the National Debt

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

The Tax Policy Implications of the Spanish Elections at the Regional, National, and European Levels

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

Benefits of Principled Tax Policy: EU VAT Reform Results

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read

A Tax Reform Plan for Growth and Opportunity: Details & Analysis

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

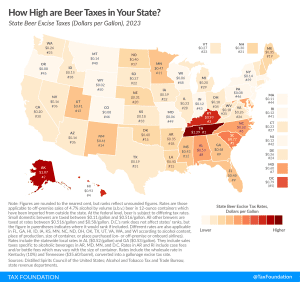

Beer Taxes by State, 2023

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

Testimony: Reviewing Recent Federal Tax Policies and Considering Pro-Growth Reforms

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

Testimony: Taxes, Spending, and Addressing the U.S. Debt Crisis

A better-designed tax system should be a goal of any fiscal consolidation package. That said, our simulations suggest that even substantially higher tax increases are insufficient to curtail long-run debt-to-GDP growth.

Why the Estonian Tax System Would Remain Competitive after Tax Reform

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

Reforming EU Own Resources: Competitiveness versus Raising Revenue

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

Tax Policy and Economic Downturns in Europe

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

How to Unlock Global Growth: The Role of Taxation

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

Insights into the Tax Systems of Scandinavian Countries

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

VAT Carveouts in Portugal

The Portuguese government has introduced plans to exempt “essential” food items from its value-added tax (VAT) in response to the recent inflation spike. While this may sound like a reasonable measure on the surface, it comes with numerous unintended consequences that compromise its effectiveness.

4 min read

Spain Is Doubling Down on Poor Tax Policy

Spain should follow the examples of Italy and the UK and enact tax reforms that have the potential to stimulate economic activity by supporting private investment while increasing its international tax competitiveness.

7 min read

America’s Progressive Tax and Transfer System: Federal, State, and Local Tax and Transfer Distributions

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

Facts & Figures 2023: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Chile Needs Pro-Growth Tax Reform

As Chile looks to the future, policymakers might want to follow the UK’s example. Policymakers should focus on growth-oriented tax policies that encourage private and foreign direct investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

2 min read

Kentucky Should Refrain from Expanding Its Taxation of Business Inputs

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read