The unique puzzle Rhode Island faces—high public spending, low per-capita income relative to its neighbors—means the state has become notorious for high tax rates on nearly everything. In 2010, the state took a positive first step by reducing the top individual income tax bracket from 9.9 percent to 5.99 percent, reducing the number of tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and credits, increasing standard deductions for most except wealthier taxpayers, and eliminating the state’s alternative minimum taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. and optional flat tax. Legislators are currently considering an effort to undo a good chunk of those valuable reforms.

Claiming this reform has depressed tax revenue while hurting local communities, Rep. Scott Guthrie (D) has introduced 2014-H 7245, which would raise the rate on income over $250,000 to 7.99 percent. The revenue raised would go to municipalities in the state via revenue sharing.

The narrative is that property taxes are going up in Rhode Island because local aid has slowed. While local aid has slowed to some degree, there are two reasons that state income tax hikes are not the answer here. First, 2014-H 7245 does not address whether local property taxes would decrease as a result of the additional state aid. This means localities would get an influx of new state funds and then taxpayers presumably just hope for consequential property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. rate cuts.

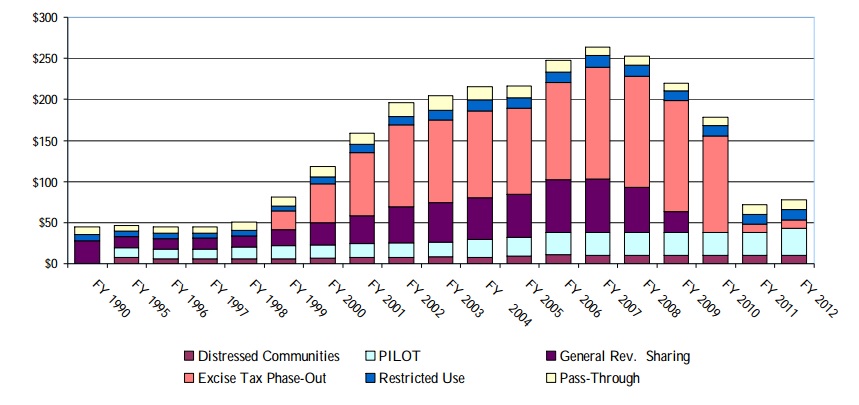

Further, it’s important to note that the recent decrease in state aid is actually a return to the norm for Rhode Island. As Figure 1 shows, state aid was much more modest in the 90s, but exploded in the 2000s.

Figure 1: Rhode Island State Aid to Local Governments (FY 1990-2012)

Source: Rhode Island House Fiscal Advisory Staff

Raising top individual income tax rates at the state level might take the sting out of local spending issues in Rhode Island temporarily, but it fails to offer a sustainable solution because it asks one small portion of the population to pay for services everyone uses. Ultimately, if people want additional local government services, they are going to have to pay for them with the primary tool in the local tax toolkit: property taxes.

On the better note, check out the recent Rhode Island corporate tax reform proposal.

Follow Scott on Twitter.

Share this article