The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative.

How Does It Work? How Much Is It Worth?

The larger the standard deduction, the less income is subject to taxation. The 2017 Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for single filers and $13,000 to $24,000 for taxpayers who are married filing jointly. The amount was indexed to inflation for future years.

Post-TCJA, the percentage of the population that itemized decreased from 30 percent to 10 percent in 2018. Prior to the TCJA, taxpayers could claim both the standard deduction and a personal exemption. To streamline the code and reduce complexity, the TCJA eliminated the personal exemption but nearly doubled the standard deduction for all filing types.

What Is the Difference Between Taking the Standard Deduction Versus Itemizing Deductions?

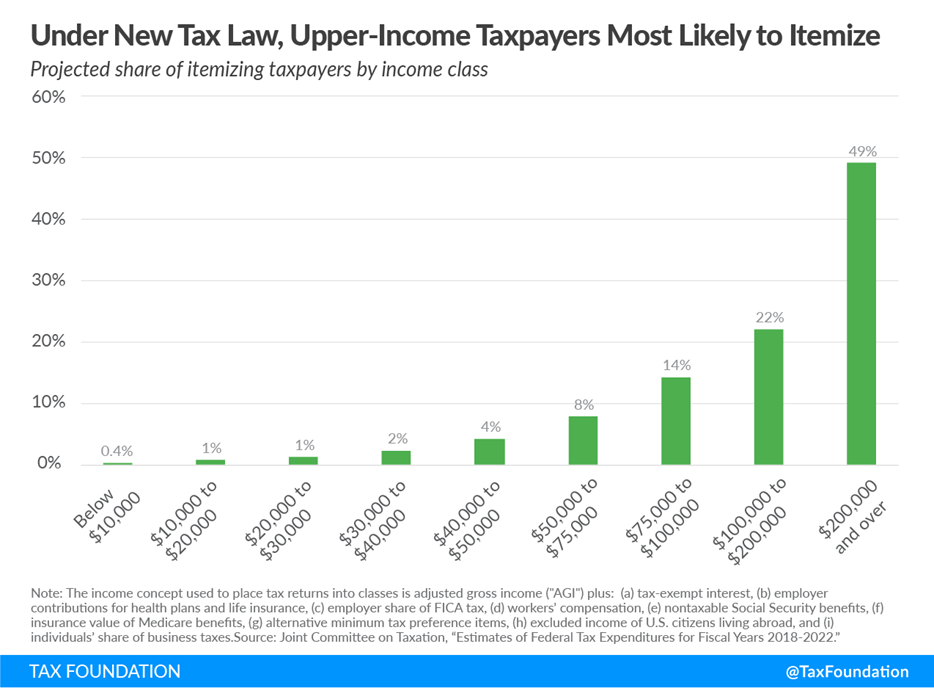

Itemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions are various expenses that may be listed to reduce taxable income for taxpayers who, for example, make charitable contributions, pay state and local taxes, or deduct the interest payments on their mortgage. Itemized deductions are more uniquely tailored and favored by taxpayers in higher-income brackets.

Taxpayers tend to choose the deduction option that lowers their taxable income the most and maximizes what they keep. The TCJA increased the standard deduction, eliminated the personal exemption, and reduced eligible expenses and amounts of itemized deductions to encourage more taxpayers to opt for the less complex route of claiming the standard deduction. This deduction is administratively easier for the taxpayer to elect and for the IRS to compute, and benefits most taxpayers in the lower-income brackets more than itemizing.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe