The state and local tax (SALT) deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The Tax Cuts and Jobs Act (TCJA) capped it at $10,000 per year, consisting of property taxes plus state income or sales taxes, but not both.

How Does the SALT Deduction Work?

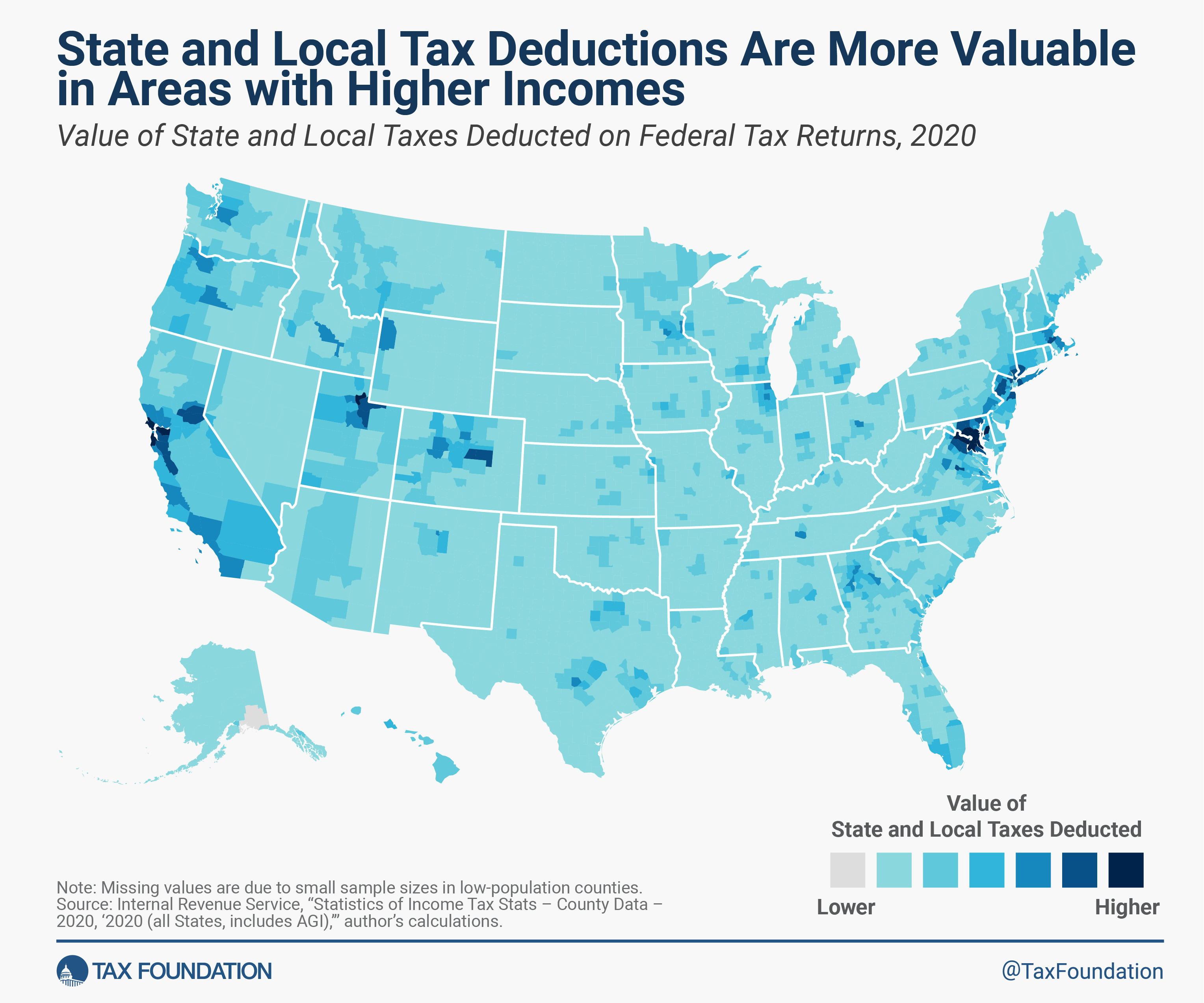

Taxpayers who itemize may deduct up to $10,000 of property, sales, or income taxes already paid to state and local governments; before the TCJA, there was no cap to the value of the SALT deduction. In theory, the deduction exists to offset some federal taxpayer liability by excluding income already taken in taxes for state and local government services. More taxpayers claim the deduction in states with higher-tax regimes that provide more government services (e.g., New York, Connecticut, New Jersey, etc.). The state and local tax deduction disproportionally benefits high-income taxpayers, violating the principle of tax neutrality (not to be confused with tax fairness). In fact, before the TCJA, 91 percent of the benefit of the SALT deduction was claimed by those with income above $100,000 and concentrated in six states: California, New York, New Jersey, Illinois, Texas, and Pennsylvania (Joint Committee on Taxation, “Tables Related to the Federal Tax System as in Effect 2017 Through 2026”).

History of the SALT Deduction

The SALT deduction is a large tax expenditure, meaning it is among the provisions in the tax code that provides a special deduction, credit, exclusion, or other tax preference that wouldn’t be included in a “normal” tax code. The Joint Committee on Taxation (JCT) estimated that the deduction for state and local taxes paid would cost the federal government $24.4 billion for 2020. If Congress does not make permanent the individual tax provisions, the SALT deduction cap of $10,000 per household will expire as scheduled after 2025.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe