Last week, Senator Orrin Hatch (R-UT) released modifications to the “Chairman’s Mark” to the Senate’s version of the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act. The amendment slightly tweaked ordinary brackets and rates from the original proposal, substantially increased the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. from the proposed $1,650 to $2,000 per qualifying child, and made many individual provisions temporary. For more details on the amended Senate bill, my colleague Nicole has a great summary.

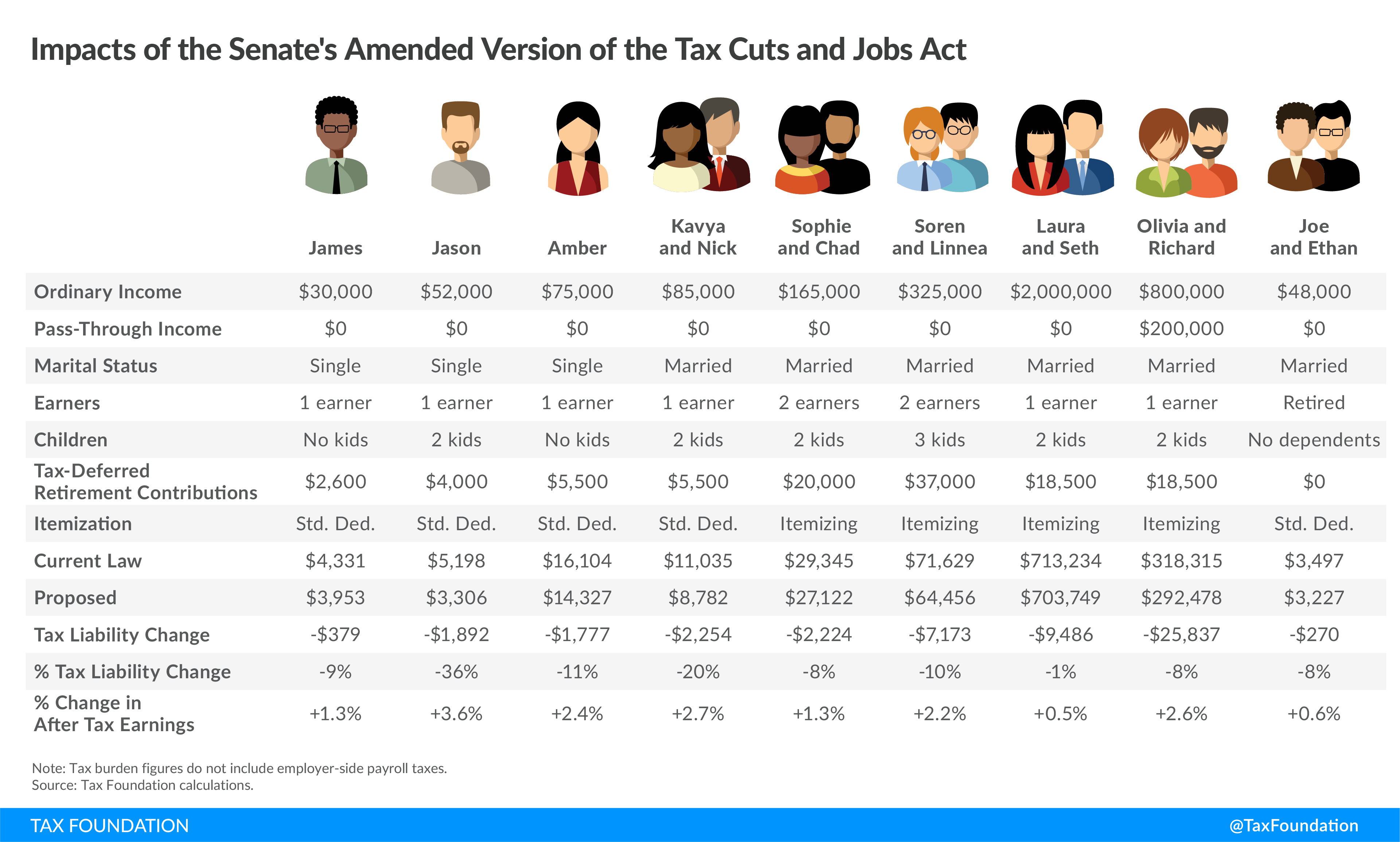

To help provide a sense of how the Senate’s amended version of the Tax Cuts and Jobs Act would impact real taxpayers, we’ve run the taxes of nine example households. Each sample taxpayer has realistic characteristics to show how the individual income tax provisions of the bill would impact individuals and families across the income spectrum. Our results indicate a reduction in tax liability for every scenario we modeled, with some of the largest cuts accruing to moderate-income families with children.

Our first household (James) is a single individual earning $30,000 with no dependents. We assume that this filer takes the standard deduction and has tax-deferred retirement contributions of $2,600 (5 percent of income). Under current law, this taxpayer faces overall tax liability (including employee-side payroll taxes) of $4,331, and would see a tax cut of 9 percent, to $3,953. This household’s after-tax income would increase by 1.3 percent.

Our second household (Jason) is a single parent with two children, earning $52,000. This filer contributes $4,000 to tax-deferred retirement accounts. The taxpayer takes the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. , and is eligible for child tax credits. This taxpayer sees a 36 percent reduction in tax liability, increasing after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. by 3.6 percent, chiefly due to the plan’s expanded child tax credit. This filer’s liability goes from $5,198 under current law to $3,306 under the proposed tax bill.

Our third household (Amber) is a single individual earning $75,000 with no dependents. We assume this filer takes the standard deduction and has tax-deferred retirement contributions of $5,500. This taxpayer’s liability is reduced by 11 percent, with after-tax income increasing by 2.4 percent. Taxes owed go from $16,104 under current law to $14,327 under the Senate proposal.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOur fourth household (Kavya and Nick) is a single-earner married couple with two kids, earning $85,000. We assume tax-deferred retirement savings of $5,500, and that the couple takes the standard deduction. They also benefit from the expanded child tax credits, and see an overall tax savings of 20 percent, from $11,035 to $8,782. This family’s after-tax income increases by 2.7 percent.

Our fifth household (Sophie and Chad) is the first to take itemized deductions, which requires additional assumptions. We modeled a dual-income family with incomes of $95,000 and $70,000 respectively (for a total of $165,000), with two children. To derive the amount of deductible home mortgage interest, we assume a $340,000 home financed with a 30-year mortgage with 3.5 percent interest and 20 percent down. (In all cases, we assume that mortgage debt meets the definition of acquisition debt, and is not equity debt.) For deductible property tax, we assume an effective property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. rate of 1 percent. We also assume charitable contributions comprise 2.5 percent of income, and an effective state and local income tax rate of 5 percent. This couple has $20,000 in tax-deferred retirement contributions, and loses most of the value of the child tax credit under current law, but could claim it in full under the Senate bill. These taxpayers see a 8 percent reduction in tax liability, from $29,345 to $27,122. Their after-tax income increases by 1.3 percent.

Our sixth household (Soren and Linnea) also itemizes. A dual-income household with three children, this household sees incomes of $250,000 and $75,000 respectively, with an $800,000 home (same assumptions as above), charitable contributions of 2.5 percent of income, an effective state and local income tax rate of 5 percent, and a slightly higher effective property tax rate of 1.25 percent. The couple has $37,000 in retirement contributions (maxing out 401(k)s under current law in 2018), and is ineligible for child tax credits under current law, but eligible under the Senate proposal. Their tax liability would decrease by 10 percent under the plan, from $71,629 to $64,456. Their after-tax income increases by 2.2 percent.

Our seventh household (Laura and Seth) is a married, single-earner, two-child household with $2 million in income, a $2.5 million home, a maxed-out 401(k), and other assumptions identical to the previous household with the addition of about $6,000 in other miscellaneous itemized deductions. In this case, tax liability decreases by 1 percent, from $713,234 to $703,749. Their after-tax income increases by 0.5 percent.

Our eighth household (Olivia and Richard) is a married, single-earner, two-child household with $1 million in income, $200,000 of which is derived from a active stake in a qualifying pass-through business subject to the proposed 17.4 percent pass-through deduction. We assume a $1.5 million home, with other assumptions identical to the other households. In this case, tax liability declines 8 percent, from $318,315 to $292,478. Their after-tax income increases by 2.6 percent.

Finally, our ninth household (Joe and Ethan) consists of married retirees with $48,000 in retirement income. We assume that they take the standard deduction, which is increased for filers over 65. They also fall within an income range that allows a portion of their Social Security income (which we set at $16,800) to be exempt from taxation. Under the plan, their after-tax income increases by 0.6 percent, with tax liability falling from $3,497 to $3,227, an 8 percent reduction in tax liability.

All of our sample filers receive a tax cut, but the size of that reduction varies. The significantly higher standard deduction, combined with lower marginal rates and a more generous (and more broadly available) child tax credit, drives the reductions in tax liability for low- and middle-income filers. A reduction in itemized deductions limits reductions in tax liability for upper-income earners, though these filers benefit from the repeal of the alternative minimum tax.

Finally, these tax calculations are assumed to take place in 2018. Because of the temporary nature of the majority of the individual title in the Senate’s version of the Tax Cuts and Jobs Act, these results are not representative of the entire 10-year budget window. We also made no assumptions regarding individual’s health insurance status, meaning impacts of functionally eliminating the individual mandate penalty are not included.

Individual income taxes are only one component of the proposed Tax Cuts and Jobs Act, and changes to business taxation could have a significant impact on wages and economic growth. Still, sometimes it’s helpful to drill down on one component of reform, and, as these sample taxpayers demonstrate, most taxpayers across the spectrum experience lower tax bills under the Senate proposal.

Share this article