Filing your taxes can be taxing. In addition to the actual amount of taxes due, there are compliance costs associated with filling out taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. forms and determining what you owe.

In the past, the Tax Foundation and others have attempted to estimate the cost of tax compliance. A new paper by Youssef Benzarti, an Assistant Professor of Economics at UCLA, uses a novel quasi-experimental approach, which could potentially shed light on the matter. He finds that the cost of tax compliance could be much larger than previous estimates made with survey methods.

For years, the Office of Information and Regulatory Affairs has compiled data on the time it takes Americans to complete tax forms, but there has been little robust insight into the cost. Therefore, to estimate the cost of filing tax forms, Benzarti designed a novel approach which uses a taxpayer’s revealed preferences per their choice to itemize or take the standard deduction.

A little background: When taxpayers file their federal individual income taxes, they have a choice between itemizing their deductions or claiming the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. . Taxpayers who choose to itemize their deductions can deduct several expenses against their income, including home mortgage interest, property taxes, state and local income or sales taxes, and charitable contributions. Otherwise, taxpayers can claim the standard deduction, which under current law is $12,000 for singles, $24,000 for married couples filing jointly, and $18,000 for heads of household.

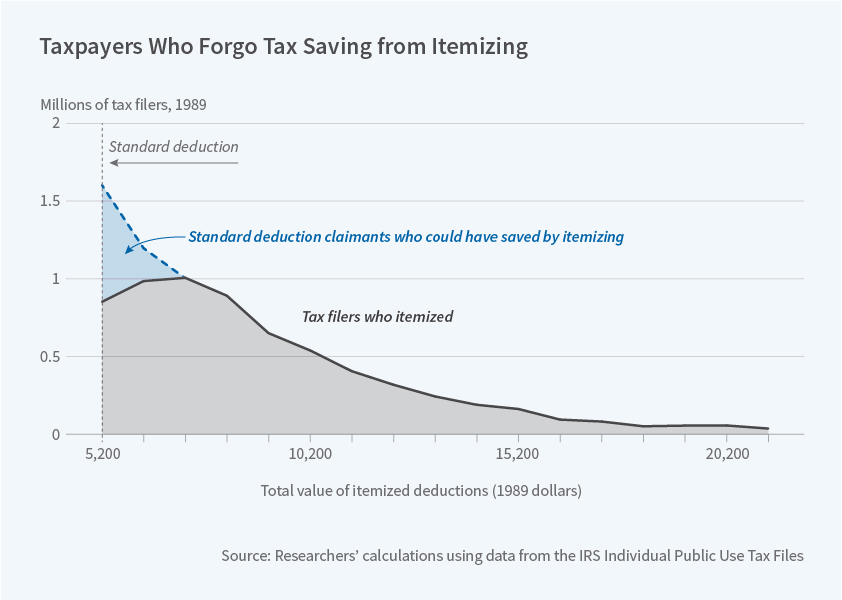

While it may initially seem intuitive that taxpayers would itemize their deductions if their total itemized deductions are worth more than the standard deduction, data shows that this is not always the case. Benzarti noticed what he called a “missing mass” (pictured below) of taxpayers who would be expected to itemize their deductions but instead opted to take the standard deduction. These taxpayers were right at the margin of itemizing, but didn’t. More specifically, these taxpayers had itemized deductions that totaled, for example, $24,005 as a married couple, but decided to take the standard deduction even though it cost them.

Source: NBER Digest

Taxpayers who opted not to itemize even if they would save money are essentially sending a signal that they consider itemizing to cost more in terms of compliance than they would save in taxes. Benzarti used those revealed preferences to estimate the cost of itemizing overall to then determine the total cost of filing Federal income taxes.

With this method, he found that tax compliance costs are meaningful. At an individual level, the cost of filing federal income taxes in 2016 varied from $175 for lower-income single taxpayers, to $591 for higher-income married taxpayers. At an aggregate level, compliance costs have been rising steadily since the mid-1980s. In 1984, the country as a whole spent about $150 billion in tax compliance; in 2006, it had risen to about $200 billion. While this has been partly driven by the increase in the number of taxpayers, it is also caused by the increased number of taxpayers who have had to file additional schedules with their Form 1040. All cost estimates are in terms of 2016 dollars.

It is worth noting that these estimates are based on the tax code prior to the passage of the Tax Cuts and Jobs Act (TCJA) last December. This will no doubt alter the tax code’s compliance costs. The standard deduction was nearly doubled. The Pease limitation on overall deductions and personal exemptions (and their more complicated phaseouts) have been completely eliminated. Additionally, the Alternative Minimum Tax exemption and its phaseout range have been increased for all filing statuses, which allows many taxpayers to avoid the AMT entirely.

Over the next eight years lawmakers and academics will attempt to quantify tax compliance costs under the TCJA. Aspects of the new law made the tax code simpler, but others, such as those pertaining to pass-through businesses, made the code more complex. Measures of tax complexity are important. The cost of tax compliance should be factored in to the equation when lawmakers determine if they want to reform the current structure of individual income taxes under the TCJA or return to pre-TCJA law.

Share this article