Tax expenditures are departures from a “normal” tax code that lower the tax burden of individuals or businesses through an exemption, deduction, credit, or preferential rate. However, defining which tax expenditures grant special benefits to certain groups of people or types of economic activity is not always straightforward.

Tax expenditures are determined based on whether they deviate from a “normal” tax code. The definition of “normal” used by the federal government generally follows the “Haig-Simons” approach, which can lead to higher tax burdens on income used for saving and investment than income used for immediate consumption. Because of the government’s definition of normal, provisions that provide neutral treatment to saving and investment may be characterized as expenditures, such as full expensing for capital investment and tax-neutral savings vehicles like 401(k)s and Individual Retirement Accounts (IRAs). However, under an alternative definition of “normal” based on neutrality between saving and consumption, provisions like full expensing of capital investment and tax-neutral savings vehicles would not be categorized as tax expenditures.

Other provisions that reward certain types of economic activity above others, like green energy tax credits, or certain household characteristics, like child tax credits, are also characterized as expenditures.

Determining whether a tax provision is a special preference or a policy that makes the tax code neutral between how someone chooses to use their income (like between saving or spending) is not as straightforward as simply checking if it is listed as a tax expenditure because of the definition used for a “normal” tax code.

Individual vs. Corporate Tax Expenditures

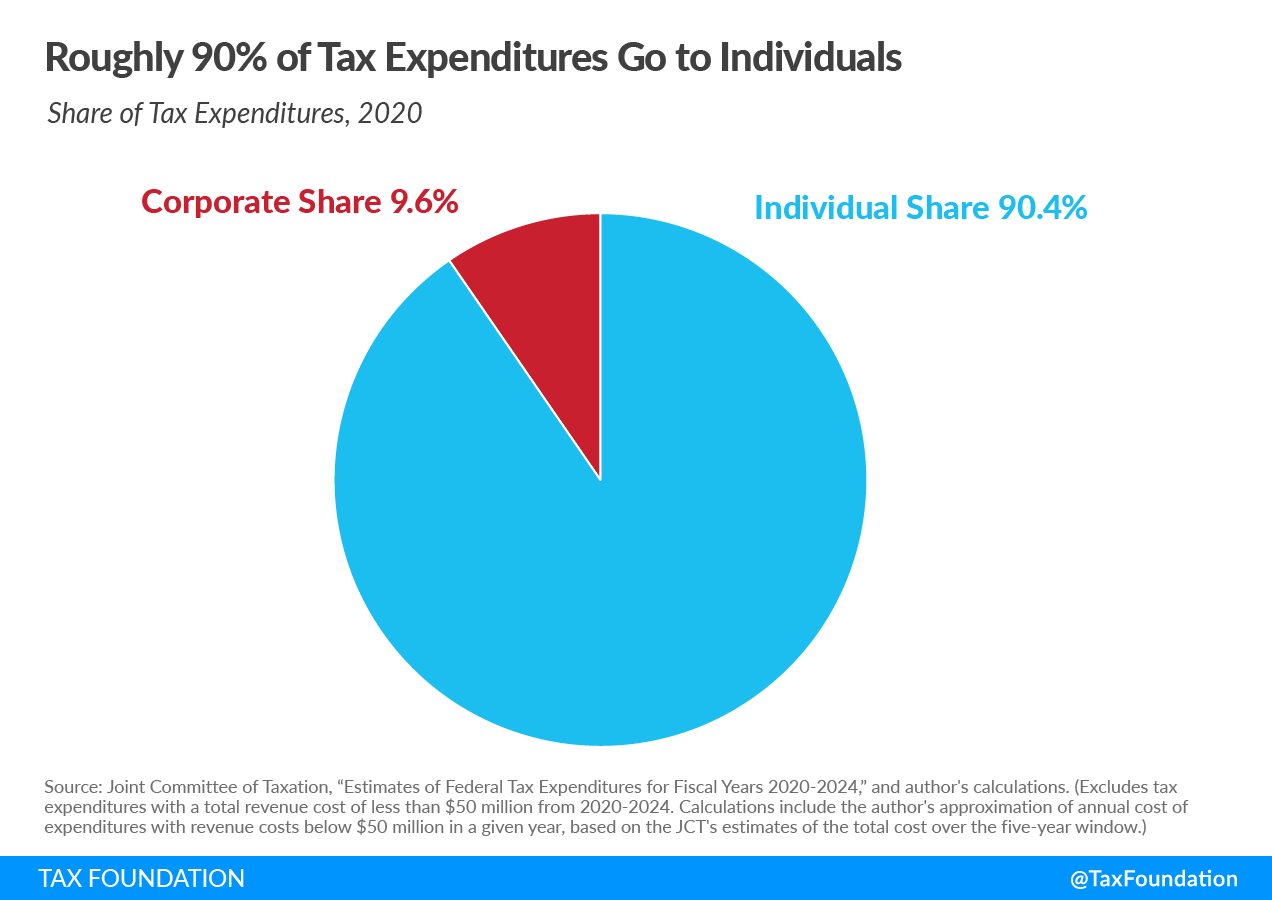

Individual and corporate tax expenditures differ in design and magnitude. While the corporate tax code captures the public’s imagination, the vast majority of tax expenditures benefit individual taxpayers, not C corporations.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe