Global Intangible Low-Taxed Income (GILTI) is a special way to calculate a U.S. multinational company’s foreign earnings to ensure it pays a minimum level of tax. GILTI was adopted as part of the 2017 Tax Cuts and Jobs Act (TCJA) and can lead to high tax burdens on foreign profits, putting U.S. companies that operate abroad at a disadvantage.

How Does Global Intangible Low-Taxed Income (GILTI) Work?

Global Intangible Low-Taxed Income is a minimum tax targeted at foreign earnings from intangible assets (copyrights, patents, trademarks, etc.) and was adopted when the U.S. moved from a worldwide tax system to a territorial tax system. GILTI changed incentives for tax avoidance and where companies hold their Intellectual Property (IP), a company’s legally protected non-physical assets. GILTI uses a formulaic approach to tax most active earnings above a 10 percent return on assets, even if those earnings are not derived from intangibles. It simply assumes that such “supernormal” returns (i.e., those above 10 percent) are from IP or other intangibles.

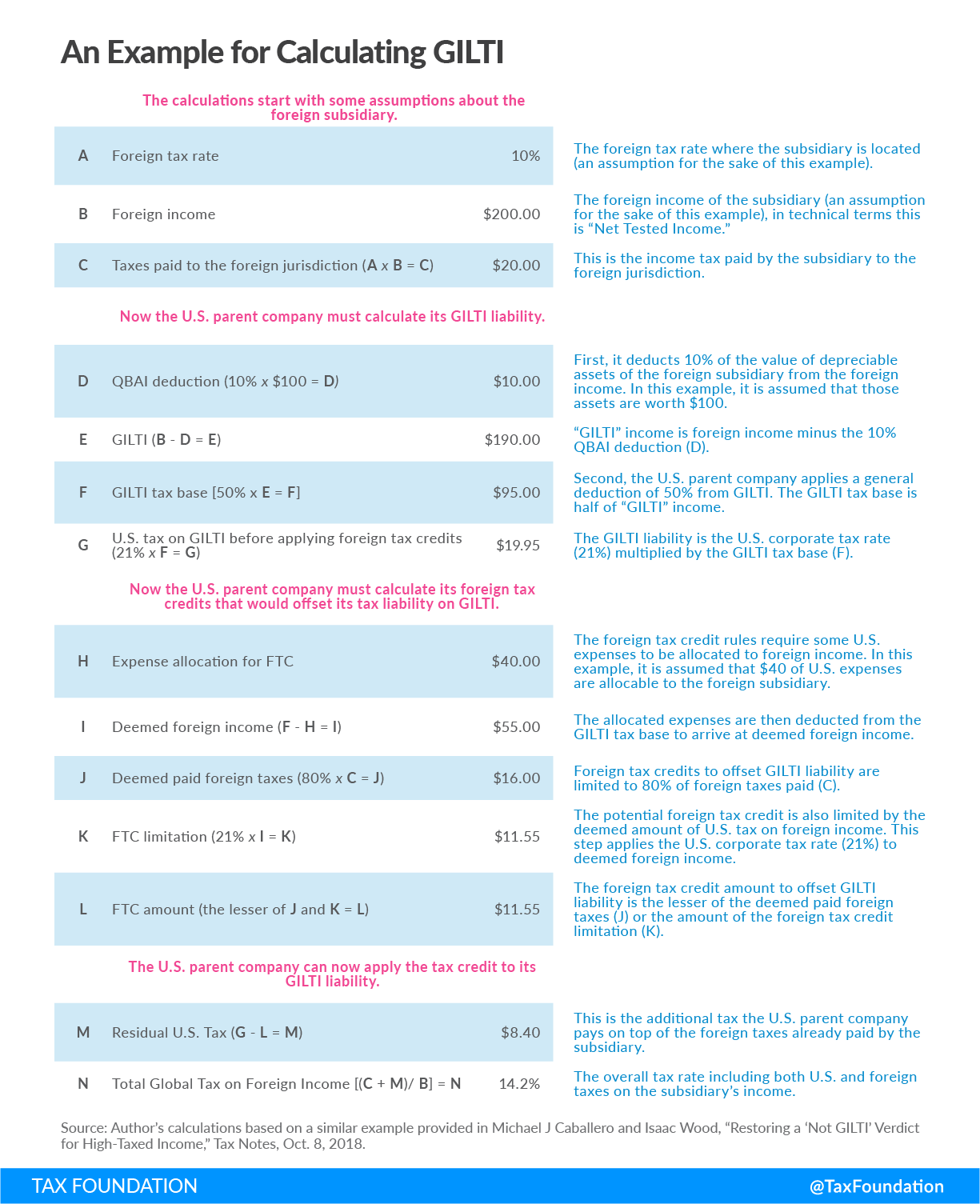

Below is an example for calculating GILTI, which you can learn more about in our in-depth explainer.

GILTI is a mirror policy to FDII, and the pair of policies is intended to balance incentives for businesses to keep intangible assets in the U.S. against choosing to place those assets in offshore jurisdictions.

If a U.S. company uses a foreign low-tax jurisdiction to avoid paying U.S. taxes, multiple approaches could be used to have that company pay more in taxes to the U.S. Treasury. One would be to require that all businesses pay a minimum level of tax on their blended foreign earnings; GILTI essentially takes that approach. GILTI allows the U.S. to be relatively indifferent about where U.S. companies do business in the world—in high-tax countries or low-tax countries—so long as companies are paying at least a minimum rate of tax. To the extent that companies are not paying that minimum rate of tax, the tax on GILTI gives the U.S. the opportunity to charge a top-up tax to ensure the minimum is paid.

Before tax reform, only certain foreign earnings of U.S. companies would be taxed annually. These included royalties, dividends, and interest income. Other foreign earnings were not taxed by the U.S. unless they were repatriated to the U.S. Now, many more companies are taxed on their foreign earnings under GILTI on an annual basis. Even though the U.S. switched from a worldwide to a territorial tax system, the U.S. tax base of foreign earnings is much broader now because of GILTI.

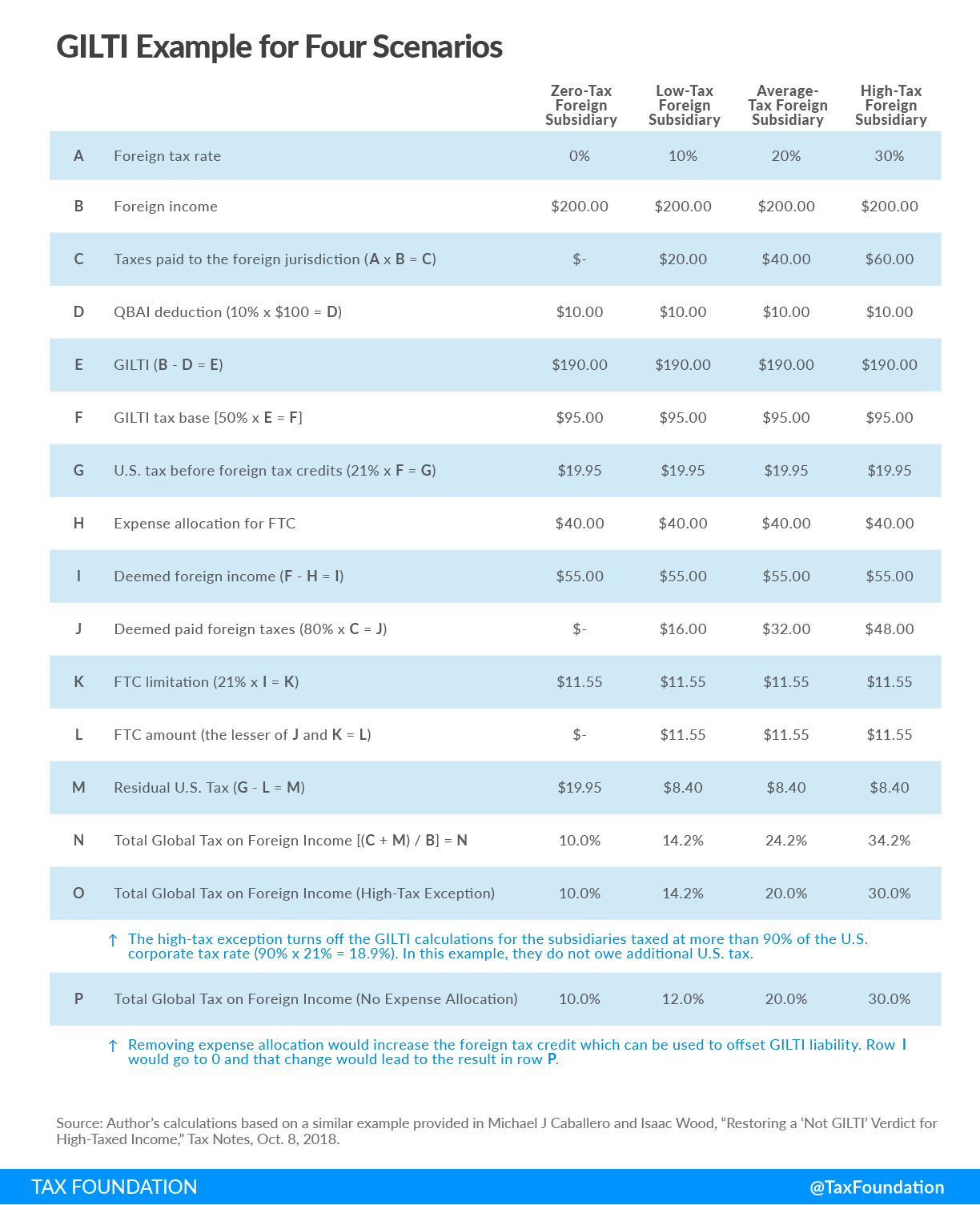

The tax rate on GILTI is intended to be in the range of 10.5 percent to 13.125 percent. However, some businesses pay much higher tax rates on GILTI because of rules for foreign tax credits. You can see an example of that in the chart below, which you can learn more about here.

In 2026, changes are scheduled to kick in that would raise the overall effective tax rate on GILTI from 13.125 percent to 16.406 percent.

Other countries are looking to use the GILTI model to adopt a global minimum tax.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe