The federal child tax credit (CTC) is a partially refundable credit that reduces a taxpayer’s tax liability dollar-for-dollar by up to $2,000 for each qualifying child. The credit phases in for lower-income taxpayers and phases out for higher-income taxpayers.

How Does It Work?

The CTC provides a maximum credit of $2,000 per child, and if the credit exceeds income tax liability, it is partially refundable up to $1,700 for tax year 2025 (the refundable portion is adjusted for inflation each year until it reaches the maximum of $2,000). The refundable portion of the credit is called the additional child tax credit (ACTC), and it is calculated as 15 percent of a taxpayer’s earnings above $2,500.

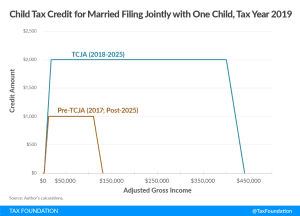

The credit begins phasing out at a 5 percent rate when income exceeds $200,000 for single filers and $400,000 for joint filers.

Additionally, taxpayers may claim a $500 non-refundable credit for dependents who do not qualify for the CTC, known as the credit for other dependents.

The 2017 Tax Cuts and Jobs Act (TCJA) established the current CTC and credit for other dependents. The changes will expire after 2025, and taxpayers will then be eligible for a smaller $1,000 CTC that phases out when income exceeds $75,000 for single filers and $110,000 for joint filers. The ACTC will be calculated as 15 percent of a taxpayer’s earnings above $3,000 and limited to $1,000.

In 2021, the American Rescue Plan Act temporarily expanded the credit for that year only. It increased the maximum credit to $3,600 for younger children or $3,000 for children age 6 or older, and it eliminated the credit’s phase-in and refundability limits. It also provided a portion of the credit in advance monthly payments. The changes expired after the end of 2021.

For a taxpayer to qualify for the credit, any child must meet age, relationship, support, dependent, citizenship, and residence criteria. The child must be under age 17; be biologically related to and claimed as a dependent by the taxpayer applying for the credit; not provide more than 50 percent of their own financial support; be a US citizen, US national, or US resident alien; and have lived with the taxpayer for more than half of the preceding calendar year. Stepchildren and foster children may qualify if they meet certain requirements. The TCJA also added a requirement that parents be able to verify a valid Social Security number (SSN) for each eligible dependent.

History of the Child Tax Credit

The CTC was originally a non-refundable $500-per-child credit enacted as part of the Taxpayer Relief Act of 1997. The credit was increased to $1,000 and made partially refundable under the Economic Growth and Tax Relief Reconciliation Act of 2001. Most recently, the TCJA increased the maximum amount of the credit from $1,000 to $2,000, expanded the refundable portion of the credit to $1,400, raised the income threshold phaseouts from $75,000/$110,000 (single/married) to $200,000/$400,000, and lowered the refundability threshold from $3,000 to $2,500. Unless Congress acts, these changes will expire at the end of 2025.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe