Pro-Growth Tax Reform for Oklahoma, 2025

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

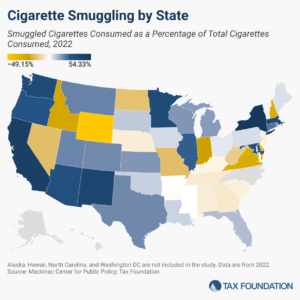

The US already has massive problems with cigarette smuggling. A cigarette prohibition would be devastating to tax coffers while pushing smokers toward what could become the world’s largest illicit market.

4 min read

Tax avoidance is a natural consequence of tax policy. Policymakers should consider the unintended consequences, both to public health and public coffers, of the excise taxes and regulatory regimes for cigarettes and other nicotine products.

5 min read

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

Recent data suggest that tax competitiveness plays a significant role in residents’ relocation decisions.

3 min read

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

Tax reform in Alabama is desirable and very possible. However, the overtime exemption, which complicates the tax code, reduces neutrality, and adds to compliance and reporting costs, is not a good example.

4 min read

Policymakers can and should address taxpayers’ legitimate grievances about out-of-control property tax bills, but they should do so without upending a system of taxation that is more efficient, fair, and pro-growth, and better suited to municipal finance, than any of the alternatives.

39 min read

The long-term value of these projects to the broader public remains highly debatable.

Due to the peculiar design of the proposed tax increase, it’s true: the largest tax increase Oregon has ever seen would create a substantial budget shortfall.

8 min read

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

Under the tax created by Measure 118, Oregon businesses would be significantly disadvantaged against their larger and out-of-state rivals.

6 min read

Oregon’s Measure 118, though presented as a tax on big business, would function as an aggressive sales tax on consumers.

7 min read