Income Tax Earmarking and Grocery Taxes on the Ballot in Utah

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

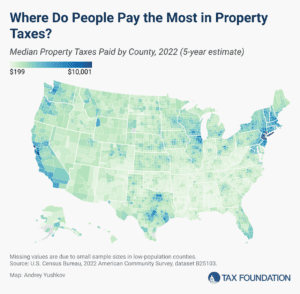

Eliminating the property tax will unfortunately set North Dakota back in significant ways, making the state a national outlier and eroding regional competitiveness.

6 min read

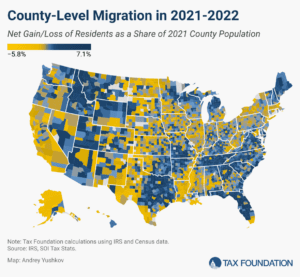

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

States would do better to broaden the sales tax base to include currently exempt classes of final consumption than to impose disproportionate taxes on prepared foods.

6 min read

The recently released FY 2025 budget for New York State signals a degree of optimism, with caveats. New York cannot tax itself toward a balanced budget.

6 min read

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

Gov. Pillen is searching for tax burden relief. But his plan, which reportedly involves a two-tiered sales tax and the state’s assumption of most school funding responsibility, would have profound implications that even those most convinced of the urgency of property tax relief may find unworkable and unpalatable.

12 min read

The Fifth Circuit has affirmed states’ authority over their respective tax policies and has asserted that the offset clause—often called the “Tax Mandate”—of the American Rescue Plan Act (ARPA) has enough fiscal impact on a state’s budget so as to be coercive, as opposed to incentivizing.

5 min read

To be fiscally responsible, recently proposed Pennsylvania tax cuts must be paid for in some way, either out of projected revenue growth or by offsetting reductions.

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

Virginia Governor Youngkin unveiled the contours of a tax reform plan incorporated into his forthcoming budget, which includes three major structural elements: a reduction in the individual income tax rate, a 0.9 percentage point increase in the sales tax rate, and the broadening of the sales tax base to include some “new economy” digital services.

6 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read