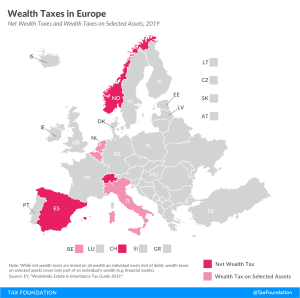

What the U.S. Can Learn from the Adoption (and Repeal) of Wealth Taxes in the OECD

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read