Fiscal Forum: Future of the EU Tax Mix with Dr. Monika Köppl-Turyna

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

The ongoing economic uncertainty from Russia’s war in Ukraine, economic recovery, supply chain disruptions, and rising interest rates have highlighted the importance of business investment.

30 min read

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

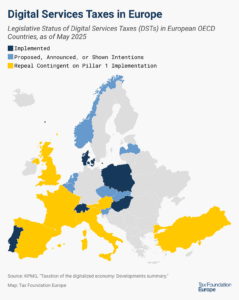

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals. If there is no agreement on changes to Pillar Two or digital services taxes, retaliatory American tariffs could be on the horizon.

8 min read

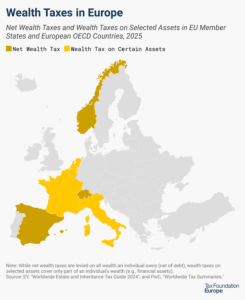

Wealth taxes not only collect little revenue and create legal uncertainty, but an OECD report argues that they can also disincentivize entrepreneurship, harming innovation and long-term growth.

5 min read

The next government needs to prioritize measures to improve Germany’s competitiveness as an investment location.

7 min read

This week, the incoming Trump administration issued a day-one executive order on the global minimum tax agreement known as Pillar Two, which seeks to ensure multinational corporations pay at least 15 percent in income tax.

6 min read

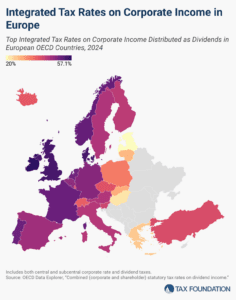

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Today marks 55 years since two students sent the first message across the Advanced Research Projects Agency Network (ARPANET) between computers at four universities, which would later become the internet we enjoy today.

5 min read

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

Pillar Two risks creating a more complex and unfair international tax system. It is inadvertently fostering new, opaque, and complex forms of competition, and policymakers should consider alternative approaches to creating a fairer international tax environment.

4 min read

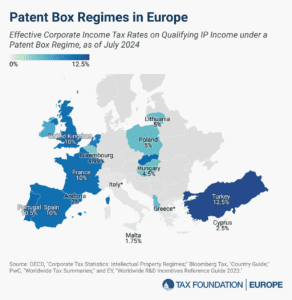

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

6 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

31 min read