FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

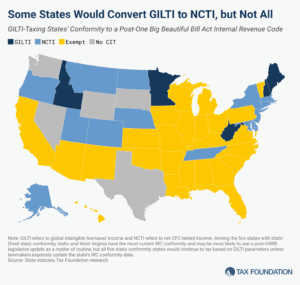

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

The BEPS project’s 15 actions were decisive responses to real problems in cross-border taxation, offering real benefits but also real costs. A decade of implementation experience has revealed a critical side effect: sharply higher compliance costs for both tax administrations and the business community.

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

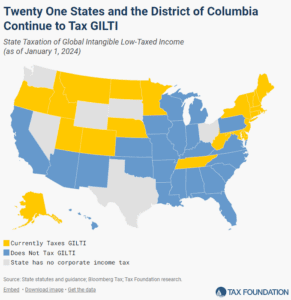

If Illinois’ budget is enacted as-is, Illinois will newly tax 50 percent of Global Intangible Low-Taxed Income (GILTI) as of tax year 2025, retroactively increasing tax burdens for US businesses and further hindering Illinois’ business tax competitiveness.

7 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

The Tax Foundation uses and maintains a General Equilibrium Model, known as our Taxes and Growth (TAG) Model to simulate the effects of government tax and spending policies on the economy and on government revenues and budgets.

9 min read

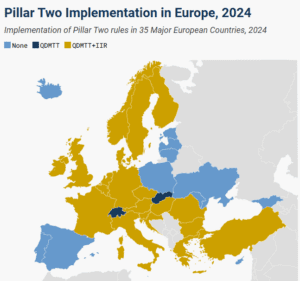

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals. If there is no agreement on changes to Pillar Two or digital services taxes, retaliatory American tariffs could be on the horizon.

8 min read

The Tax Foundation models tax policy using our proprietary Taxes and Growth model, illustrating the economic, revenue, and distributional impacts of different changes to the federal tax code. We’ve recently implemented improvements to the model that have been underway for the past several years, and we will be detailing them further in our forthcoming model methodology update.

4 min read

This week, the incoming Trump administration issued a day-one executive order on the global minimum tax agreement known as Pillar Two, which seeks to ensure multinational corporations pay at least 15 percent in income tax.

6 min read

18 of the 27 EU Member States have implemented both the income inclusion rule and the qualified domestic minimum top-up tax in 2024.

4 min read

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

States that tax GILTI increase filing complexity, drive up the cost of tax compliance, and introduce unnecessary economic uncertainty and legal risk. 21 states and DC continue to tax GILTI despite these challenges.

6 min read

Supernormal profits are an important concept, but we should be wary of analysis that both defines supernormal profits very broadly and equates all supernormal profits with monopoly profits that can be easily taxed without negative economic effects.

23 min read

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read