Biden’s New Tax Proposals Are Complicated and Rife with Double Taxation

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

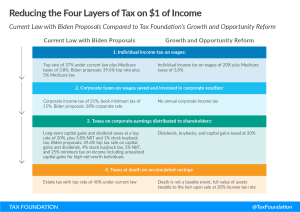

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

If the EU wants to strategically compete with economic powers like the United States or China, it needs principled, pro-growth tax policy that prioritizes efficient ways to raise revenue over geopolitical ambitions.

6 min read

The business tax changes originally introduced in the TCJA are scheduled to increase tax burdens on businesses at a time when economic headwinds and broader uncertainty are higher than they have been in decades.

12 min read

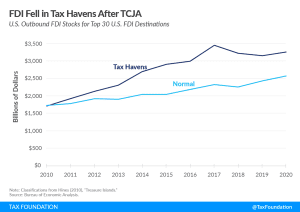

Academic research indicates foreign direct investment (FDI) is highly responsive to the corporate effective tax rate (ETRs); that is, the tax rate after accounting for all deduction and credits available to corporations.

3 min read

Overall, the data shows outbound FDI shifted from low-tax to other jurisdictions, while inbound FDI remained largely unchanged.

3 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

Federal policymakers are debating a legislative package focused on boosting U.S. competitiveness vis-a-vis China; however, it currently contains little to no improvements to the U.S. tax code.

34 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

One goal for the Build Back Better Act has been to increase the amount of revenue the U.S. raises from U.S. companies at home or abroad. With the global minimum tax rules in play, it is likely that the expected gains to the U.S. Treasury from foreign profits of U.S. companies will diminish.

5 min read

As 2021 comes to a close, countries are moving toward harmonizing tax rules for multinationals, but stalled talks on the Build Back Better Act in the United States means new uncertainties for a global agreement and for taxpayers.

5 min read

As Congress contemplates adding a new worldwide interest limitation rule as part of the House Build Back Better Act, it is useful to consider the potential effects of this proposal as well as whether it is necessary to add this on top of the U.S.’s existing restrictions on the value of interest deductions.

9 min read

Using Tax Foundation’s Multinational Tax Model, we estimate the effective tax rates on controlled foreign corporation (CFC) profits under current law and under each of the proposed plans for business tax hikes.

9 min read

In general, the effective tax rates on the foreign profits of U.S. multinationals are not that low relative to the U.S. tax rate, contrary to popular rhetoric.

7 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have surfaced in recent weeks, there are clear divides among various proposals.

5 min read