All Related Articles

Testimony: Prioritizing Comprehensive Tax Modernization in Nebraska

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

Can GILTI and the GloBE be Harmonized in a Biden Administration?

While there are several parts of the policy that are subject to further discussion and agreement, GloBE is expected to be different from GILTI in several ways.

Alabama Passes Tax Reform Aimed at Throwback, GILTI, and More

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

U.S. Cross-border Tax Reform and the Cautionary Tale of GILTI

The Biden campaign and Senate Democrats identified changes to GILTI that would increase the taxes U.S. companies pay on their foreign earnings. Rather than tacking on changes to a system that is currently neither fully territorial nor worldwide, policymakers should evaluate the structure of the current system with a goal of it becoming more, not less, coherent.

51 min read

Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Personnel Is Policy: Biden International Tax Team Edition

This week, the Treasury Department added several new appointees as staffing continues following President Biden’s inauguration. Among them were three scholars of international tax policy: economist Kimberly Clausing and law professors Rebecca Kysar and Itai Grinberg. These three will be influential in developing the administration’s approach to changing U.S. tax rules for multinational corporations and negotiating international tax policy changes at the Organisation for Economic Co-operation and Development (OECD).

4 min read

Thirteen Priorities for Pro-Growth Tax Modernization in Nebraska

We identify 13 of the highest tax reform priorities Nebraska policymakers should consider in their effort to create a more growth-friendly tax code. We also offer a sample comprehensive tax reform plan to show one way policymakers could begin tackling these objectives over the next couple legislative sessions, with further progress to be made in the years ahead.

8 min read

Potential Regulatory Changes in Tax Policy Under the Biden Administration

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

Details and Analysis of President Joe Biden’s Campaign Tax Plan

What has President Joe Biden proposed in terms of tax policy changes? Our experts provide the details and analyze the potential economic, revenue, and distributional impacts.

23 min read

Reviewing Joe Biden’s Tax Vision

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

Iowa Decouples from 163(j) and GILTI, Clarifies Non-Taxation of PPP Loans

Iowa’s HF 2614, which passed both chambers of the legislature and now waits for the governor’s signature, makes several changes to the state’s tax code, which, although they will affect revenue, will encourage economic growth and make the state’s tax code more competitive.

4 min read

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

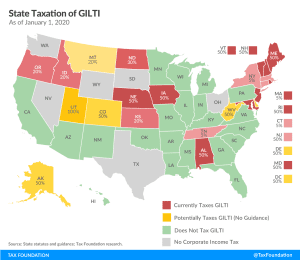

Kansas, Nebraska, and Utah Lawmakers Pursue “Not GILTI” Verdicts

Taxing GILTI puts states at a competitive disadvantage compared to their peers—all for a tax that makes very little sense at the state level, and which legislators never sought in the first place.

5 min read

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min readGILTI and Other Conformity Issues Still Loom for States in 2020

Even two years after enactment of the federal Tax Cuts and Jobs Act (TCJA), many states have yet to issue guidance explaining how they conform to key provisions of the law, particularly those pertaining to international income.

27 min read

Tax Foundation Response to OECD Public Consultation Document: Global Anti-Base Erosion Proposal (“GloBE”) (Pillar Two)

The tax base for the income-inclusion rule will be just as important as determining the rate, and both the base and the rate will likely impact business decisions. Additionally, policymakers need to determine how the choice for blending fits with the overarching goal of the policy. And as the example of GILTI shows, it is essential to assess how current international tax regulations would interact with a global minimum tax.

Senator Van Hollen Introduces Proposal to Raise Taxes on High-Income Households

Van Hollen’s proposals add to the long list of Democratic Party tax proposals that attempt to both raise additional revenue from corporations and high-income households and make the tax code more progressive and “equitable.”

3 min read