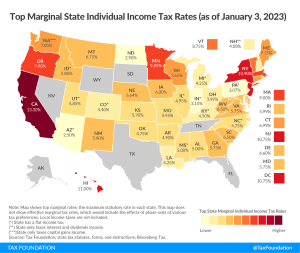

State Individual Income Tax Rates and Brackets, 2023

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min readHow does Arkansas’s tax code compare? Arkansas has a graduated individual income tax, with rates ranging from 2.00 percent to 4.90 percent. Arkansas also has a 1.0 to 5.30 percent corporate income tax rate. Arkansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 6.125 percent, and an average combined state and local sales tax rate of 9.46 percent. Arkansas’s tax system ranks 38th overall on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Arkansas is no exception. The first step towards understanding Arkansas’s tax code is knowing the basics. How does Arkansas collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures: How Does Your State Compare?

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

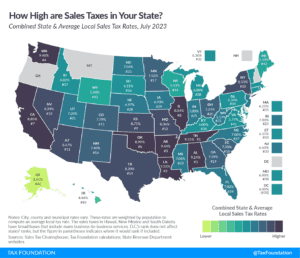

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

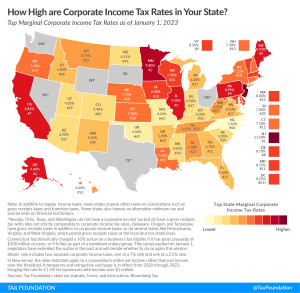

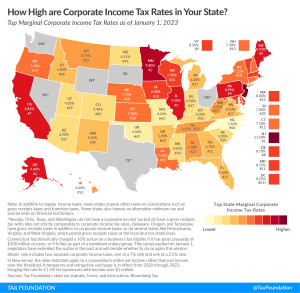

New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

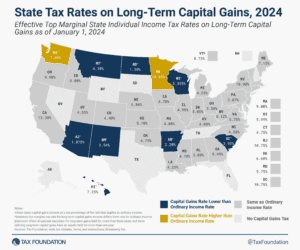

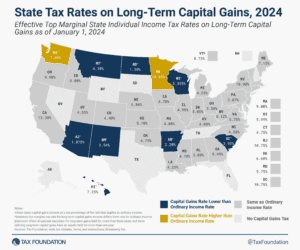

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

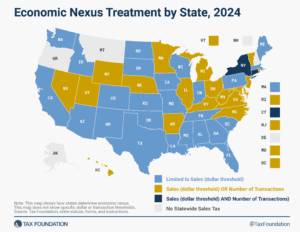

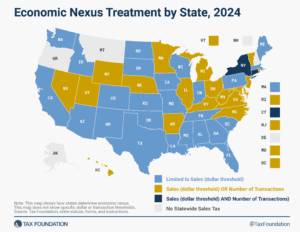

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

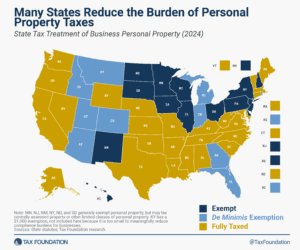

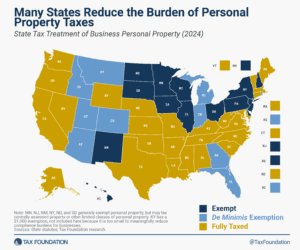

Does your state have a small business exemption for machinery and equipment?

3 min read

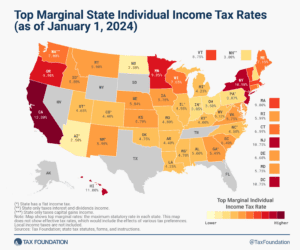

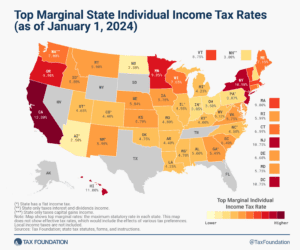

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

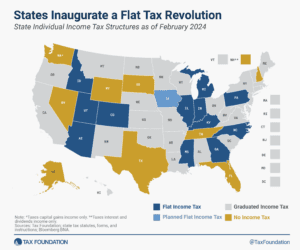

In 2021 and 2022 alone, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Working from home is great. The tax complications? Not so much.

4 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read