State sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. bases have two key areas in need of improvement: in some ways, they are too narrow, and in other ways, they are too broad. State sales tax bases have narrowed over time as new exemptions have been created, such as exemptions for groceries and prescription drugs. Another factor contributing to the shrinking of sales tax bases is that most states do not yet apply the sales tax to services, even as the U.S. economy is becoming increasingly service-oriented, with goods declining as a share of personal consumption.

At the same time, there are many instances in which states apply the sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. too broadly, capturing business inputs that ought to be exempt. When businesses pay taxes on inputs, the costs of production rise, resulting in some combination of higher prices for consumers, less business expansion, and fewer job opportunities. This concept is known as “tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. ,” whereby the sales tax is assessed multiple times throughout the production cycle. When a state’s sales tax is applied to too many business inputs, the sales tax starts to function as a gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. , arguably the most economically harmful of the major state-levied taxes.

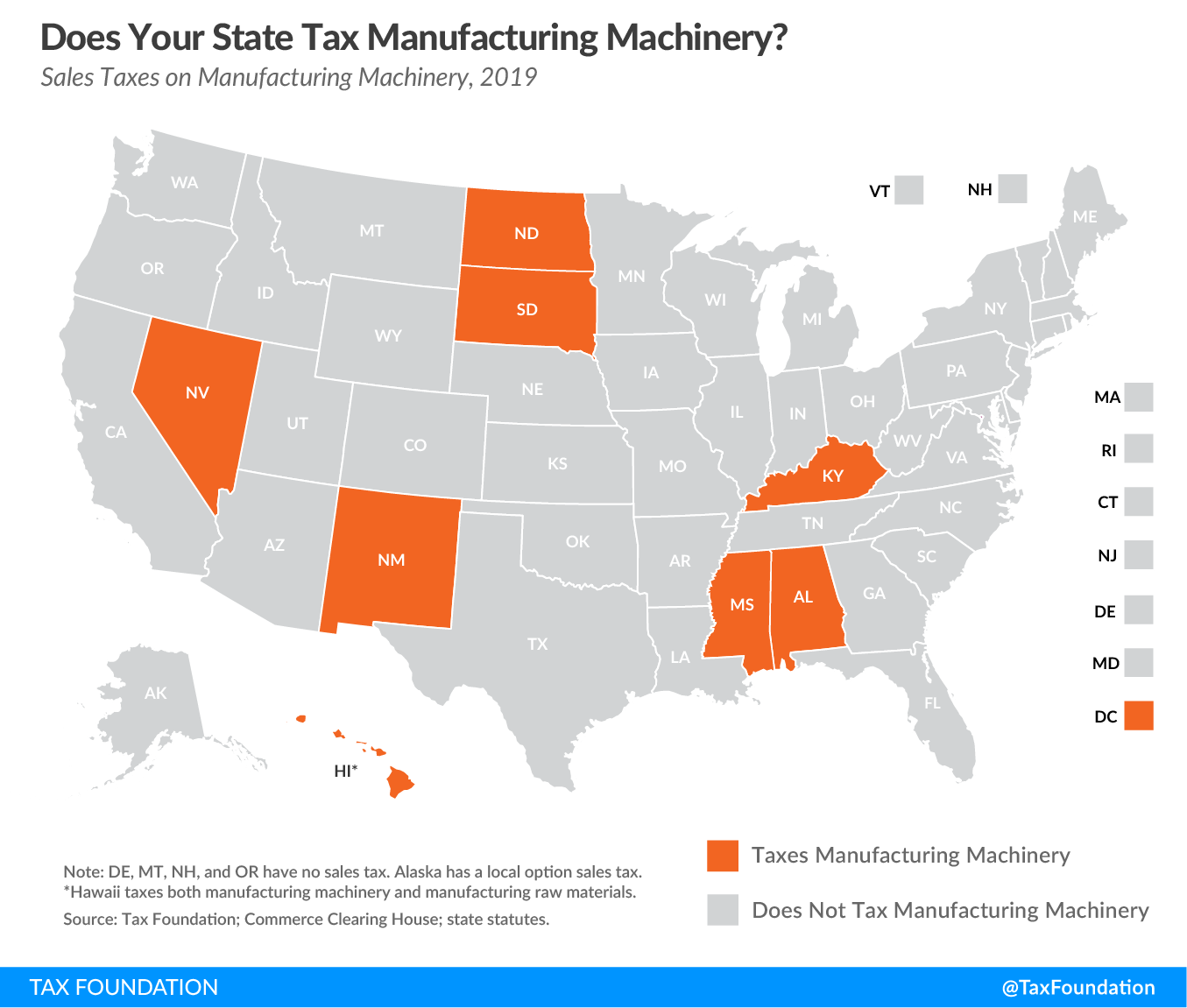

The map below examines states that apply their sales tax to manufacturing machinery, one of many business inputs that ought to be exempt.

While most states correctly exempt manufacturing machinery from their sales tax, notable exceptions exist in Alabama, Hawaii, Kentucky, Mississippi, Nevada, New Mexico, North Dakota, South Dakota, and the District of Columbia. Hawaii, a state with a sales tax base so broad that it applies to more than the state’s entire economy, taxes not just the machinery businesses use to manufacture goods, but also the raw materials used in manufacturing. New Mexico and South Dakota are other states that tax a high number of business inputs compared to the rest of the country.

Eliminating taxes on manufacturing machinery and other business inputs is one way states can make strides in becoming more attractive for business investment, while making progress toward a more properly-functioning consumption tax.

To see which other business inputs your state should consider removing from its sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , see Table 16 in our 2019 State Business Tax Climate Index. To see how your state’s sales tax compares to other states in terms of competitiveness, check out our interactive map.

Share this article