Recently released data from The Pew Charitable Trusts shows the strain on state retirement systems nationwide as state pension funds strive to keep pace with benefits owed to public employees.

Fiscal year 2017 (the most recent data available) saw a combined $1.28 trillion in state pension plan funding deficits. While massive, this was actually a decrease from Fiscal Year 2016’s $1.35 trillion gap. Pew attributes this improvement to strong returns on investment from higher-risk plans that helped some states to narrow their funding gaps since last year. To be fair, the improvements have been modest. The message is still clear: many states face a pension crisis.

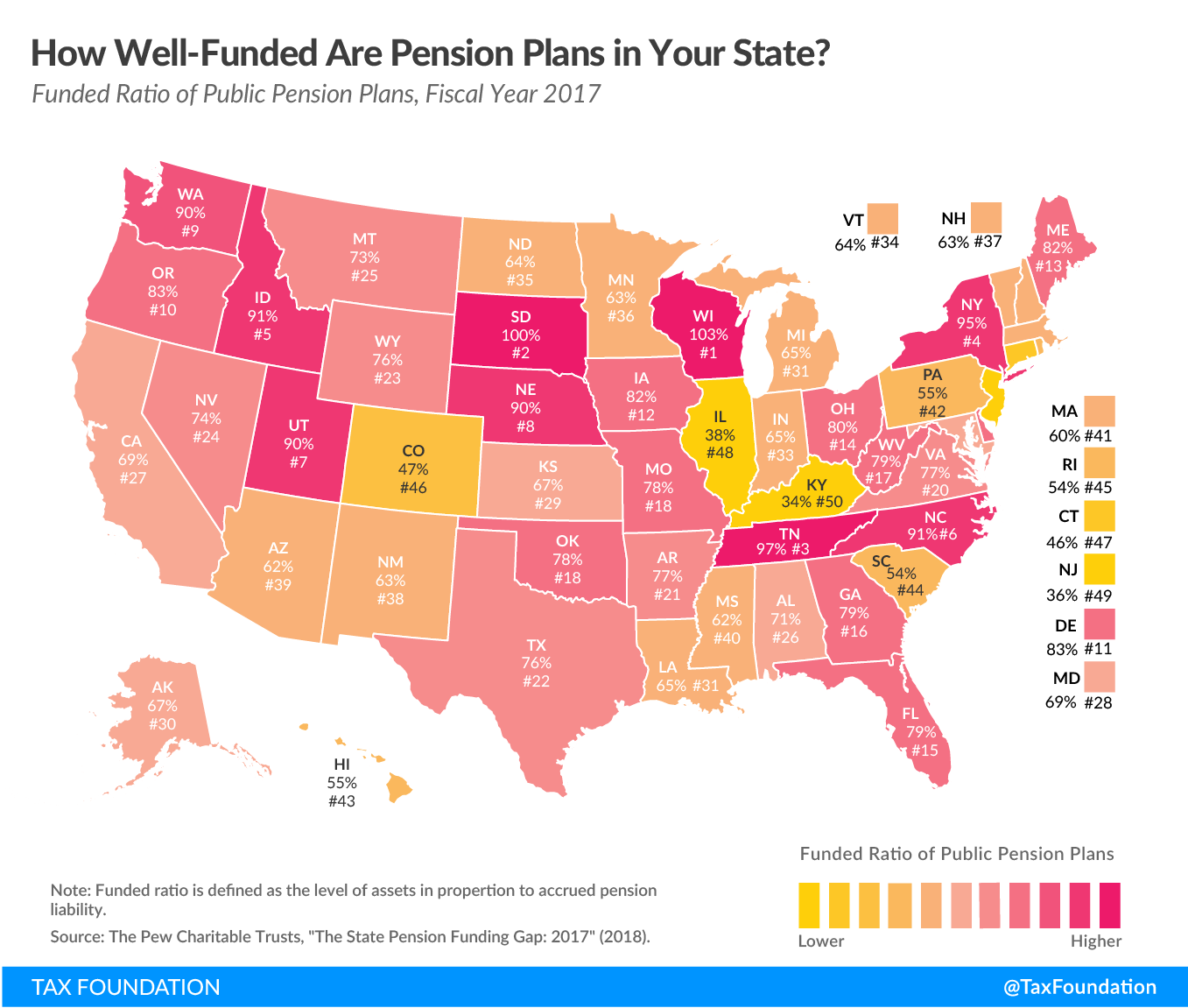

This week’s map uses FY 2017 data to show the funded ratio of public pension plans by state, calculated by measuring the market value of state pension plan assets in proportion to each state’s accrued pension liabilities. Lower funded ratios indicate when a state’s pension plan is not adequately funded, while higher funded ratios are evident in states where pension assets are keeping relatively good pace with accrued liabilities. Low funding levels are challenging not only because of the large contributions required to make up the debt, but also because they generate less in investment earnings.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeKentucky faces the largest deficit, with its plans only 34 percent funded. New Jersey follows at 36 percent funded, with Illinois only slightly better at 38 percent. According to Pew, these three states each increased their pension contributions in 2017—enough to slightly improve their funding ratios, but not enough to keep their debts from increasing.

Pension plans in Wisconsin and South Dakota are in the best shape, with funded ratios of 103 and 100 percent, respectively. Tennessee is right behind with a 97 percent ratio.

Twenty states have pension plans that are less than two-thirds funded, and five states have pension plans that are less than 50 percent funded.

Pension plan structures vary from state to state, but historically, most states have provided some form of defined benefit plan that promises retirees a lifetime annuity. In recent years, some states have transitioned to a defined contribution plan for new employees, with employees controlling their own accounts and employer contributions funded by the state. Other states have shifted to a hybrid plan that combines elements of a defined benefit and a defined contribution plan. The shift from defined benefit plans toward more fiscally responsible alternatives can help states better manage future liability, but many states still face years of underfunded obligations that will need to be fulfilled.

In the case of dramatically underfunded pension plans, reform now may be less costly and less painful than coping with a larger crisis later.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe