Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate. Many states also levy taxes on corporate income. Forty-four states and D.C. have corporate income taxes on the books, with top marginal rates ranging from 2.5 percent in North Carolina to a top marginal rate of 12 percent in Iowa. Fourteen states levy graduated corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates, while the remaining 30 states levy a flat rate on corporate income.

In Nevada, Ohio, Texas, and Washington, corporations are subject to gross receipts taxes in lieu of corporate income taxes. Delaware imposes a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on corporate income and a separate levy on gross receipts.

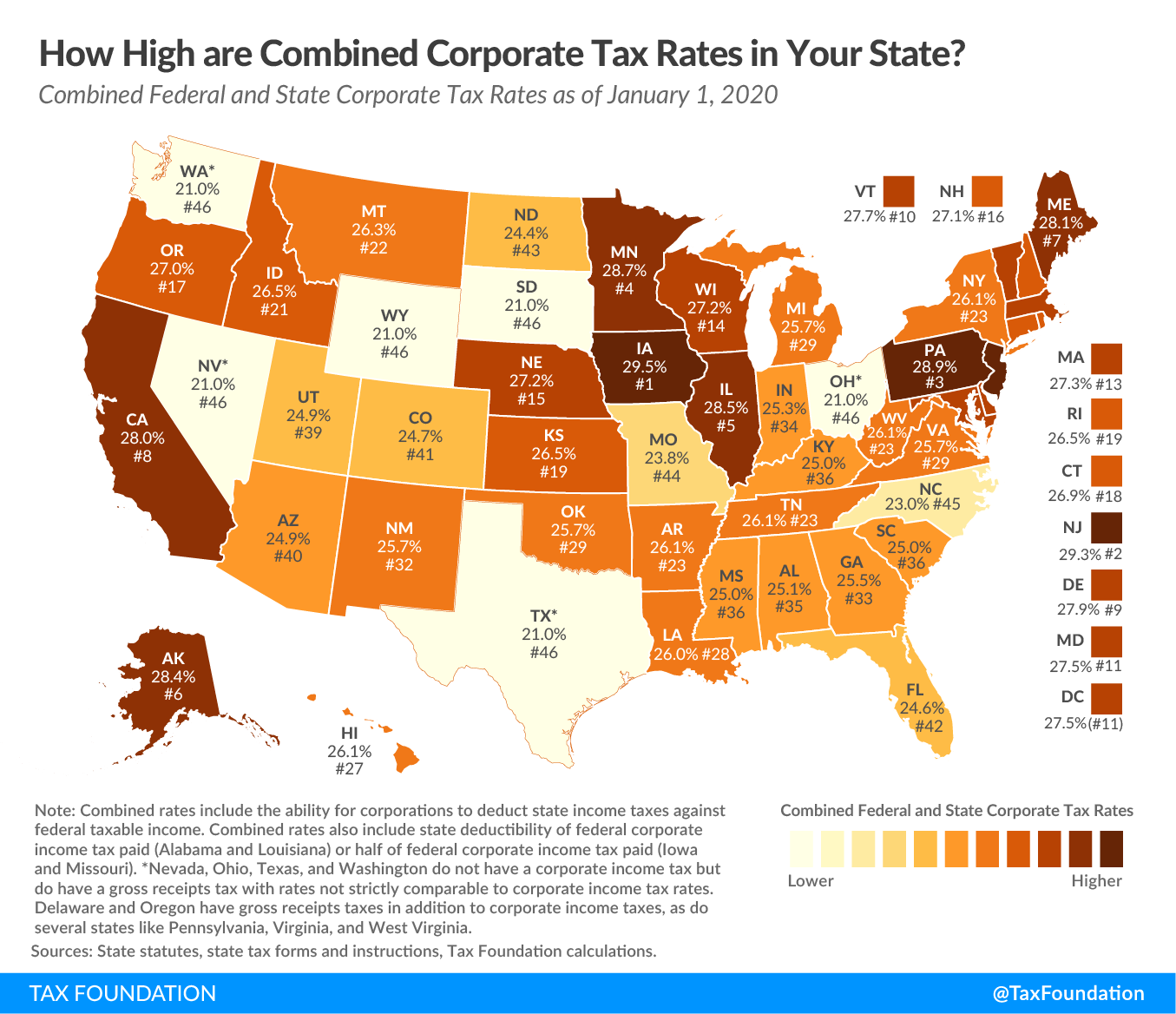

The state with the highest combined corporate income tax rate is Iowa, at 29.5 percent. Corporations in Alaska, California, Illinois, Maine, Minnesota, New Jersey, and Pennsylvania face combined corporate income tax rates at or above 28 percent. Six states—Ohio, Nevada, South Dakota, Texas, Washington, and Wyoming—face no state corporate income tax and only the federal tax rate of 21 percent.

Corporations may deduct state corporate income tax paid against federal taxable income, lowering the effective federal corporate income tax rate. For example, a corporation in Kentucky may deduct tax paid at a 5 percent flat rate against the 21 percent federal corporate income tax, reducing its federal rate to 19.95 percent.

Additionally, four other states allow corporations to deduct federal corporate income tax against some portion of state corporate income tax. Alabama and Louisiana allow full deductibility of federal corporate income tax liability against state liability, while Iowa and Missouri permit a 50 percent deduction of federal corporate income tax liability. This lowers the effective corporate income tax rate faced by corporations in these states.

While policymakers at the federal level debate corporate income tax rates, it is important to consider state corporate income taxes and combined corporate income tax rates when evaluating the tax system’s impact on corporate profits, economic output, and worker wages.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe