Last week, we reviewed how states are conformed to the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code for individual income. Many states use the federal tax code as the basis of their state individual income tax code, but even more states use the federal corporate tax code to form their state corporate income taxes.

For reasons of administrative simplicity, states frequently seek to conform many, though rarely all, elements of their state tax codes to the federal tax code. This harmonization of definitions and policies reduces compliance costs for individuals and businesses with liability in multiple states and limits the potential for double taxation of income. No state conforms to the federal code in all respects, and not all provisions of the federal code make for good tax policy, but greater conformity substantially reduces tax complexity and has significant value.

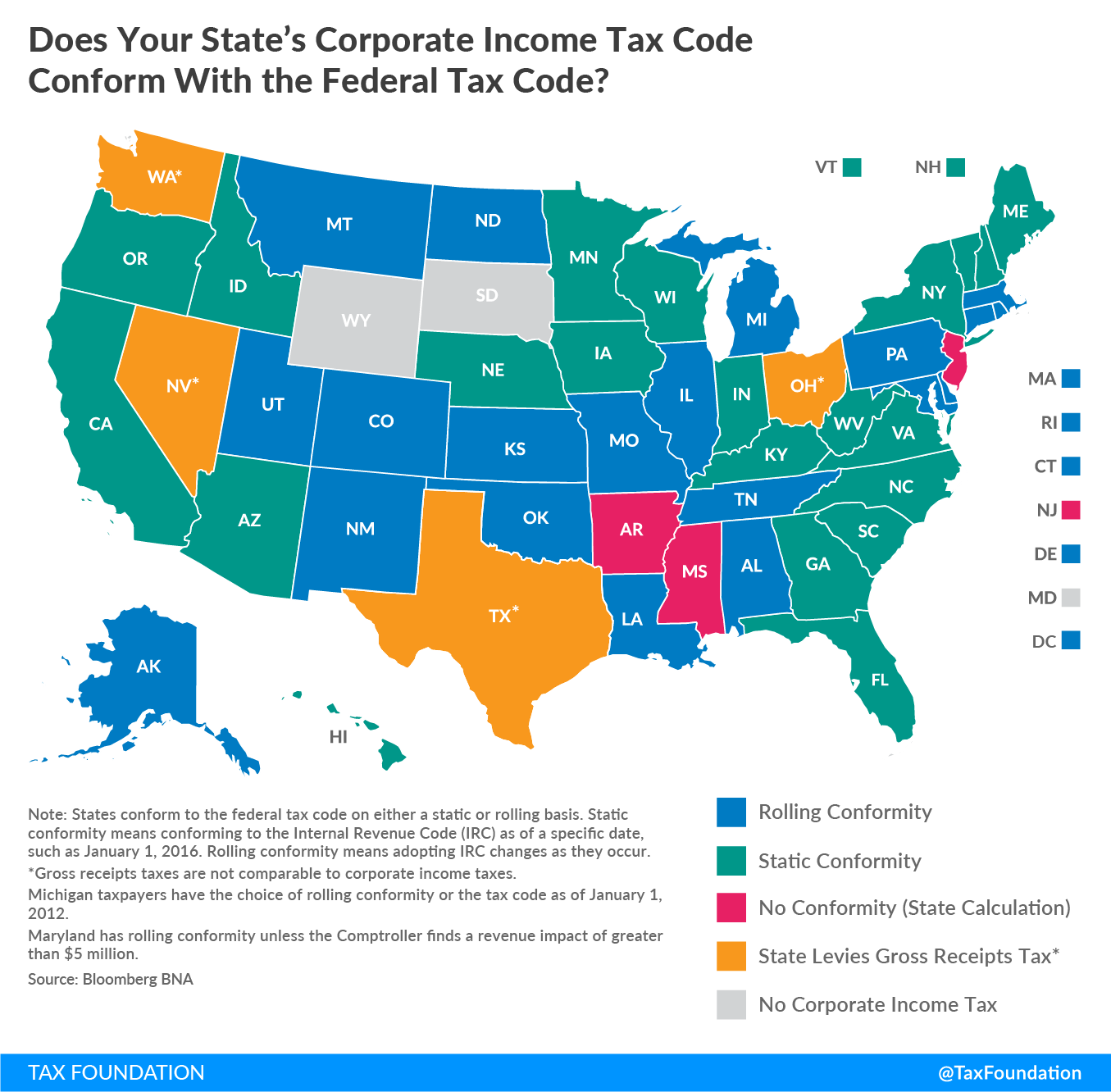

States conform to the Internal Revenue Code (IRC) for corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. calculations. (Last week’s map looked at individual income tax conformity.) States tend to conform to either taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. before net operating losses or taxable income after net operating losses. Forty-one states conform to one of these two definitions of income. Three states have their own calculations of income, and the remaining states either do not tax corporate income or impose a statewide gross receipts tax (see map below).

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn general, states are more conformed on corporate income than individual income, but even when conformed on the definition of level, many states decouple on other provisions. For instance, many states do not conform on the length of time that net operating losses can be carried forward or backward, but the majority of states do conform to federal Section 179 bonus depreciation schedules.

How states define their tax bases would matter a great deal for their revenue impacts under federal tax reform. For instance, the federal tax changes in the Tax Cuts and Jobs Act expand the base of taxable income in many different ways, such as limiting the deduction for net interest or the Section 199 domestic production deduction. The federal changes include rate cuts to offset the broader bases, but states set their tax rates independently. Absent state-level changes, states would have a much larger tax base without correspondingly lower rates, leading to higher state-level revenue.

A more detailed list on state conformity is available here.

Share this article