Key Findings

- States incorporate provisions of the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. codes into their own codes in varying degrees, meaning that federal tax reform has implications for state revenue beyond any broader economic effects of tax reform.

- Because the base-broadening provisions of the new federal tax law often flow through to states, while the corresponding rate reductions do not, most states will experience a revenue increase. The vast majority of filers will receive a tax cut at the federal level, but they could easily see a state tax increase unless states act to prevent one.

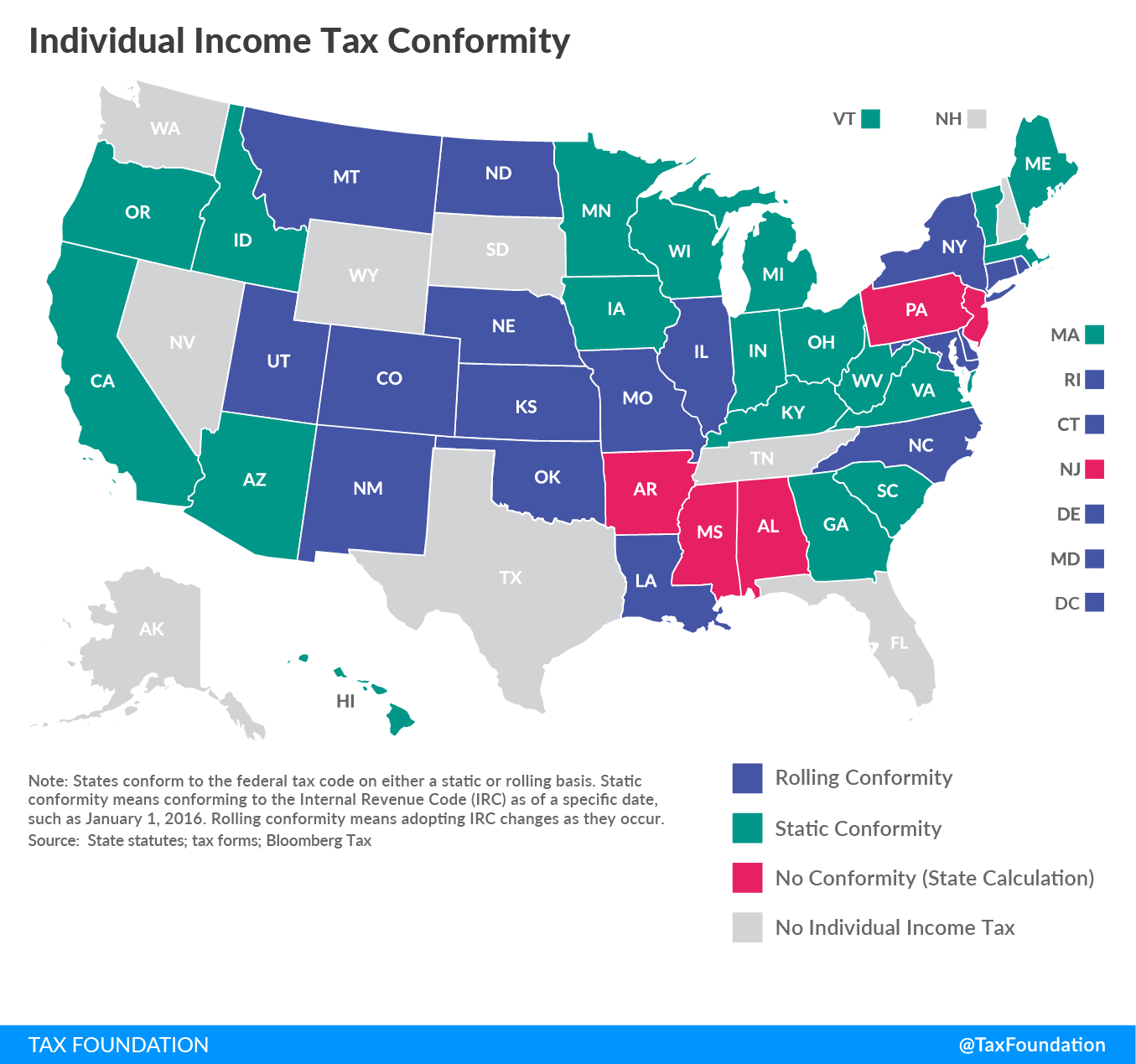

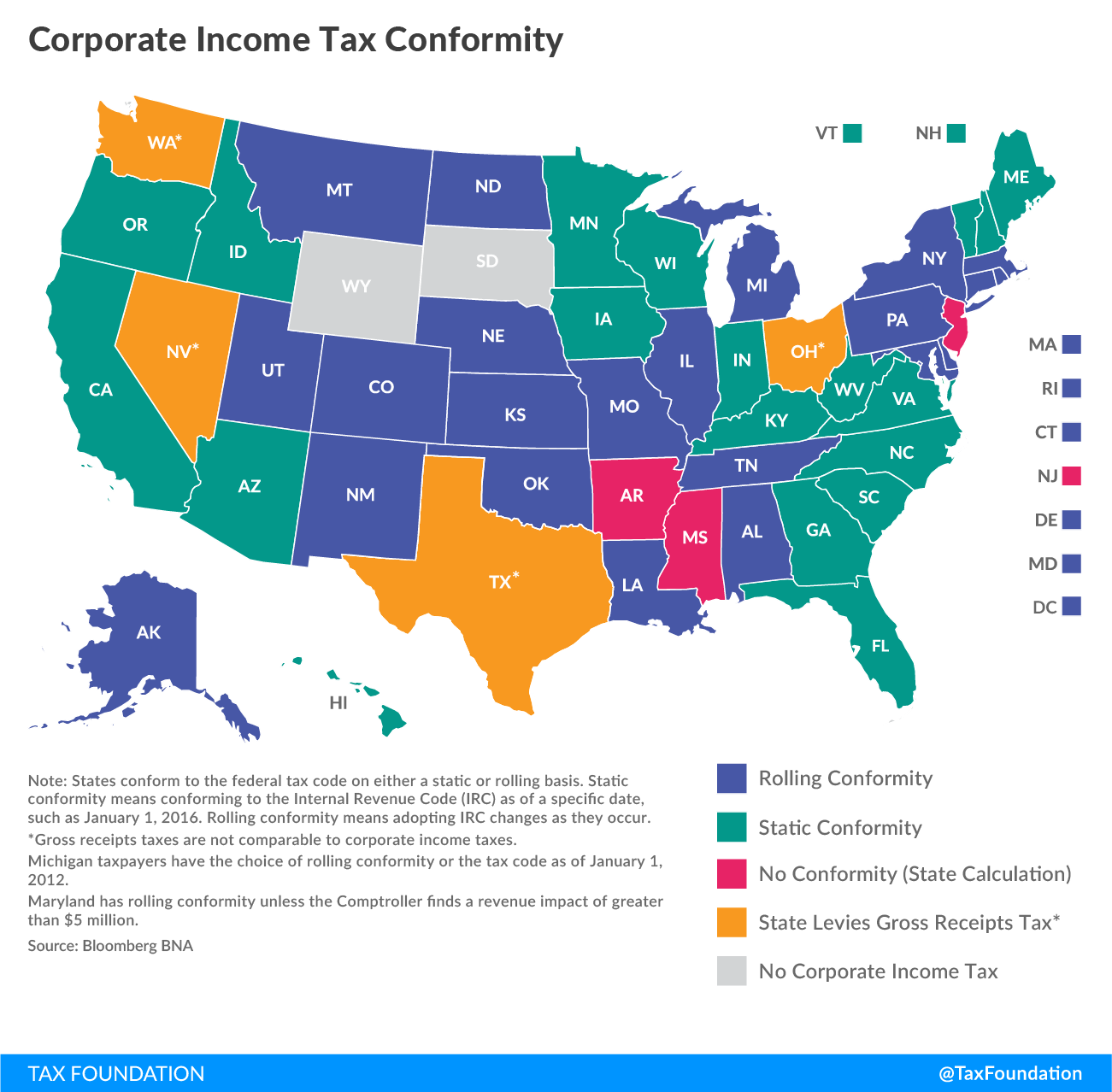

- Eighteen states and the District Columbia have “rolling” conformity with the Internal Revenue Code, meaning that they will conform to relevant provisions of the new federal law automatically, while nineteen must update their fixed-date conformity statutes to adopt the new provisions. The remaining states only conform selectively.

- The largest revenue increases will be in states which conform to the now-repealed federal exemption, either directly or by linking their own personal exemptions to the number of exemptions claimed at the federal level. States which conform to both the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. and the personal exemption will also experience a revenue increase.

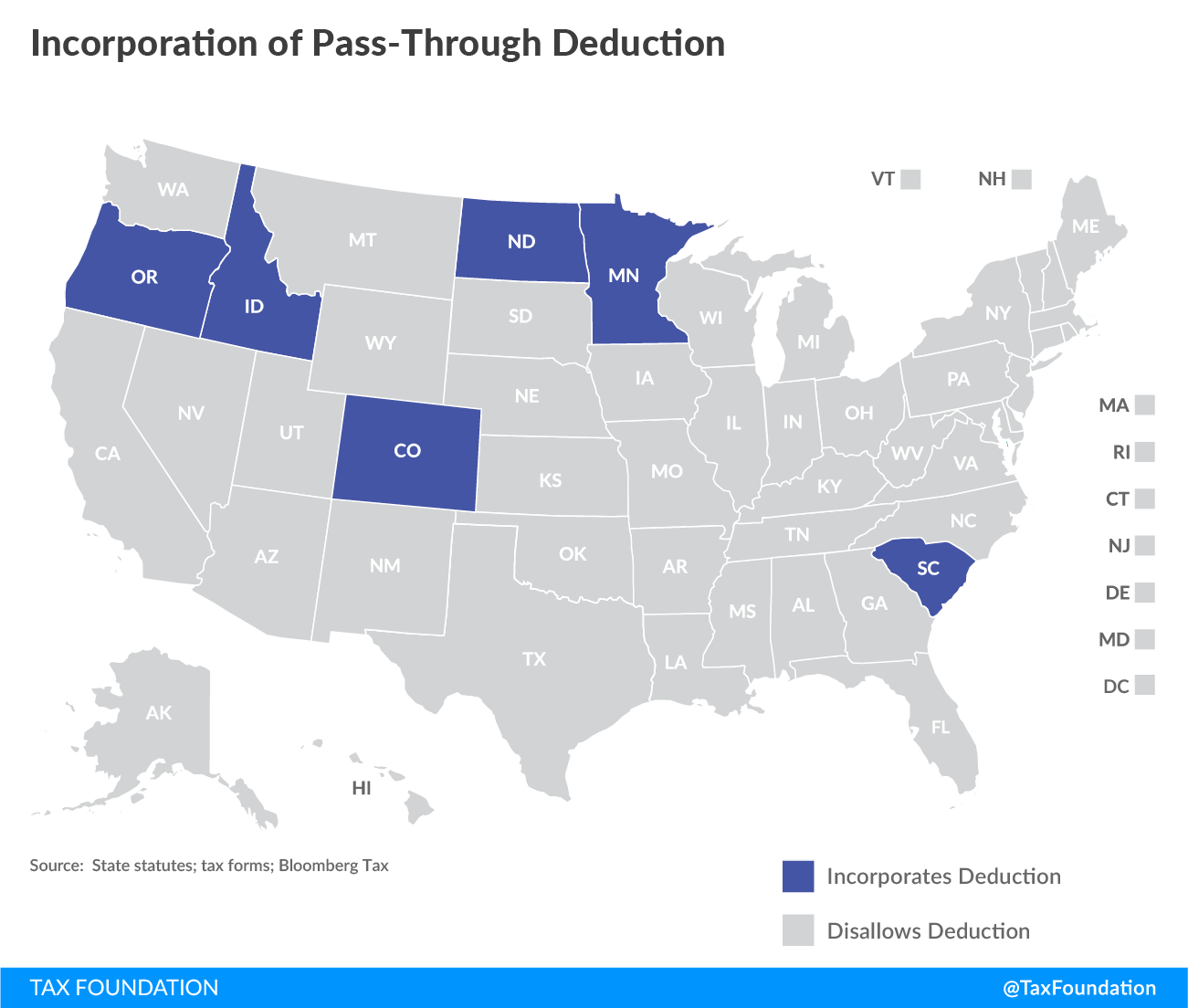

- Six states will incorporate the new 20 percent deduction for pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income unless they decouple from the provision or change their income starting point from federal taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. to federal adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” .

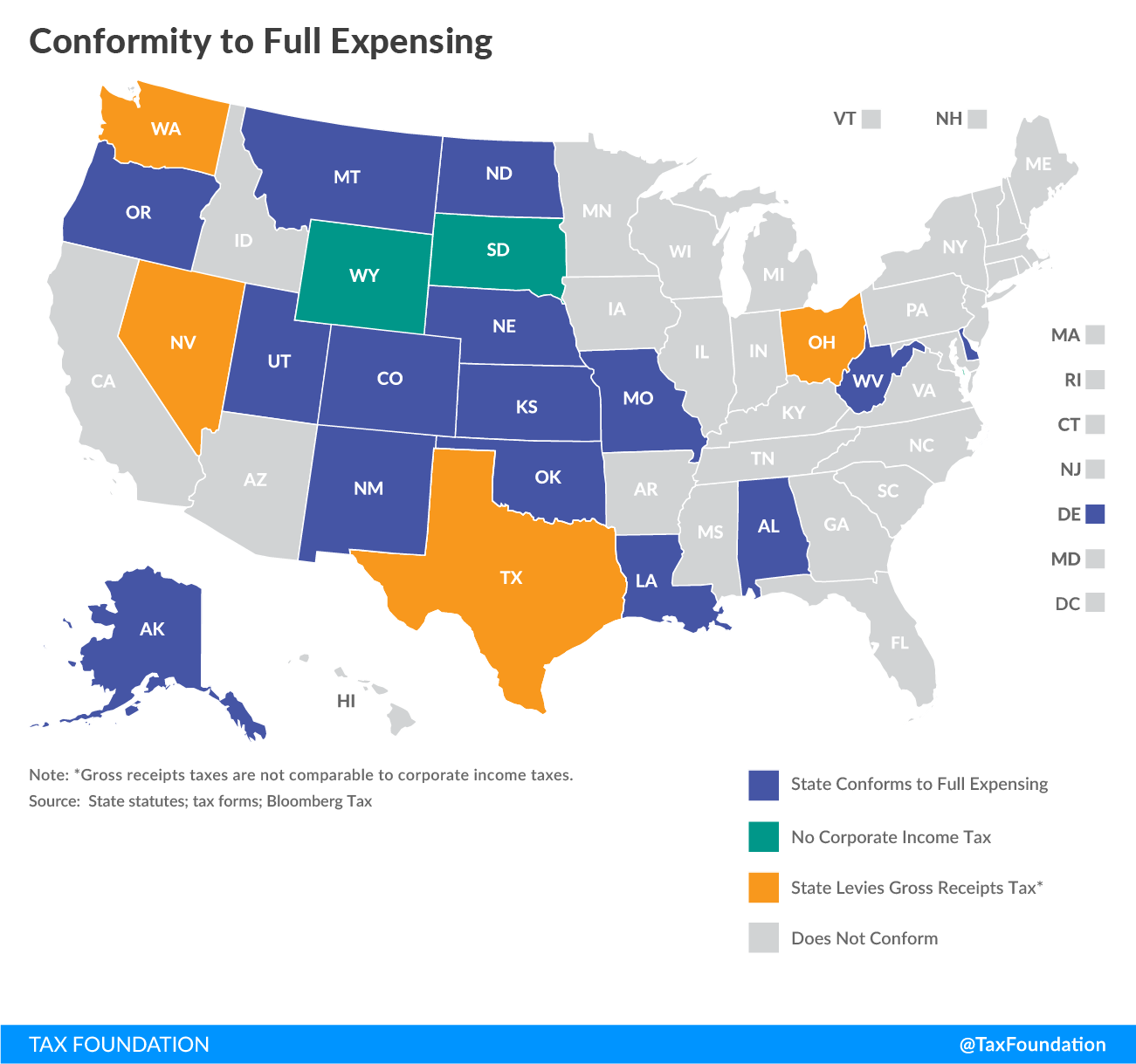

- Unless they act, most states will not conform to an important pro-growth element of federal tax reform, the provision providing for immediate expensing of investments in machinery and equipment. The additional revenue from base broadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability. elsewhere—including restrictions on interest deductibility—may provide an opportunity to conform to this provision.

- States which include Subpart F income, a component of income for multinational businesses, in their base may receive a repatriationTax repatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the U.S. tax code created major disincentives for U.S. companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. windfall, but should avoid building this one-time revenue into their budget baseline.

- States anticipating additional revenue should view this as an opportunity to make their tax codes more competitive. In the past, federal tax reform has initiated a round of state tax reform as well.

- State fiscal offices have an obligation to provide critical revenue estimate information to legislators during the 2018 legislative sessions.

Table of Contents

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIntroduction

Each state has its own approach to taxation—its own combination of tax types, rates and structures, and rules and exemptions. These variations reflect a multiplicity of purposes and an array of fiscal aims, some with contemporary urgency and others lost to the ages. Yet even the most iconoclastic state tax structures draw upon the federal tax code, which becomes more pertinent with the federal Tax Cuts and Jobs Act now in effect.

Some states adopt large swaths of the federal tax code by reference; others use it as a starting point, then tinker endlessly; and still others incorporate federal provisions and definitions more sparingly. In some states, the federal tax code is mirrored; in others, echoed. The differences matter greatly, but so do the points of agreement.

States conform to provisions of the federal tax code for a variety of reasons, largely to reduce the compliance burden of state taxation. Doing so allows state administrators and taxpayers alike to rely on federal statutes, rulings, and interpretations, which are generally more detailed and extensive than what any individual state could produce. [1] It provides consistency of definitions for those filing in multiple states, and reduces duplication of effort in filing federal and state taxes. It permits substantial reliance on federal audits and enforcement, along with federal taxpayer data. It helps to curtail tax arbitrage and reduce double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. . For the filer, it can make things easier by allowing the filer to copy lines directly from their federal tax forms. In the words of one scholar, federal conformity represents a case of “delegating up,” allowing states to conserve legislative, administrative, and judicial resources while reducing taxpayer compliance burdens. [2]

Delegating up, of course, means ceding a certain amount of control, hence the myriad of ways that states modify or decouple from the Internal Revenue Code (IRC). As states enter their legislative sessions following the first overhaul of the federal tax code since 1986, lawmakers are understandably eager to determine what effects these federal changes will have on their own states’ system of taxation—and, perhaps more to the point, on state revenues.

Most states stand to see increased revenue due to federal tax reform, with expansions of the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. reflected in state tax systems while corresponding rate reductions fail to flow down. The extent to which this is true (and indeed in some cases, whether it is true) depends on the federal tax provisions to which a state conforms. This paper aims to survey some of the more significant federal provisions often incorporated by the states, shedding light on what each state can expect and what options are available to states as they respond to federal tax changes. In the wake of federal tax reform, states have a golden opportunity to move their own tax codes in a more simple, neutral, and pro-growth direction.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeState Approaches to Federal Conformity

All states incorporate parts of the federal tax code into their own system of taxation, but how they do so varies widely. In broad terms, however, approaches to IRC conformity can be divided into three classes: rolling, static, and selective. [3]

States with rolling conformity automatically implement federal tax changes as they are enacted, unless the state specifically decouples from a provision. This autopilot approach tends to provide the greatest clarity and predictability for taxpayers, though at a modest cost of state control.

Static (or “fixed date”) conformity also incorporates wholesale updates of the federal tax code, but to the IRC as it existed at a specific point in time, rather than the adopting all changes on a rolling basis. Some such states conform legislatively every year and are functionally identical to states with rolling conformity, albeit with a measure of added uncertainty. Others are inconsistent, and may even conform to an outdated version of the IRC for many years.

Finally, a handful of states only conform selectively, incorporating certain federal provisions or definitions by reference, but omitting large swaths of the federal tax code and forgoing the use of federal definitions of income as their own starting points for calculation.

No state, of course, conforms to every provision of the Internal Revenue Code. Each state offers its own set of modifications, additions, and subtractions to the code. Each adopts its own set of rules and definitions, frequently layered atop those flowing through from the federal code. But from definitions of income to exemptions to net operating losses, and even what filing statuses are available and whether a taxpayer can itemize their deductions, the federal tax code consistently informs state-level taxation.

Federal Tax Changes with State Impacts

In the course of about two hundred pages, the 2017 tax reform bill fundamentally remade significant aspects of the tax code and substantively modified many others. [4] Only some of these changes, however, have the potential to alter state tax systems. Among those which will impact states are:

- the larger standard deduction (base narrower);

- the repeal of the personal exemption (base broadener);

- more generous child tax credits (base narrower);

- a lower cap on the mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. (base broadener);

- a temporarily lower threshold for claiming the medical expense deduction (base narrower);

- repeal of the moving expense and alimony deductions (base broadener);

- the 20 percent pass-through deduction (base narrower);

- changes to interest deductibility (base broadener);

- changes to Section 179 pass-through expensing and bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. (base narrower);

- adjustments to net operating loss provisions (base broadener);

- repeal of Section 199 and modification of other business tax credits (base broadener);

- a $10,000 state and local tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. cap (base broadener);

- modifications to subpart F income (base narrower);

- a reduction in the dividends received deduction (base broadener);

- deemed repatriation (one-time windfall); and

- the higher estate tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. (base narrower).

In aggregate, the base-broadening provisions are worth considerably more than the base-narrowing ones, particularly within the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. code. Each provision changed at the federal level has varying impacts on states, though, and each will be considered in turn. [5] In the tables that follow, provisions where conformity is expected to increase state revenue are indicated with a (+) and those where conformity may result in a loss of revenue are denoted with a (-). As state legislators grapple with what these provisions mean for their state, it is vital that state fiscal offices provide estimates of the effects of each relevant provision.

Individual Income Tax Conformity

State and local individual income taxes account for 23.5 percent of state and local government tax collections nationwide, compared to the 3.7 percent which comes from corporate income taxes. [6] Consequently, even though the 2017 federal tax reform bill made more changes to corporate than personal taxation, the latter are of far greater significance to state government finances.

At the federal level, individuals will receive the benefit of a higher standard deduction, rate cuts (along with broader bracket widths), a more generous child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. , and a higher alternative minimum tax (AMT) exemption threshold. To help pay for these changes, the personal exemption has been repealed, the state and local tax deduction is capped at $10,000, the mortgage interest deduction now applies to the first $750,000 of principal value (down from $1 million) and was eliminated for home equity indebtedness in its entirety, and several deductions were eliminated outright. The vast majority of filers will receive a tax cut at the federal level, [7] but because base-broadening measures flow through to many states, while rate reductions do not, they could easily see a state tax increase unless states act to prevent one.

An increase in the standard deduction and the repeal of the personal exemption are easily the most consequential changes for many states, and eliminating the personal exemption broadens the tax base considerably more than raising the standard deduction narrows it. The other changes, although not insubstantial, do not change the fact that for most states, the tax base would be broader after federal tax reform, forcing states to decide whether to keep the additional revenue to grow government, cut rates to avoid an automatic tax increase, or use the broader base to help pay down broader tax reform.

Income Starting Point and Conformity Method

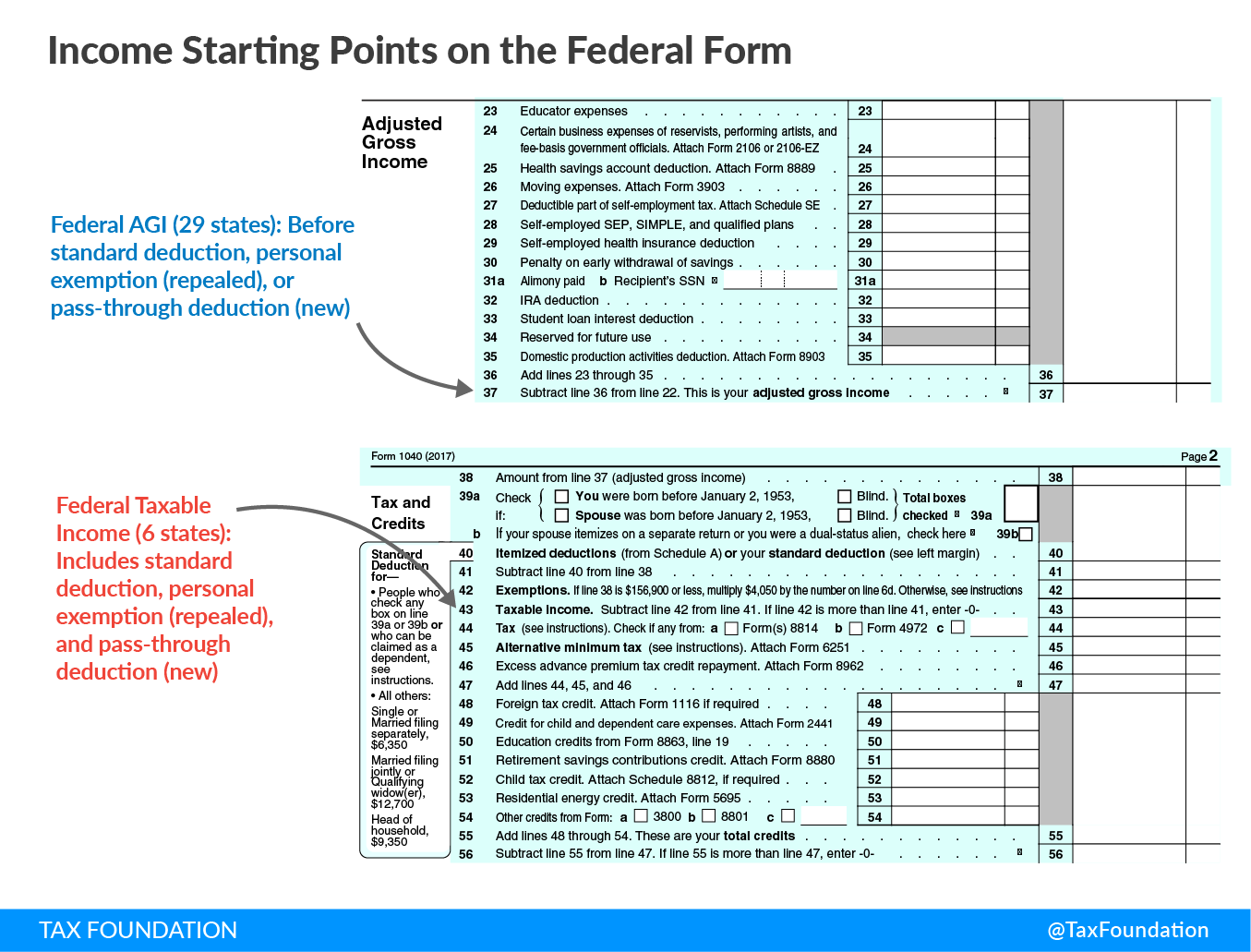

Although each has its own additions and subtractions, twenty-nine states and the District of Columbia use federal adjusted gross income (AGI) as their starting point for calculating individual income tax liability. Another six states (Colorado, Idaho, Minnesota, North Dakota, Oregon, and South Carolina) use federal taxable income. [8] The remaining six states which tax wage income [9] use state-specific definitions of income, although they incorporate some IRC provisions into these definitions.

Figure 1 illustrates how this concept plays out from the perspective of taxpayers on their individual income tax returns. In states which conform to federal AGI, taxpayers carry line 37 from their federal return to their state return. In states which use federal taxable income, taxpayers start by copying line 43, which, as Figure 1 illustrates, includes additional deductions and exemptions, and thus carries with it more provisions from the federal system.

Electing federal taxable income as a starting point for state income taxes has the effect of incorporating federal standard and itemized deductions, the personal exemption, and a new deduction for qualified pass-through business income, unless the state expressly decouples from these provisions. [10] Each of these elements will be considered separately.

Figure 1.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeEighteen states and the District of Columbia have rolling conformity, nineteen have static conformity, and four only conform selectively without universal reference to a specific version of the IRC. Two states with their own state-defined income starting points nevertheless conform to the IRC: Alabama on a rolling basis and Massachusetts to a fixed year. Most, but not all, static conformity states adopt conforming legislation every year as a matter of course, albeit sometimes retroactively. Massachusetts, however, conforms to the federal tax code as it existed in 2005, and California, Iowa, Kentucky, and Oregon have only brought their federal conformity up to 2015. Figure 2 shows how frequently states update their conformity to federal definitions.

Figure 2.

Even when static conformity states routinely incorporate updated versions of the federal tax code, the process introduces some measure of uncertainty, and with the recent tax overhaul at the federal level, some states may weigh their options before adopting new IRC conformity legislation. It will, however, be in the best interest of most states to do so, since tax reform broadens the individual income tax base overall.

| Sources: State statutes; tax forms; Bloomberg Tax | ||

| State | Individual Income Starting Point | Individual Conformity |

|---|---|---|

| Alabama | State calculation | Rolling |

| Alaska | No tax | No tax |

| Arizona | Federal AGI | January 1, 2017 |

| Arkansas | State calculation | Selective |

| California | Federal AGI | January 1, 2015 |

| Colorado | Federal taxable income | Rolling |

| Connecticut | Federal AGI | Rolling |

| Delaware | Federal AGI | Rolling |

| Florida | No tax | No tax |

| Georgia | Federal AGI | January 1, 2017 |

| Hawaii | Federal AGI | December 31, 2016 |

| Idaho | Federal taxable income | January 1, 2017 |

| Illinois | Federal AGI | Rolling |

| Indiana | Federal AGI | January 1, 2016 |

| Iowa | Federal AGI | January 1, 2015 |

| Kansas | Federal AGI | Rolling |

| Kentucky | Federal AGI | December 31, 2015 |

| Louisiana | Federal AGI | Rolling |

| Maine | Federal AGI | December 31, 2016 |

| Maryland | Federal AGI | Rolling |

| Massachusetts | State calculation | January 1, 2005 |

| Michigan | Federal AGI | Rolling |

| Minnesota | Federal taxable income | December 16, 2016 |

| Mississippi | State calculation | Selective |

| Missouri | Federal AGI | Rolling |

| Montana | Federal AGI | Rolling |

| Nebraska | Federal AGI | Rolling |

| Nevada | No tax | No tax |

| New Hampshire | Tax on interest & dividends only | Tax on interest & dividends only |

| New Jersey | State calculation | Selective |

| New Mexico | Federal AGI | Rolling |

| New York | Federal AGI | Rolling |

| North Carolina | Federal AGI | January 1, 2017 |

| North Dakota | Federal taxable income | Rolling |

| Ohio | Federal AGI | March 30, 2017 |

| Oklahoma | Federal AGI | Rolling |

| Oregon | Federal taxable income | December 31, 2016 |

| Pennsylvania | State calculation | Selective |

| Rhode Island | Federal AGI | Rolling |

| South Carolina | Federal taxable income | December 31, 2016 |

| South Dakota | No tax | No tax |

| Tennessee | Tax on interest & dividends only | Tax on interest & dividends only |

| Texas | No tax | No tax |

| Utah | Federal AGI | Rolling |

| Vermont | Federal AGI | December 31, 2016 |

| Virginia | Federal AGI | December 31, 2016 |

| Washington | No tax | No tax |

| West Virginia | Federal AGI | December 31, 2016 |

| Wisconsin | Federal AGI | December 31, 2016 |

| Wyoming | No tax | No tax |

| District of Columbia | Federal AGI | Rolling |

Standard Deduction and Personal Exemption

The new federal law dramatically increases the standard deduction, from $6,500 to $12,000 per single filer (double for joint filers), while repealing the $4,050 per-person personal exemption. These provisions result in the most profound revenue changes in many states.

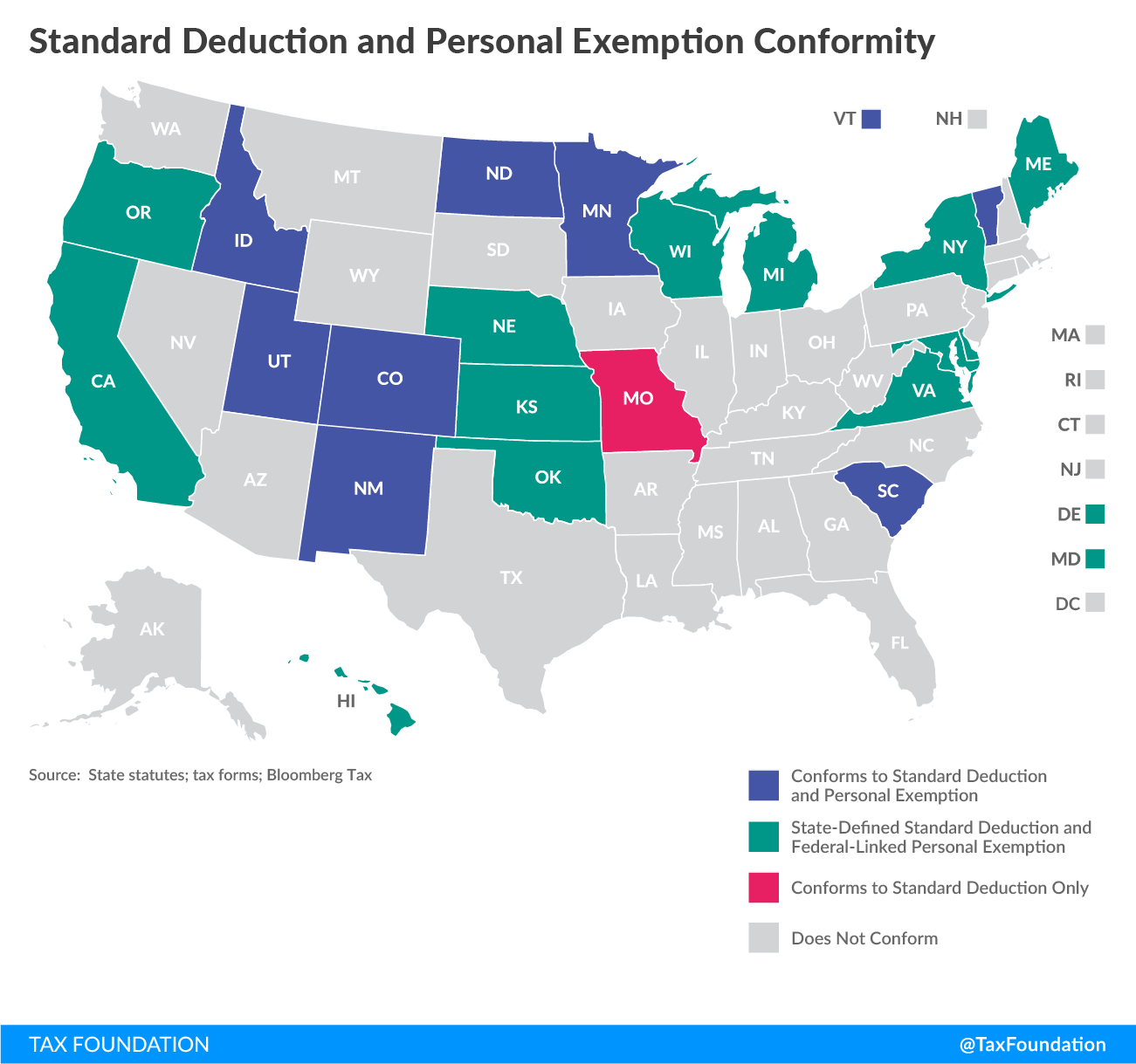

On federal income tax forms, standard and itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. s, and the personal exemption, are below-the-line, meaning that they are claimed after arriving at one’s adjusted gross income (line 37 on Form 1040 for tax year 2016, where AGI is the “line” referenced; see Figure 1), but before arriving at one’s federal taxable income (line 43). Therefore, if a state uses federal taxable income as the starting point for its income tax calculations, then it begins by incorporating filers’ standard (or itemized) deductions and personal exemptions as claimed at the federal level. If a state instead uses federal adjusted gross income as its starting point, then it begins its calculation without the inclusion of these deductions or exemptions.

It is, however, possible for a state which begins with adjusted gross income to expressly incorporate the federal standard deduction, personal exemption, or both, just as it is possible for a state beginning with federal taxable income to disallow them by adding back the value of those adjustments to the filer’s state taxable income. Figure 3 shows how states incorporate the federal standard deduction and personal exemption into their own tax codes.

Eliminating the personal exemption broadens the tax base considerably more than raising the standard deduction narrows it. At the federal level, those changes are paired with a far larger child tax credit, but that provision only flows through to three states, and then only in part.

Figure 3.

The seven states (Colorado, Idaho, Minnesota, New Mexico, North Dakota, South Carolina, and Vermont) that conform on both the standard deduction and personal exemption will experience base broadening, as the standard deduction roughly doubles but the personal exemption is repealed. Missouri, which conforms to the standard deduction but only partially to the personal exemption, [11] could see a revenue loss, while Maine, which conforms to the personal exemption and not the standard deduction, could experience a larger revenue gain. Utah offers credits worth 6 percent of the value of federal deductions and exemptions, and will see a revenue increase due to this proportionality.

Another twelve states offer their own state-defined standard deductions and personal exemptions, but multiply their state-defined personal exemption by the number of exemptions claimed at the federal level. Since the exemption no longer exists at the federal level, this has the practical effect of repealing these states’ personal exemptions unless amended to base the exemptions on the number of dependents claimed, rather than the number of exemptions taken on one’s federal return. [12] Notably, five of these states (California, Hawaii, Oregon, Virginia, and Wisconsin) use static rather than rolling conformity, but would still experience an immediate impact, because the number of exemptions taken on the federal return will be zero without regard to whether a state conforms to the new provisions.

In one of those twelve states, Nebraska, the standard deduction takes the form of the lesser of a state-defined standard deduction or the federal standard deduction. Whereas the federal standard deduction has been the lower of the two since this provision was adopted in 2007, [13] the state-defined deduction is now the lower due to the expanded standard deduction under federal tax reform. Consequently, Nebraska’s standard deduction will rise to the inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. -adjusted level of its own standard deduction (about $6,700 for single filers) rather than mirroring the new federal level ($12,000).

With the exception of Missouri and Nebraska, all states either (1) conform to both the standard deduction and the personal exemption, yielding a broader tax base; (2) conform, in whole or in part, only to the personal exemption, yielding an even broader tax base; or (3) forgo or use both state-defined standard deductions and personal exemptions, leaving the tax base unchanged.

| Notes: States which conform to federal taxable income automatically incorporate the federal standard deduction and personal exemption. Nebraska’s standard deduction is the lesser of a state-defined value and the federal standard deduction, and in the aftermath of federal tax reform, the state-defined deduction is the lower of the two. New Hampshire and Tennessee tax interest and dividend income only. Sources: State statutes; tax forms; Bloomberg Tax |

||

| State | Standard Deduction (-) | Personal Exemption (+) |

|---|---|---|

| Alabama | State defined | State defined deduction |

| Alaska | No tax | No tax |

| Arizona | State defined | State defined deduction |

| Arkansas | State defined | State defined credit |

| California | State defined | Credit linked to federal exemptions claimed |

| Colorado | Conforms to federal | Conforms to federal |

| Connecticut | n/a | State defined deduction |

| Delaware | State defined | Credit linked to federal exemptions claimed |

| Florida | No tax | No tax |

| Georgia | State defined | State defined deduction |

| Hawaii | State defined | Deduction linked to federal exemptions claimed |

| Idaho | Conforms to federal | Conforms to federal |

| Illinois | n/a | Deduction linked to federal exemptions claimed |

| Indiana | n/a | Deduction linked to federal exemptions claimed |

| Iowa | State defined | State defined credit |

| Kansas | State defined | Deduction linked to federal exemptions claimed |

| Kentucky | State defined | State defined credit |

| Louisiana | State defined | State defined deduction |

| Maine | State defined | Conforms to federal |

| Maryland | State defined | Deduction linked to federal exemptions claimed |

| Massachusetts | State defined | State defined deduction |

| Michigan | State defined | Deduction linked to federal exemptions claimed |

| Minnesota | Conforms to federal | Conforms to federal |

| Mississippi | State defined | State defined deduction |

| Missouri | Conforms to federal | Deduction linked to federal exemptions claimed |

| Montana | State defined | State defined deduction |

| Nebraska | State defined | Credit linked to federal exemptions claimed |

| Nevada | No tax | No tax |

| New Hampshire | No tax | No tax |

| New Jersey | n/a | State defined |

| New Mexico | Conforms to federal | Conforms to federal |

| New York | State defined | Deduction linked to federal exemptions claimed |

| North Carolina | State defined | n/a |

| North Dakota | Conforms to federal | Conforms to federal |

| Ohio | n/a | State defined |

| Oklahoma | State defined | Deduction linked to federal exemptions claimed |

| Oregon | State defined | Credit linked to federal exemptions claimed |

| Pennsylvania | n/a | n/a |

| Rhode Island | State defined | State defined |

| South Carolina | Conforms to federal | Conforms to federal |

| South Dakota | No tax | No tax |

| Tennessee | No tax | No tax |

| Texas | No tax | No tax |

| Utah | Credit worth 6% of federal deduction | Credit worth 6% of value of federal exemption |

| Vermont | Conforms to federal | Conforms to federal |

| Virginia | State defined | Deduction linked to federal exemptions claimed |

| Washington | No tax | No tax |

| West Virginia | n/a | Deduction linked to federal exemptions claimed |

| Wisconsin | State defined | Deduction linked to federal exemptions claimed |

| Wyoming | No tax | No tax |

| District of Columbia | State defined | State defined deduction |

Above-the-Line and Itemized Deductions

Many states incorporate federal tax deductions into their own codes, some of which have been modified or even repealed under the new tax law. Changes to both above-the-line and itemized deductions can have an impact on state revenues.

Above-the-line deductions are those which reduce adjusted gross income. (These are the adjustments made prior to line 37 in Figure 1.) They can be claimed by all filers, regardless of whether they choose to itemize or take the standard deduction. At the federal level, examples of above-the-line deductions have included contributions to Individual Retirement Accounts (IRAs), interest on student loans, higher education expenses, health savings account contributions, moving expenses, and alimony payments, among other deductions.

Below-the-line deductions, by contrast, come after adjusted gross income. They have included the standard deduction and the personal exemption, considered previously, but also itemized deductions, which can only be claimed by filers who do not take the standard deduction. Common itemized deductions include those for state and local taxes, home mortgage interest, medical expenses, and charitable contributions.

The new law repeals the above-the-line deduction for moving expenses (except for active duty military personnel), but also temporarily lowers the eligibility threshold for taking the medical expense deduction. The mortgage interest deduction, which formerly applied to the first $1 million in acquisition value, now applies to $750,000 in acquisition value, though existing mortgages are grandfathered in. Additionally, deductions for home equity indebtedness are no longer allowed.

Even a new $10,000 aggregate cap on state and local tax deductions affects states, even though it is commonly regarded (rightly) as a deduction against state tax liability. This is because many states allow a portion of the deduction (typically that associated with local property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. es) to be claimed, and limit the total size of the state deduction based upon the amount claimed on federal tax returns.

States which begin their calculations with federal taxable income incorporate itemized deductions by default, unless they specifically add back the value of a specific deduction. However, states which begin with adjusted gross income frequently offer these itemized deductions as well. If, in doing so, they tie them to the federal tax code rather than creating them as stand-alone provisions of their own codes, then the new federal changes will affect them as well.

Save for the medical expense deduction, which is now available to a larger number of filers, all these changes are base-broadeners, and will increase revenues for states which conform to these provisions.

| Notes: New Hampshire and Tennessee tax interest and dividend income only. Sources: State statutes; tax forms; Bloomberg Tax |

||||

| State | Moving Expense (+) | Mortgage Interest (+) | Medical Expense (-) | Property Tax (+) |

|---|---|---|---|---|

| Alabama | Yes | Yes | Yes | Yes |

| Alaska | No tax | No tax | No tax | No tax |

| Arizona | Yes | Yes | No | Yes |

| Arkansas | Yes | Yes | Yes | No |

| California | Yes | Yes | Yes | Yes |

| Colorado | No | Yes | Yes | Yes |

| Connecticut | Yes | No | No | No |

| Delaware | Yes | Yes | Yes | Yes |

| Florida | No tax | No tax | No tax | No tax |

| Georgia | No | Yes | Yes | No |

| Hawaii | Yes | Yes | Yes | Yes |

| Idaho | Yes | Yes | Yes | Yes |

| Illinois | Yes | No | No | No |

| Indiana | Yes | No | No | No |

| Iowa | Yes | Yes | Yes | Yes |

| Kansas | No | Yes | Yes | No |

| Kentucky | Yes | Yes | Yes | Yes |

| Louisiana | Yes | Yes | No | No |

| Maine | Yes | Yes | Yes | No |

| Maryland | Yes | Yes | Yes | Yes |

| Massachusetts | No | No | Yes | No |

| Michigan | No | No | No | No |

| Minnesota | Yes | Yes | Yes | Yes |

| Mississippi | Yes | Yes | Yes | Yes |

| Missouri | Yes | Yes | Yes | Yes |

| Montana | Yes | Yes | Yes | Yes |

| Nebraska | Yes | Yes | Yes | No |

| Nevada | No tax | No tax | No tax | No tax |

| New Hampshire | No tax | No tax | No tax | No tax |

| New Jersey | No | No | Yes | No |

| New Mexico | Yes | Yes | Yes | Yes |

| New York | No | Yes | Yes | Yes |

| North Carolina | Yes | Yes | Yes | Yes |

| North Dakota | Yes | Yes | Yes | Yes |

| Ohio | No | No | No | No |

| Oklahoma | Yes | Yes | Yes | Yes |

| Oregon | Yes | Yes | Yes | Yes |

| Pennsylvania | No | No | No | No |

| Rhode Island | Yes | No | No | Yes |

| South Carolina | Yes | Yes | Yes | Yes |

| South Dakota | No tax | No tax | No tax | No tax |

| Tennessee | No tax | No tax | No tax | No tax |

| Texas | No tax | No tax | No tax | No tax |

| Utah | No | No | No | No |

| Vermont | Yes | Yes | Yes | Yes |

| Virginia | Yes | Yes | Yes | Yes |

| Washington | No tax | No tax | No tax | No tax |

| West Virginia | No | No | No | No |

| Wisconsin | No | No | Yes | No |

| Wyoming | No tax | No tax | No tax | No tax |

| District of Columbia | Yes | Yes | Yes | Yes |

Child and Family Provisions

Federal tax reform doubled the size of the child tax credit, from $1,000 to $2,000, while dramatically increasing the refundable share, to $1,400. The credit is also available to a much wider range of taxpayers, since income phaseout thresholds rose dramatically. [14] At the federal level, the much larger child tax credit, along with a new $500 per-person family tax credit for dependents not eligible for the child tax credit, more than offsets the loss of the personal exemption for many filers.

Most states, however, do not offer such credits and would not automatically conform to the provision, meaning that they gain (in many cases) from the repeal of the personal exemption without any obligation associated with the expanded child tax credit. However, three states—Colorado, New York, and Oklahoma [15]—offer child tax credits linked to a percentage of the federal credit (for instance, Colorado offers a credit in the amount of 30 percent of the value of the federal credit). The expanded credit would represent a cost to these states if they do not decouple or reduce the percentage at which they match the federal provision.

Thirty-three states offer deductions for contributions to 529 education savings accounts, which may see increased use now that they can be utilized for primary and secondary, as well as higher, education. However, in some states the enabling legislation specifies use for higher education, which may result in a disallowance of state tax benefits to the extent that the accounts are used for primary and secondary education.

| Notes: Table indicates whether state offers a deduction for contributions to 529 plans. Some of these plans may not be in compliance with the new federal law permitting withdrawals for K-12 educational spending. New Hampshire and Tennessee tax interest and dividend income only. Sources: State statutes; tax forms; Bloomberg Tax; Tax Credits for Workers and Their Families |

||

| State | Child Tax Credits (-) | 529 Deduction (-) |

|---|---|---|

| Alabama | No | Yes |

| Alaska | No tax | No tax |

| Arizona | No | Yes |

| Arkansas | No | Yes |

| California | State defined | No |

| Colorado | 30% of federal | Yes |

| Connecticut | No | Yes |

| Delaware | No | No |

| Florida | No tax | No tax |

| Georgia | No | Yes |

| Hawaii | No | Yes |

| Idaho | No | Yes |

| Illinois | No | Yes |

| Indiana | No | No |

| Iowa | No | No |

| Kansas | No | Yes |

| Kentucky | No | No |

| Louisiana | No | Yes |

| Maine | No | No |

| Maryland | No | Yes |

| Massachusetts | No | Yes |

| Michigan | No | Yes |

| Minnesota | No | Yes |

| Mississippi | No | Yes |

| Missouri | No | Yes |

| Montana | No | Yes |

| Nebraska | No | Yes |

| Nevada | No tax | No tax |

| New Hampshire | No tax | No tax |

| New Jersey | No | Yes |

| New Mexico | No | Yes |

| New York | 33% of federal | Yes |

| North Carolina | State defined | No |

| North Dakota | No | Yes |

| Ohio | No | Yes |

| Oklahoma | 5% of federal | Yes |

| Oregon | No | Yes |

| Pennsylvania | No | Yes |

| Rhode Island | No | Yes |

| South Carolina | No | Yes |

| South Dakota | No tax | No tax |

| Tennessee | No tax | No tax |

| Texas | No tax | No tax |

| Utah | No | No |

| Vermont | No | No |

| Virginia | No | Yes |

| Washington | No tax | No tax |

| West Virginia | No | Yes |

| Wisconsin | No | Yes |

| Wyoming | No tax | No tax |

| District of Columbia | No | Yes |

Uniformity Requirements

Federal tax reform will also affect state taxes in more subtle ways, even where state tax codes are unaffected. With a far more generous standard deduction and a curtailment of some itemized deductions, far more taxpayers can be expected to take the standard deduction rather than itemizing on their federal tax return, a decision which affects the taxpayer’s ability to itemize state taxes in some jurisdictions. Before tax reform, about 30 percent of filers itemized. Most now expect fewer than 10 percent of filers to do so under the new law.

If federal changes influence a taxpayer’s choice of filing status (i.e., from married filing jointly to married filing separately or vice versa), this too can constrain choices at the state level, since many require that taxpayers use the same filing status on their federal and state returns.

In some cases, there will be filers who would have been better off taking the standard deduction at the state level but who are forced to itemize because doing so is disproportionately beneficial to them at the federal level, and they are required to follow their federal filing choice on their state return. If these filers now elect to take advantage of the higher federal standard deduction, they would be in a position to use a more personally advantageous choice at the state level, reducing state revenues.

| Notes: Not all states offer itemized deductions. Pennsylvania offers neither standard nor itemized deductions. New Hampshire and Tennessee tax interest and dividend income only. Sources: State statutes; tax forms; Bloomberg Tax |

||

| State | Filing Status Linkage | Itemization Linkage |

|---|---|---|

| Alabama | No | No |

| Alaska | No tax | No tax |

| Arizona | No | No |

| Arkansas | No | No |

| California | Yes | No |

| Colorado | Yes | n/a |

| Connecticut | Yes | n/a |

| Delaware | No | No |

| Florida | No tax | No tax |

| Georgia | Yes | Yes |

| Hawaii | No | No |

| Idaho | Yes | No |

| Illinois | Yes | n/a |

| Indiana | Yes | n/a |

| Iowa | No | No |

| Kansas | Yes | Yes |

| Kentucky | No | No |

| Louisiana | Yes | n/a |

| Maine | Yes | Yes |

| Maryland | Yes | No |

| Massachusetts | Yes | n/a |

| Michigan | Yes | n/a |

| Minnesota | Yes | No |

| Mississippi | No | No |

| Missouri | Yes | Yes |

| Montana | No | No |

| Nebraska | Yes | No |

| Nevada | No tax | No tax |

| New Hampshire | No tax | No tax |

| New Jersey | Yes | n/a |

| New Mexico | Yes | Yes |

| New York | Yes | Yes |

| North Carolina | Yes | Yes |

| North Dakota | Yes | n/a |

| Ohio | Yes | n/a |

| Oklahoma | Yes | Yes |

| Oregon | Yes | No |

| Pennsylvania | No | n/a |

| Rhode Island | Yes | n/a |

| South Carolina | Yes | n/a |

| South Dakota | No tax | No tax |

| Tennessee | No tax | No tax |

| Texas | No tax | No tax |

| Utah | Yes | No |

| Vermont | Yes | n/a |

| Virginia | Yes | Yes |

| Washington | No tax | No tax |

| West Virginia | Yes | n/a |

| Wisconsin | Yes | n/a |

| Wyoming | No tax | No tax |

| District of Columbia | No | Yes |

Small Business Expensing and Treatment of Pass-Through Income

With federal tax reform, small businesses will see an expansion of the Section 179 small business expensing provision, which allows certain investments in machinery and equipment to be fully expensed in the year of purchase. This provision will flow through to the states which conform with federal tax treatment.

Under the old law, small businesses could expense up to $500,000 in the year of purchase, with the benefit beginning to phase out above $2 million. The Tax Cuts and Jobs Act raised the expensing cap to $1 million and begins the phaseout at $2.5 million. Thirty-six states adopt federal Section 179 expensing allowances and investment limits, while seven states offer small business expensing regimes with their own expensing limits.

Section 179 applies to businesses on the basis of size, not entity formation, and is thus available to small C corporations as well as pass-through businesses. Because of its phaseout levels, however, it is overwhelmingly utilized by pass-through businesses against individual income tax liability. The full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. provisions of the new federal law, discussed later, should render Section 179 expensing almost exclusive to pass-through businesses, hence its inclusion in the individual income tax section of this paper. However, because it is not legally limited to such entities, the deduction is available in states which forgo individual but not corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. es.

A new federal provision, the deduction for qualified pass-through business income, will affect a small number of states if they do not decouple proactively. The new provision provides a 20 percent deduction against qualified pass-through business income for those with incomes below $315,000 (if filing jointly). For those above that threshold, the deduction is limited to the greater of (a) 50 percent of wage income or (b) 25 percent of wage income plus 2.5 percent of the cost of tangible depreciable property. Above the threshold, moreover, many professional services firms are excluded. [16]

The Joint Committee on Taxation estimates that the deduction will cost the federal government $414.5 billion over the next ten years, so states which conform to the provision could face a meaningful revenue loss. [17] Consequently, it has understandably emerged as a point of consternation.

A state’s individual income starting point determines whether pass-through businesses will receive the benefit of the deduction at the state as well as the federal level. Crucially, it is structured as a deduction against taxable income, not adjusted gross income. As such, it would be incorporated into the tax codes of Colorado, Idaho, Minnesota, North Dakota, Oregon, [18] and South Carolina, which use federal taxable income as the starting point in determining state tax liability.

Of these, only Colorado and North Dakota conform on a rolling basis; in the other four states, this provision would be picked up only when conformity statutes are updated. If states do not wish to offer the pass-through deduction, they could disallow the deduction expressly by adding back the amount of the deduction into state taxable income, or indirectly by adopting federal AGI as their income starting point.

Figure 4.

Of states which conform to federal AGI or use their own state-defined definition of income, only Montana has the potential to incorporate the pass-through deduction. The state begins with federal AGI, but allows as adjustments to income all “items” contained in Section 161 of the Internal Revenue Code. That section in turn incorporates a wide swath of code which now includes the new pass-through income deduction. The Montana Department of Revenue has concluded that this makes the deduction available in the state, although an independent legislative analysis suggests that the deduction could be disallowed, noting that the state does not fully incorporate every provision that is added to that expansive stretch of federal code. [19]

| Notes: Section 179 primarily benefits pass-through businesses, but can be claimed by C corporations as well. The incorporation of the pass-through deduction is disputed in Montana, and to a lesser extent in Oregon. New Hampshire and Tennessee tax interest and dividend income only. Sources: State statutes; tax forms; Bloomberg Tax |

||

| State | Section 179 Expensing (-) | Pass-Through Deduction (-) |

|---|---|---|

| Alabama | Conforms to federal | No |

| Alaska | Conforms to federal | No individual income tax |

| Arizona | Conforms to federal | No |

| Arkansas | State defined | No |

| California | State defined | No |

| Colorado | Conforms to federal | Yes |

| Connecticut | Conforms to federal | No |

| Delaware | Conforms to federal | No |

| Florida | State defined | No individual income tax |

| Georgia | Conforms to federal | No |

| Hawaii | State defined | No |

| Idaho | Conforms to federal | Yes |

| Illinois | Conforms to federal | No |

| Indiana | State defined | No |

| Iowa | State defined | No |

| Kansas | Conforms to federal | No |

| Kentucky | Conforms to federal | No |

| Louisiana | Conforms to federal | No |

| Maine | Conforms to federal | No |

| Maryland | Conforms to federal | No |

| Massachusetts | Conforms to federal | No |

| Michigan | Conforms to federal | No |

| Minnesota | Conforms to federal | Yes |

| Mississippi | Conforms to federal | No |

| Missouri | Conforms to federal | No |

| Montana | Conforms to federal | Disputed |

| Nebraska | Conforms to federal | No |

| Nevada | Gross receipts tax | No individual income tax |

| New Hampshire | State defined | No individual income tax |

| New Jersey | No | No |

| New Mexico | Conforms to federal | No |

| New York | Conforms to federal | No |

| North Carolina | No | No |

| North Dakota | Conforms to federal | Yes |

| Ohio | Gross receipts tax | No |

| Oklahoma | Conforms to federal | No |

| Oregon | Conforms to federal | Yes |

| Pennsylvania | Conforms to federal | No |

| Rhode Island | Conforms to federal | No |

| South Carolina | Conforms to federal | Yes |

| South Dakota | No tax | No individual income tax |

| Tennessee | Conforms to federal | No individual income tax |

| Texas | Conforms to federal | No individual income tax |

| Utah | Conforms to federal | No |

| Vermont | Conforms to federal | No |

| Virginia | Conforms to federal | No |

| Washington | Gross receipts tax | No individual income tax |

| West Virginia | Conforms to federal | No |

| Wisconsin | Conforms to federal | No |

| Wyoming | No tax | No individual income tax |

| District of Columbia | State defined | No |

Corporate Tax Conformity

Federal tax reform ushered in a major overhaul of corporate taxation. The new tax law brings the corporate income tax rate in line with the rest of the developed world, overhauls the international taxation regime, changes the tax treatment of capital investment, and modifies or eliminates several targeted tax preferences.

The law modernizes the U.S. tax code by shifting from a worldwide to a territorial tax regime, which is in line with most developed nations. Under a worldwide system, all income, no matter where earned, is subject to domestic taxation, but with credits for taxes paid to other countries. Under a territorial system, a company is only taxed on domestic economic activity. The new U.S. territorial tax systemA territorial tax system for corporations, as opposed to a worldwide tax system, excludes profits multinational companies earn in foreign countries from their domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. includes a base erosion anti-abuse tax and rules about effectively connected income, designed to counter international tax sheltering or other tax avoidance techniques.

It also allows the full expensing of short-lived capital assets—essentially, investment in machinery and equipment—for five years, after which the provision phases out. The corporate income tax is imposed on net income (after expenses), but traditionally, investment costs must be amortized over many years, following asset depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules. This creates a bias against investment, and this disparate treatment has long been in the crosshairs of reformers. The new law does not eliminate depreciation schedules altogether, but allows purchases of machinery and equipment to be expensed immediately. This new cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. system builds on the prior “bonus depreciation” regime, under which 50 percent of the cost of new machinery and equipment could be expensed in the first year.

At 21 percent, the new corporate income tax rate is now in line with averages for developed nations, while certain deductions, most notably the Section 199 domestic production activities deduction, have been modified or (as in the case of Section 199) repealed. Net operating losses (NOLs) may now be carried forward indefinitely, but carrybacks are disallowed and the amount of losses that can be taken is capped at 80 percent of tax liability in a given year.

While corporate income taxes generally constitute a modest share of state revenue, limiting the impact these changes will have on state coffers, they nonetheless flow through to states in ways worth exploring.

Corporate Income Starting Point and Conformity Method

Forty-five states and the District of Columbia impose corporate income taxes. Of these, sixteen begin their calculations with federal taxable income, while twenty-two adopt federal taxable income before net operating losses and special deductions as their starting point. (Both options represent lines on the federal corporate income tax return.) Alabama, North Carolina, and Vermont use federal taxable income before NOLs but not special deductions.

Louisiana and the District of Columbia begin with federal gross receipts and sales before making a range of adjustments to approach a net figure, while Arkansas and Mississippi implement state-specific calculations. Four states (Nevada, Ohio, Texas, and Washington) use gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding. es in lieu of corporate income taxes, while South Dakota and Wyoming forgo both corporate income and gross receipts taxes.

Twenty-two states and the District of Columbia adopt rolling conformity, implementing changes to the Internal Revenue Code as they are made. Of these, however, Michigan allows taxpayers the choice of rolling conformity or the IRC as it existed on January 1, 2012, while Maryland suspends rolling conformity if—as will happen this year—the state comptroller finds a revenue impact of greater than $5 million.

Twenty-one states use static conformity, and they are more likely to be a couple of years behind on corporate than individual income tax conformity. Arkansas and Mississippi use their own definitions and therefore do not conform. New Jersey also fails to conform, but stipulates that state taxable income is equivalent to federal taxable income before net operations losses and special deductions.

Figure 5.

State tax codes and revenues are influenced by a range of corporate tax changes, including the loss or reform of certain business deductions, modification of the treatment of net operating losses, and the full expensing of machinery and equipment. The latter provision has the potential to outstrip the base broadening associated with the former, but the revenue-positive changes to individual income taxes are far more significant for states’ revenue outlooks. The choice of starting point is chiefly important for the state’s treatment of net operating losses—even though most states adopt their own set of modifications—except for the handful of states which diverge from the norm by using their own state calculation or beginning with gross income.

| Sources: State statutes; tax forms; Bloomberg Tax | ||

| State | Corporate Income Starting Point | Corporate Conformity |

|---|---|---|

| Alabama | Federal taxable income before NOL | Rolling |

| Alaska | Federal taxable income before NOL and special deductions | Rolling |

| Arizona | Federal taxable income | January 1, 2017 |

| Arkansas | State calculation | Selective |

| California | Federal taxable income before NOL and special deductions | January 1, 2015 |

| Colorado | Federal taxable income | Rolling |

| Connecticut | Federal taxable income before NOL and special deductions | Rolling |

| Delaware | Federal taxable income | Rolling |

| Florida | Federal taxable income | January 1, 2017 |

| Georgia | Federal taxable income | January 1, 2017 |

| Hawaii | Federal taxable income before NOL and special deductions | December 31, 2016 |

| Idaho | Federal taxable income | January 1, 2017 |

| Illinois | Federal taxable income | Rolling |

| Indiana | Federal taxable income before NOL and special deductions | January 1, 2016 |

| Iowa | Federal taxable income before NOL and special deductions | January 1, 2015 |

| Kansas | Federal taxable income | Rolling |

| Kentucky | Federal taxable income before NOL and special deductions | December 31, 2015 |

| Louisiana | Federal gross receipts and sales | Rolling |

| Maine | Federal taxable income | December 31, 2016 |

| Maryland | Federal taxable income before NOL and special deductions | Rolling |

| Massachusetts | Federal taxable income before NOL and special deductions | Rolling |

| Michigan | Federal taxable income | Rolling |

| Minnesota | Federal taxable income before NOL and special deductions | December 31, 2016 |

| Mississippi | State calculation | Selective |

| Missouri | Federal taxable income | Rolling |

| Montana | Federal taxable income before NOL and special deductions | Rolling |

| Nebraska | Federal taxable income | Rolling |

| Nevada | Gross receipts tax | Gross receipts tax |

| New Hampshire | Federal taxable income before NOL and special deductions | December 31, 2015 |

| New Jersey | Federal taxable income before NOL and special deductions | Selective |

| New Mexico | Federal taxable income before NOL and special deductions | Rolling |

| New York | Federal taxable income before NOL and special deductions | Rolling |

| North Carolina | Federal taxable income before NOL | January 1, 2017 |

| North Dakota | Federal taxable income | Rolling |

| Ohio | Gross receipts tax | February 14, 2016 |

| Oklahoma | Federal taxable income before NOL and special deductions | Rolling |

| Oregon | Federal taxable income before NOL and special deductions | December 31, 2016 |

| Pennsylvania | Federal taxable income before NOL and special deductions | Rolling |

| Rhode Island | Federal taxable income before NOL and special deductions | Rolling |

| South Carolina | Federal taxable income | December 31, 2016 |

| South Dakota | No tax | No tax |

| Tennessee | Federal taxable income before NOL and special deductions | Rolling |

| Texas | Gross receipts tax | January 1, 2007 |

| Utah | Federal taxable income before NOL and special deductions | Rolling |

| Vermont | Federal taxable income before NOL | December 31, 2016 |

| Virginia | Federal taxable income | December 31, 2016 |

| Washington | Gross receipts tax | Selective |

| West Virginia | Federal taxable income | December 31, 2016 |

| Wisconsin | Federal taxable income before NOL and special deductions | December 31, 2016 |

| Wyoming | No tax | No tax |

| District of Columbia | Federal gross receipts and sales | Rolling |

Treatment of Net Operating Losses

Net operating losses (NOLs) occur when a company’s tax-deductible expenses exceed revenues. Corporate income taxes are intended to fall on net income, but business cycles do not fit neatly into tax years. Absent net operating loss provisions, a corporation which posted a profit in years one and three but took significant losses in year two would not be taxed on its net income over those three years, but rather on the profits of years one and three, without regard to the losses in year two.

To address this problem, the federal tax code permits net operating losses to be carried into other tax years. Under prior law, they could be carried forward up to twenty years and backward up to two years. The new tax law eliminates NOL carrybacks but allows indefinite carryforwards. The amount of losses that can be taken in a given year, however, may not exceed 80 percent of tax liability, ensuring that NOL carryforwards cannot eliminate a company’s tax liability.

Few states conform fully to federal net operating loss provisions. More frequently, states “shadow” federal NOL treatment in a variety of ways, bringing portions of the federal code into state definitions but diverging in various respects.

Fifteen states use a net taxable income starting point, which includes net operating losses. Many of these, however, require that NOLs be added back to taxable income, even if they subsequently offer their own NOL deduction. Separately, many states which use a starting point prior to the NOL deduction subsequently provide their own subtraction from income, representing a state NOL deduction.

Whether states begin their corporate income tax calculations before or after the NOL deduction says less about whether they offer a deduction than about how that deduction conforms to federal provisions. Of significance in the wake of federal tax reform is not the intricacies of each state’s NOL regime, but whether states conform to the number of years that NOLs are permitted to be carried forward and backward, and whether they will incorporate the new caps imposed at the federal level.

A few states conform on years a loss can be carried forward, but disallow carryback losses. Since federal law no longer allows carrybacks, a state is listed as conforming on how long NOLs can be carried so long as it conforms with carryforward provisions, even if statutes require an add-back for carrybacks.

| Sources: State statutes; tax forms; Bloomberg Tax | |||

| State | General Rule | Years (-) | 80% Cap (+) |

|---|---|---|---|

| Alabama | Modifies years | Statutory | Federal |

| Alaska | Conforms without modification | Federal | Federal |

| Arizona | Conforms with year and other modifications | Statutory | Federal |

| Arkansas | State calculation | Statutory | Statutory |

| California | Conforms with % and other modifications | Federal | Statutory |

| Colorado | Conforms with modifications | Federal | Federal |

| Connecticut | State calculation | Statutory | Statutory |

| Delaware | Conforms with dollar cap | Federal | Dollar Cap |

| Florida | Conforms | Federal | Federal |

| Georgia | State calculation | Statutory | Statutory |

| Hawaii | Conforms with modifications | Federal | Federal |

| Idaho | State calculation | Statutory | Statutory |

| Illinois | State calculation | Statutory | Statutory |

| Indiana | Adopts federal carryover years | Federal | Statutory |

| Iowa | Modifies years | Statutory | Federal |

| Kansas | Conforms with year and other modifications | Statutory | Federal |

| Kentucky | Conforms with modifications | Federal | Federal |

| Louisiana | State calculation | Statutory | Statutory |

| Maine | Conforms with modifications | Federal | Federal |

| Maryland | Conforms with modifications | Federal | Federal |

| Massachusetts | State calculation | Statutory | Statutory |

| Michigan | State calculation | Statutory | Statutory |

| Minnesota | Conforms with modifications | Statutory | Federal |

| Mississippi | State calculation | Statutory | Statutory |

| Missouri | Conforms with modifications | Federal | Federal |

| Montana | Modifies years | Statutory | Federal |

| Nebraska | State calculation | Statutory | Statutory |

| Nevada | Gross receipts tax | n/a | n/a |

| New Hampshire | Conforms to prior year with modifications | Statutory | Statutory |

| New Jersey | State calculation | Statutory | Statutory |

| New Mexico | Conforms with modifications | Federal | Federal |

| New York | State calculation | Statutory | Statutory |

| North Carolina | State calculation | Statutory | Statutory |

| North Dakota | Conforms with modifications | Federal | Federal |

| Ohio | Gross receipts tax | n/a | n/a |

| Oklahoma | Conforms with modifications | Federal | Federal |

| Oregon | State calculation | Statutory | Statutory |

| Pennsylvania | State calculation | Statutory | Percentage Cap |

| Rhode Island | Modifies years | Statutory | Federal |

| South Carolina | Conforms with modifications | Federal | Federal |

| South Dakota | No tax | n/a | n/a |

| Tennessee | State calculation | Statutory | Statutory |

| Texas | Gross receipts tax | n/a | n/a |

| Utah | State calculation | Statutory | Statutory |

| Vermont | State calculation | Statutory | Statutory |

| Virginia | Conforms with modifications | Federal | Federal |

| Washington | Gross receipts tax | n/a | n/a |

| West Virginia | Conforms with modifications | Federal | Federal |

| Wisconsin | State calculation | Statutory | Statutory |

| Wyoming | No tax | n/a | n/a |

| District of Columbia | Conforms with modifications | Federal | Federal |

Capital Investment, Interest Deductibility, and Manufacturing Activity

The new federal law’s more favorable treatment of capital investment, described previously, flows through to some states. Federal law now allows purchases of short-lived capital assets (machinery and equipment) to be expensed immediately, rather than depreciated over many years. This replaces the prior bonus depreciation regime, which offered accelerated (but not immediate) depreciation, and the fifteen states which conformed to that cost recovery provision will also conform to the full expensing of machinery and equipment.

Although full expensing reduces state revenue, it is also highly pro-growth, and states would do well to conform to this provision. Accepting this cost should be made easier by the fact that most states can expect a broader overall tax base due to federal tax reform. Within this context, it makes sense to incorporate provisions which drive economic expansion.

Figure 6.

Federal law now restricts the deduction of business interest, limiting the deduction to 30 percent of modified income, with the ability to carry the remainder forward to future tax years. For the first four years, the definition of modified income is earnings before interest, taxes, depreciation, and amortization (EBITDA); afterwards, a more restrictive standard of gross income less depreciation or amortization (EBIT) goes into effect. [20] These changes mean that a greater share of interest costs will be taxable, increasing revenue. Every state except Mississippi conforms to the federal definition of interest expense. Given this change, which increases the cost of investment, states would do well to ensure that they also conform to the new full expensing provision.

The new law also repeals the Section 199 domestic production activities deduction, which provided a deduction worth 9 percent of domestic production gross receipts (or taxable income, if less), meant to advantage domestic manufacturing. Many states, either due to their corporate income starting point or an express linkage, conform to the Section 199 deduction. Its elimination, therefore, represents a broadening of the base for states which have previously offered the preference.

| Sources: State statutes; tax forms; Bloomberg Tax | |||

| State | Full Expensing (-) | Interest Limitation (+) | Section 199 (+) |

|---|---|---|---|

| Alabama | Yes | Yes | Yes |

| Alaska | Yes | Yes | Yes |

| Arizona | No | Yes | Yes |

| Arkansas | No | Yes | No |

| California | No | Yes | No |

| Colorado | Yes | Yes | Yes |

| Connecticut | No | Yes | No |

| Delaware | Yes | Yes | Yes |

| Florida | No | Yes | Yes |

| Georgia | No | Yes | No |

| Hawaii | No | Yes | No |

| Idaho | No | Yes | Yes |

| Illinois | No | Yes | No |

| Indiana | No | Yes | No |

| Iowa | No | Yes | Yes |

| Kansas | Yes | Yes | Yes |

| Kentucky | No | Yes | No |

| Louisiana | Yes | Yes | Yes |

| Maine | No | Yes | No |

| Maryland | No | Yes | No |

| Massachusetts | No | Yes | No |

| Michigan | No | Yes | No |

| Minnesota | No | Yes | No |

| Mississippi | No | No | No |

| Missouri | Yes | Yes | Yes |

| Montana | Yes | Yes | Yes |

| Nebraska | Yes | Yes | Yes |

| Nevada | Gross receipts tax | Yes | Gross receipts tax |

| New Hampshire | No | Yes | No |

| New Jersey | No | Yes | No |

| New Mexico | Yes | Yes | Yes |

| New York | No | Yes | No |

| North Carolina | No | Yes | No |

| North Dakota | Yes | Yes | No |

| Ohio | Gross receipts tax | Yes | Gross receipts tax |

| Oklahoma | Yes | Yes | Yes |

| Oregon | Yes | Yes | No |

| Pennsylvania | No | Yes | Yes |

| Rhode Island | No | Yes | No |

| South Carolina | No | Yes | No |

| South Dakota | No tax | Yes | No tax |

| Tennessee | No | Yes | No |

| Texas | Gross receipts tax | Yes | Gross receipts tax |

| Utah | Yes | Yes | Yes |

| Vermont | No | Yes | Yes |

| Virginia | No | Yes | Yes |

| Washington | Gross receipts tax | Yes | Gross receipts tax |

| West Virginia | Yes | Yes | Yes |

| Wisconsin | No | Yes | No |

| Wyoming | No tax | Yes | No tax |

| District of Columbia | No | Yes | Yes |

International Taxation

The adoption of a more internationally competitive corporate income tax rate and the shift to a territorial tax system will have significant impacts on business decision-making. The immediate state impact of changes to the structure of international taxation, however, depends on states’ treatment of foreign income.

American corporations ended 2017 with about $2.6 trillion in overseas earnings that have not been transferred back into the United States. [21] Under the old “worldwide” system of taxation, U.S. corporations paid the difference between the U.S. statutory corporate income tax of 35 percent and the effective rate in the other nation where the income was earned. However, that liability was deferred so long as the income was not repatriated. As part of the transition to a territorial tax code, these deferred earnings were “deemed” to have been repatriated, meaning they are immediately taxable by the federal government at rates of 15.5 percent on liquid assets and 8.0 percent on illiquid assets. This repatriated income is categorized as Subpart F income.

Whether states include Subpart F income in their tax base dictates whether they will receive additional revenue from income “deemed” repatriated. Since the income was deemed to be repatriated as of the end of calendar year 2017, states which do not tax Subpart F income may be unable to revise their treatment of repatriated income to take advantage of this change. However, even states which decouple from the taxation of Subpart F income may tax the income when it is actually distributed. If distributions to U.S. parent corporations are accelerated, even states which do not tax Subpart F income may stand to benefit. [22]

Deemed repatriation is a one-time event, so states should avoid appropriating the money for recurring expenses or using it to pay down permanent tax relief. Rather than incorporating it into the budget baseline, states might consider depositing any Subpart F windfall in pension funds or rainy day funds, or using it for one-time expenditures.

Shareholders in the United States are now also required to include as income the global intangible low-taxed income (GILTI) of controlled foreign corporations in which they have a stake, treating the income as a deemed dividend. The U.S. parent claims the dividends received deduction of 50 percent at the federal level, meaning that the inclusion is taxed at an effective rate of 10.5 percent (half the new federal corporate income tax rate). This represents a lower deduction percentage, adopted in concert with lower federal rates. Only the lower deduction percentage will flow through to states. Twenty-six states and the District of Columbia conform to the federal dividends received deduction; another nineteen do not.

| Sources: State statutes; tax forms; Bloomberg Tax | ||

| State | Includes Subpart F Income (+) | Offers Dividends Received Deduction (-) |

|---|---|---|

| Alabama | No | Yes |

| Alaska | Yes | Yes |

| Arizona | Yes | No |

| Arkansas | No | No |

| California | No | No |

| Colorado | Yes | Yes |

| Connecticut | No | No |

| Delaware | No | No |

| Florida | No | No |

| Georgia | No | Yes |

| Hawaii | No | No |

| Idaho | Yes | No |

| Illinois | No | Yes |

| Indiana | No | Yes |

| Iowa | No | Yes |

| Kansas | No | Yes |

| Kentucky | No | No |

| Louisiana | Yes | No |

| Maine | No | Yes |

| Maryland | No | Yes |

| Massachusetts | No | No |

| Michigan | No | Yes |

| Minnesota | Yes | Yes |

| Mississippi | Yes | No |

| Missouri | No | Yes |

| Montana | Depends | Yes |

| Nebraska | No | Yes |

| Nevada | Gross receipts tax | Gross receipts tax |

| New Hampshire | Yes | Yes |

| New Jersey | No guidance | No |

| New Mexico | No | Yes |

| New York | Yes | No |

| North Carolina | No | Yes |

| North Dakota | No | No |

| Ohio | Gross receipts tax | Gross receipts tax |

| Oklahoma | Yes | No |

| Oregon | No | No |

| Pennsylvania | No | Yes |

| Rhode Island | No | Yes |

| South Carolina | No | Yes |

| South Dakota | No tax | No tax |

| Tennessee | Yes | Yes |

| Texas | No | Yes |

| Utah | No | No |

| Vermont | Yes | No |

| Virginia | No | Yes |

| Washington | Gross receipts tax | Gross receipts tax |

| West Virginia | No | Yes |

| Wisconsin | No | Yes |

| Wyoming | No tax | No tax |

| District of Columbia | No | Yes |

Estate TaxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. Conformity

The House version of the Tax Cuts and Jobs Act sought to repeal the federal estate tax, which would have had major implications for all states which still levy estate taxes, as they tend to rely heavily on the tax infrastructure established by the federal government. The conference report, however, doubled the exemption amount (from $5.6 million to $11.2 million) but retained the tax itself. The changes, therefore, only affect the three jurisdictions—Hawaii, Maine, and the District of Columbia—which conform to the federal exemption level.

States Most Affected by Federal Tax Reform

States which conform to the now-repealed personal exemption will see the largest revenue increases under federal tax reform. Maine, which conforms to the personal exemption but applies a state-defined standard deduction, is the largest beneficiary, followed by the seven states (Colorado, Idaho, Minnesota, New Mexico, North Dakota, South Carolina, and Vermont) which conform on both the standard deduction and the personal exemption.

States which offer their own state-defined standard deductions but tie their personal exemptions, even if at state-defined values, to the number of exemptions claimed at the federal level also stand to gain revenue, in some cases considerably. Most states benefit from changes to deductions for mortgage interest and moving expenses, while the twenty-four states and the District of Columbia which could see their local property tax deductions capped at $10,000 would see a further revenue increase.

The six states which use federal taxable income as their income starting point (Colorado, Idaho, Minnesota, North Dakota, Oregon, and South Carolina) are the most likely to experience revenue losses, since these states would incorporate the new pass-through deduction absent legislation to the contrary. Missouri, which will adopt the much-higher federal standard deduction while dropping a relatively modest personal exemption credit, may also be positioned to lose revenue.

States with a strong multinational presence, and which conform to Subpart F, may experience a windfall due to repatriation. Changes to net operating loss treatment and the elimination of the Section 199 deduction will also increase revenues in many states, while the fifteen which will conform to full expensing will see losses on that provision, generally offset by gains elsewhere.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOptions for States

Most states can expect additional revenue due to base-broadening provisions of federal tax reform. Although this additional revenue will not match the windfall experienced after tax reform in 1986, when all but one state with an individual income tax conformed the subsequent year, [23] the increases will be substantial for some states, particularly those which conform to the now-repealed federal personal exemption. A few states, chiefly those which begin their individual income tax calculations with federal taxable income rather than federal adjusted gross income, may stand to lose revenue absent changes to their tax codes.

Decouple from the Pass-Through Deduction

States facing a loss of revenue due to the pass-through deduction may wish to decouple from that provision, either by adopting federal AGI as their income starting point or by expressly adding back the new pass-through deduction. A state like Missouri, which conforms on the much-higher standard deduction but not the now-repealed personal exemption, could restore the personal exemption or, if need be, decouple from the higher standard deduction. States anticipating additional revenue, however, have a more interesting set of options.

Couple to New Expensing Rules