’Tis the season to crack open a cold one, and as the country is reopening, doing so at a cookout or a baseball game is back on the schedule. In the midst of summer’s usual uptick in beer sales, take a minute to discover how much of your cash is actually going toward the cost of a brew.

The United States collects an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on beer at the federal level (ranging from $0.11 to $0.58 per gallon based on production, location, and quantity), but all 50 states and the District of Columbia also collect their own taxes on fermented malt beverages. While general sales taxes are tacked on after the price of goods is subtotaled, most states go straight to the retailer for beer excise taxes, collecting according to the quantity of beer sold (usually expressed as a rate of dollars per gallon). Although you can’t see the taxes on your receipt, vendors pass along those costs to consumers in the form of higher prices.

In most states, the legal burden of remitting beer excise taxes falls on retailers, but some collection variations exist from state to state. For instance, some states levy taxes further up the supply chain by taxing brewers, importers, or other wholesalers at a percentage of revenue generated or at a fixed price per gallon, bottle, or case of beer sold. Many states also generate revenue by collecting license fees from beer distributors.

Because beer taxes are often collected at earlier points in the supply chain, the only taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. a consumer will see printed on his or her receipt is any applicable state or local sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. that applies to the purchase. Some states specify higher alcoholic beverage sales tax rates (that apply to beer, wine, and spirits) in lieu of the general sales tax rate.

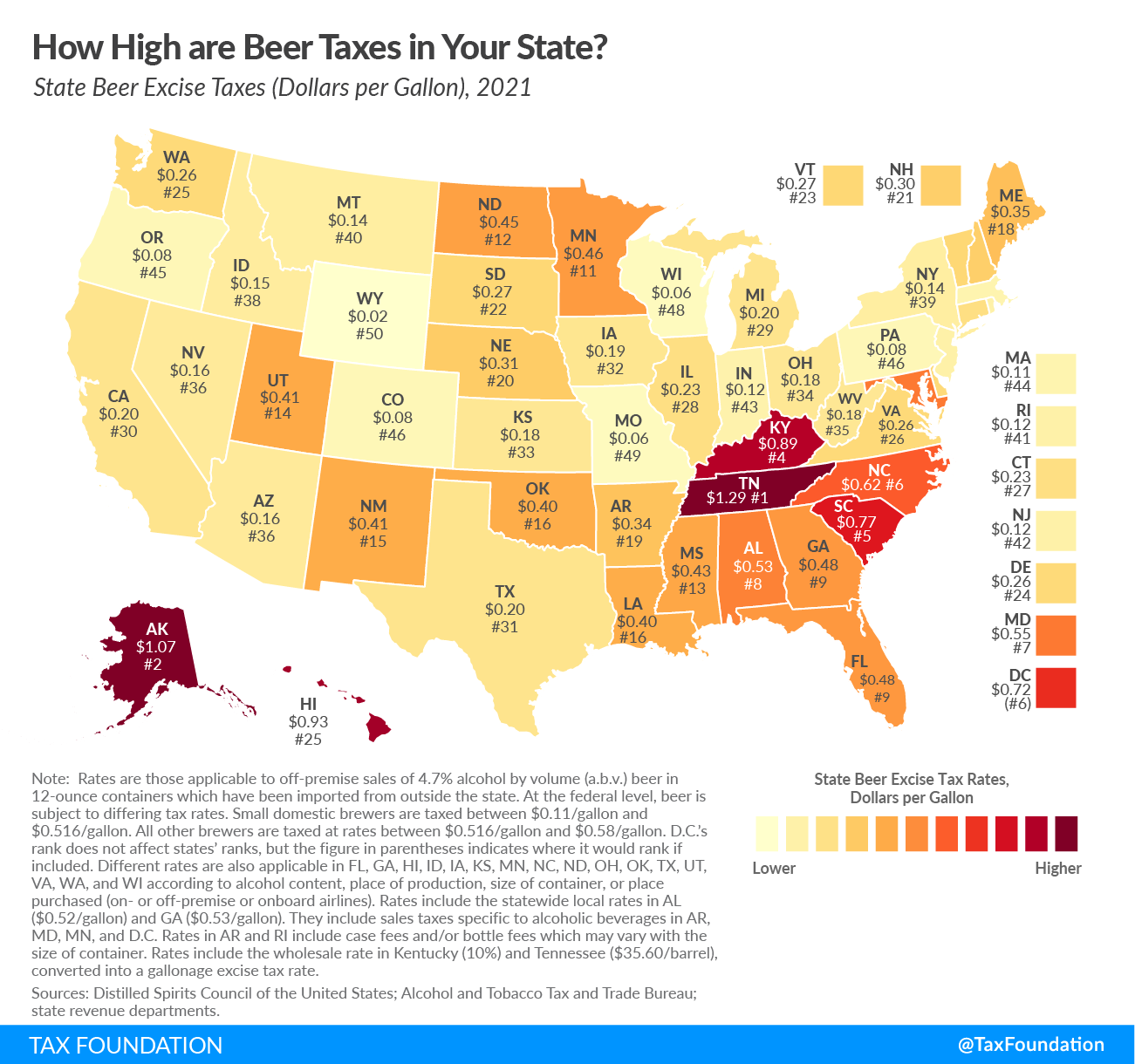

The accompanying map shows the state beer excise tax rates in all 50 states and the District of Columbia. Rates vary widely: as low as $0.02 per gallon in Wyoming and as high as $1.29 per gallon in Tennessee. Missouri and Wisconsin tie for second lowest at $0.06 per gallon, and Alaska is second highest with its $1.07 per gallon tax.

The per-gallon rate shown on the map reflects the beer excise tax for a 4.7 percent alcohol by volume (ABV) beer in a 12-ounce container. Sixteen states have beer excise tax rates that vary based on alcohol content, place of production, size of container, or place purchased. For example, in Idaho, beer containing more than 4 percent ABV is considered “strong beer” and is taxed like wine at $0.45 per gallon. In Virginia, the per-bottle rate varies for bottles that exceed 7- and 12-ounce thresholds.

How does your state compare?

Note: This is part of a series in which we examine state excise tax collections.