Full Expensing to Be Made Permanent in the United Kingdom

The policy will likely raise GDP by 0.9 percent, investment by 1.5 percent, and wages by 0.8 percent, relative to a return to the pre-2021 law.

4 min read

The policy will likely raise GDP by 0.9 percent, investment by 1.5 percent, and wages by 0.8 percent, relative to a return to the pre-2021 law.

4 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

The rules of tax competition are changing with the recent agreement on a global minimum tax and other changes to tax rules around the world, but that does not mean the contest is over.

5 min read

The EU Tax Observatory has taken an extreme view in assessing the global minimum tax. The rules were not meant to immediately reduce the stock of shifted profits or align profitability levels more closely with employment costs. The rules do change incentives for multinationals, but profits may continue to remain in low-tax jurisdictions for many years.

6 min read

While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT actionable policy gap is 15.65 percent, more than triple the compliance gap.

5 min read

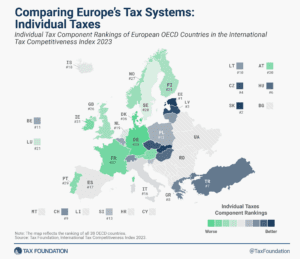

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

The uncertain future of American finances in a time of potential economic instability points to the need for tax reforms that encourage individuals to save and build financial security in a relatively simple way, such as through universal savings accounts.

6 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

While existing carbon taxes are a step towards the right direction in addressing climate change and incentivizing reductions in emissions, there is considerable room for improvement to reach the ideal theoretical carbon tax model.

59 min read