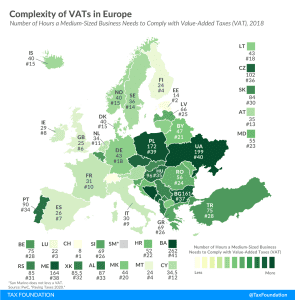

Germany Adopts a Temporary VAT Cut

Tax policy responses to the pandemic should be designed to provide immediate support while paving the way to recovery. A temporary VAT rate cut in the context of an inefficient VAT system is likely to deliver mixed results at best.

4 min read