All Related Articles

New Evidence on Territorial Taxation

6 min read

Sources of Government Revenue in the OECD, 2020

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

13 min read

Analysis of Democratic Presidential Candidates Corporate Income Tax Proposals

2020 Democratic presidential candidates have proposed various changes to the corporate income tax, which includes increasing the rate, ranging from 25 percent to 35 percent, imposing a corporate surtax or a minimum tax, and lengthening depreciation schedules.

17 min read

How Controlled Foreign Corporation Rules Look Around the World: Germany

Germany has had a Controlled Foreign Corporation (CFC) regime since 1972, when the German Foreign Transactions Tax Act was enacted. Under the German regime, a CFC is a foreign company where its capital or voting rights are either directly or indirectly majority-owned by German residents at the end of its fiscal year.

6 min read

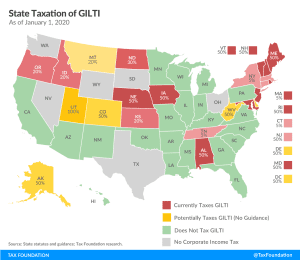

Kansas, Nebraska, and Utah Lawmakers Pursue “Not GILTI” Verdicts

Taxing GILTI puts states at a competitive disadvantage compared to their peers—all for a tax that makes very little sense at the state level, and which legislators never sought in the first place.

5 min read

Toomey Introduces Legislation to Make Bonus Depreciation Permanent and Fix the Retail Glitch

Making 100 percent bonus depreciation permanent avoids the uncertainty associated with the phaseout of a powerful pro-growth policy and would provide a cost-effective boost to long-run economic output, wages, and employment in the United States.

2 min read