All Related Articles

9139 Results

The Case for Universal Savings Accounts

21 min read

Evaluating Education Tax Provisions

Research shows that the current menu of education-related tax benefits is not effectively promoting affordability or the decision to attend college. Lawmakers wishing to provide education assistance should reconsider whether the tax code is the best tool to achieve that goal.

21 min read

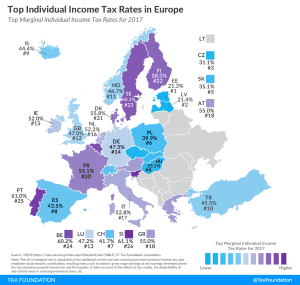

Opportunities for Pro-Growth Tax Reform in Austria

Austria needs to pursue comprehensive business and individual tax reform if it wants to remain competitive. Our new guide explores several ways the Austrian government can achieve a simpler, more pro-growth tax code.

10 min read