All Related Articles

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

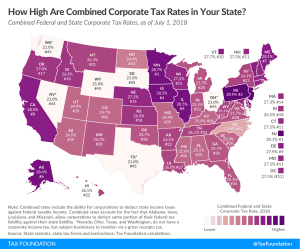

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

U.S. Businesses Pay or Remit 93 Percent of All Taxes Collected in America

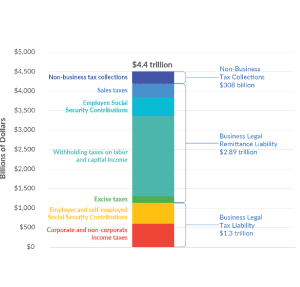

Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

5 min read

Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read

How High are Other Nations’ Gas Taxes?

3 min read

The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

One of the most significant provisions in the Tax Cuts and Jobs Act was the reduction of the U.S. corporate income tax rate from 35 percent to 21 percent. Over time, the lower corporate rate will encourage new investment and lead to additional economic growth. It will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions.

2 min read

Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries

The U.S. decision to adopt a territorial tax system is certainly an improvement over having a worldwide system. However, in moving to a territorial system some of the new features created with the TCJA increased the complexity of the system.

38 min read