All Related Articles

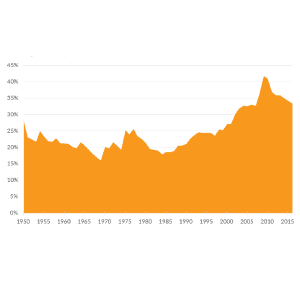

A Growing Percentage of Americans Have Zero Income Tax Liability

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read

What’s up with Being GILTI?

The Tax Cuts and Jobs Act made significant changes to the way U.S. multinationals’ foreign profits are taxed. GILTI, or “Global Intangible Low Tax Income,” was introduced as an outbound anti-base erosion provision.

5 min read

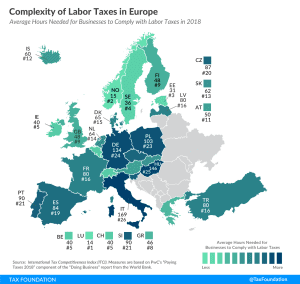

Complexity of Labor Taxes in Europe

3 min read

Testimony: Temporary Policy in the Federal Tax Code

Tax policy can increase the size of the economy by having a positive impact on the incentives to work and invest. However, when tax policy is temporary or retroactive, these positive effects are muted, and policies do not effectively incentivize the intended activity.

How Do Transfers and Progressive Taxes Affect the Distribution of Income?

Federal tax rates vary by income group and tax source. The federal tax system redistributes income from high- and low-income taxpayers.

3 min read